Cryptocurrency investment products collected updated inflows last week, offsetting the previous week's $1.4 billion outflow.

Crypto Exchange-Traded Products (ETPS) recorded an influx of $2.48 billion last week, Coinshares data showed Monday.

Despite the influx, Bitcoin (BTC) struggled with market prices, trading over $113,000 early in the week before slipping under $108,000.

Ether (ETH) fell below $4,300 after starting the week above $4,600, reflecting Bitcoin turbulence.

Spot Ether ETP retains control

Last week's inflow was notable following the $1.4 billion runoff the previous week, but it was well below the $4.4 billion record set in July.

The Spot Ether Exchange-Traded Funds (ETF) maintained its market dominance last week, attracting $1.4 billion inflows, while the Bitcoin Fund recorded a profit of $748 million.

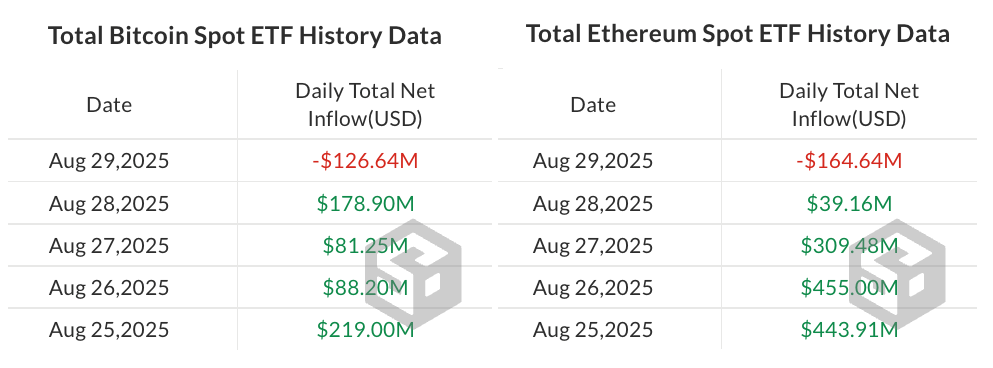

Last week, the daily flow of spot Bitcoin ETFs and spot ether ETFs. Source: SosoValue

According to data from Sosovalue, both Ether and Bitcoin ETF experienced a leak last Friday, ending the six-day inflow streak of ether and four consecutive days of Bitcoin.

In the meantime, according to Coinshares, Solana (Sol) and XRP (XRP) continued to receive optimistic benefits for potential US ETF launches, posting inflows of $177 million and $134 million, respectively.

magazine: XRP 'Cycle Target' $20, Strategic Bitcoin Lawsuit Dismissed: Hodler's Digest, August 24-30