Ethereum is trading nearly $4,600 and is stable after a volatile August, where he saw repeated rejections of nearly $4,800. The market is supported by a massive whale accumulation and fresh on-chain influx, but technological resistance continues to hold back rallying.

Spot Data has shown ETH over $427 million in Bitmine's purchases, marking one of the largest single-day whale acquisitions in months. Combined with the positive netflow of August 27th, sentiment has improved despite the broader crypto market becoming more cautious towards September.

The current question is whether Ethereum price action can retest $4,800 and build enough momentum to break into a higher range of nearly $5,200-5,400.

Ethereum prices are kept within the upward channel

ETH Price Dynamics (Source: TradingView)

On the 4-hour chart, ETH trades comfortably within ascending parallel channels, with support at nearly $4,525-4,530 and resistance at $4,800. 50 Emma, which costs around $4,525, has repeatedly provided daytime support, while 100 Emma, which costs $4,405, supports a wider uptrend.

ETH Price Dynamics (Source: TradingView)

The RSI is 53.1, suggesting that the momentum is neutral after a recent pullback from excessive levels. Pushings over 60 on RSI indicate a breakout attempt. Meanwhile, the daily chart shows ETH holding support for the supertrends above $4,058, while the parabolic SAR dots go below the price and keep the long-term structure bullish.

Technically, Ethereum requires a clean breakout that exceeds the $4,800 supply zone to see a fresh upside down. If you do not complete this level, you will be at risk of pullbacks between $4,400 and $4,200.

Whale accumulation and positive flows boost confidence

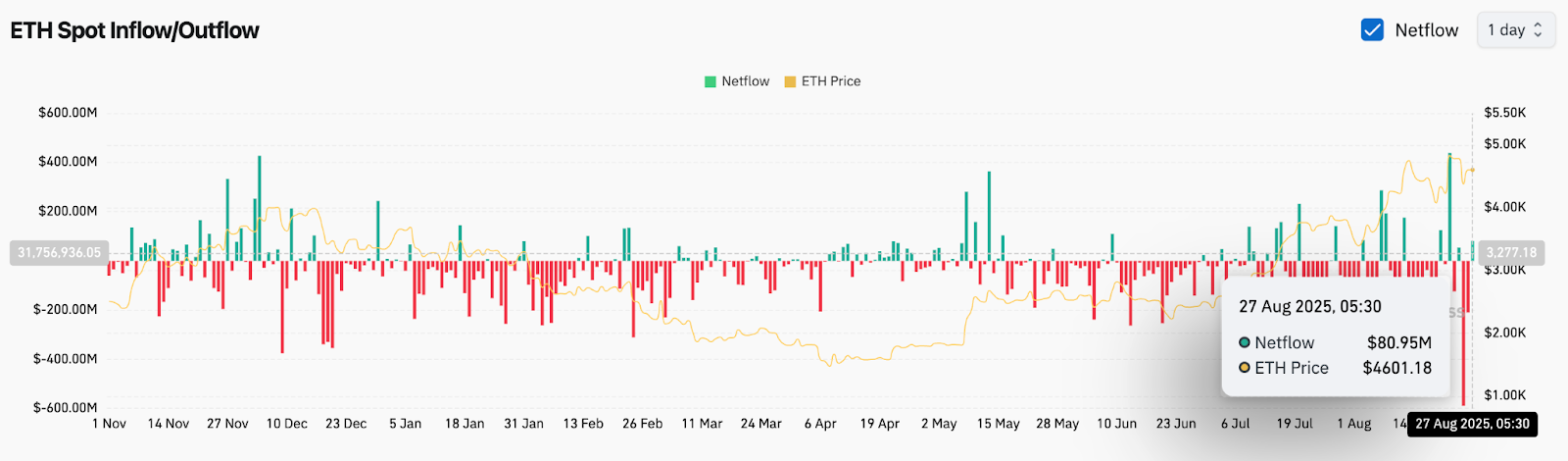

ETH On-Chain Activity (Source: Coinglass)

On-chain data has become supportive. Coinglass reports $80.95 million in positive ETH net influx on August 27, the first meaningful green print after a few weeks of spills. This reversal suggests a new accumulation among large investors.

Whale tracking data shared by additional fuel analyst @TedPillows confirmed that Bitmine has earned $427 million worth of ETH, spreading across multiple transfers from Bitgo Wallet. Such large purchases have preceded historically sharp price increases as the expected institutional demand for whales at the forefront.

Bitmine once again bought the $427,000,000 ETH.

Ethereum has not yet been done. pic.twitter.com/w4hwj3yr7u

– Ted (@tedpillows) August 27, 2025

This accumulation scale contrasts with the stable ETF outflow of Bitcoin, highlighting the branching flow within the cryptographic measure. If these influx continues, ETH can gain relative strength against BTC in September.

Contrasting opinions: Bullseye $5,200, under $4,400 Note

The bullish case rests on ETH, which holds the channel and clears a $4,800 resistance. If successful, the next reverse target is near $5,200, with the upper channel boundary extending to $5,400. Strong whale accumulation and improved spot flow enhance this outlook.

However, note that the Bears' repeating $4,800 failures have created a potential double-top formation. A breakdown below $4,400 will negate bullish structures, pave the way for $4,200 and have deeper support from $4,050 to $4,100, where daily supertrends line up.

For now, ETH is trading in high stakes zones. Breakouts can cause momentum-driven benefits, but failure risks another sharp retrace into a historically volatile period of September.

Ethereum Short-Term Outlook: $4,800 Eye

Over the next 24 hours, Ethereum prices are expected to merge between $4,525 and $4,750, closing with fictional resistance. A break above $4,800 could trigger an acceleration to $5,000, but if it falls below $4,525, the slide will risk to $4,400.

Over the next week, the fight will be centered around $4,800 in resistance. If ETH can be broken and maintained on top of it, the upward momentum could extend into September despite seasonal weaknesses across the broader market. However, if you can't hold a $4,400 pivot, you can control the bear.

Ethereum Price forecast table

Conclusion: Today's Ethereum prices remain trapped in the $4,800 channel as an important barrier. Whale accumulation and positive influx provide a strong bullish signal, but if you don't break resistance you'll be drawn to $4,400. The next few sessions will determine whether the ETH can be expanded to $5,200 or if it can remain trapped below supply.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.