Bitcoin OG, which began spinning its $11.4 billion in fortune into ether in August, has continued to buy ETH over the weekend and currently holds $3.8 billion.

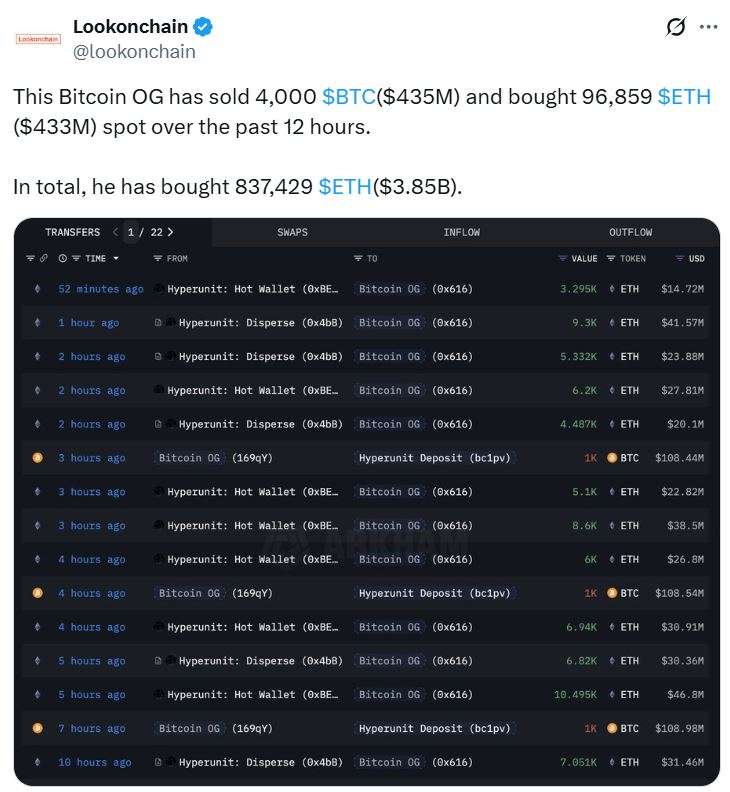

In the latest move, Bitcoin Zilla will sell 4,000 Bitcoin (BTC) worth $435 million, trading it for 96,859 spot ether for a 12-hour splurge, noting in a post on Sunday.

The whales then deposited another 1,000 bitcoins on decentralized exchange high lipids on Monday.

The Blockchain Analytics Service first noticed the whale on August 25th, calculating its total holdings at 100,784 Bitcoin, which is more than $11.4 billion at its current price.

sauce: Lookonchain

“Bitcoin OG” joins the string of other whales who trade out Bitcoin and are purchasing ether for the first time. Analysts told Cointelegraph that it is a sign that the market is maturing and that whales are diversifying in light of positive US regulatory moves.

Whales diversify as ETH momentum builds

Speaking to Cointelegraph, Henrik Andersson, chief investment officer at investment firm Apollo Crypto, said it's hard to know what individual whales are thinking, but historically there has been a market rotation from Bitcoin to Ether to Altcoin.

“After the Genius Bill and Pro-US regulations, there could be some altcoins behind Ethereum, particularly those behind Ethereum, with gravity increasing and whales choosing to diversify against a positive background,” he said.

The pod at nine whale addresses purchased a cumulative $456 million worth of ether in late August. sauce: Arkham

In July, President Donald Trump later signed an act of genius. The law focuses on stubcoins and is the country's first federal law focusing solely on payment stability.

Anderson said the ether has gained momentum ever since. According to Coingecko, it reached a new all-time high on August 24th, exceeding $4,946. Tokens are currently trading at $4,389, a 1.2% decrease over the past 24 hours.

“Bitcoin has real momentum for Ethereum for months. We've seen the ETF trend in August to support Ethereum a lot. In our view, this could last in the medium term.”

Crypto is no longer a one-horse bitcoin race

Ryan McMillin, chief investment officer at Australia's crypto investment manager Merkle Tree Capital, told Cointelegraph that longtime Bitcoin holders have diversified into ether, but not token abandonment. Instead, it is recognized that the code landscape has matured.

“After years of detention, many OG whales consider Bitcoin to be digital gold, and ether provides yields through staking and exposure to the broader smart contract economy,” he said.

“For Bitcoin veterans, assigning ether is not about chasing hype, but about acknowledging that digital assets are not just a conservation of value, but a multiprotocol ecosystem with diverse and growing sets of use cases.”

However, McMillin said that not all OG whales are spinning. Most of them leave Bitcoin exposure as is. It is only this subset that shows that ether has become a core holding rather than a speculative side bet.

At the same time, he speculates that other altcoins can also see some influx from Bitcoin Zilla, and the timing hints at a “classic alto-season rotation” when bitcoin is strong and some capital “flows naturally into ETH as investors seek relative value.”

“If ETH rotation is gaining momentum, it's no surprise to see flows grow to Solana (SOL) next, given the consumer app and debt traction.”