Ethereum prices have fallen more than 5% today, trading around $4,300. This marks one of the sharpest daily declines in weeks. However, monthly profits remained at over 13%, indicating that the wider upward trend has not broken.

The question now is whether autumn today is merely a noise or is it the beginning of something deeper? On-chain and technical signals suggest that DIP will not last long, reducing profit bookings and whales intervening.

Profits will be eased as whales add $1 billion in ETH

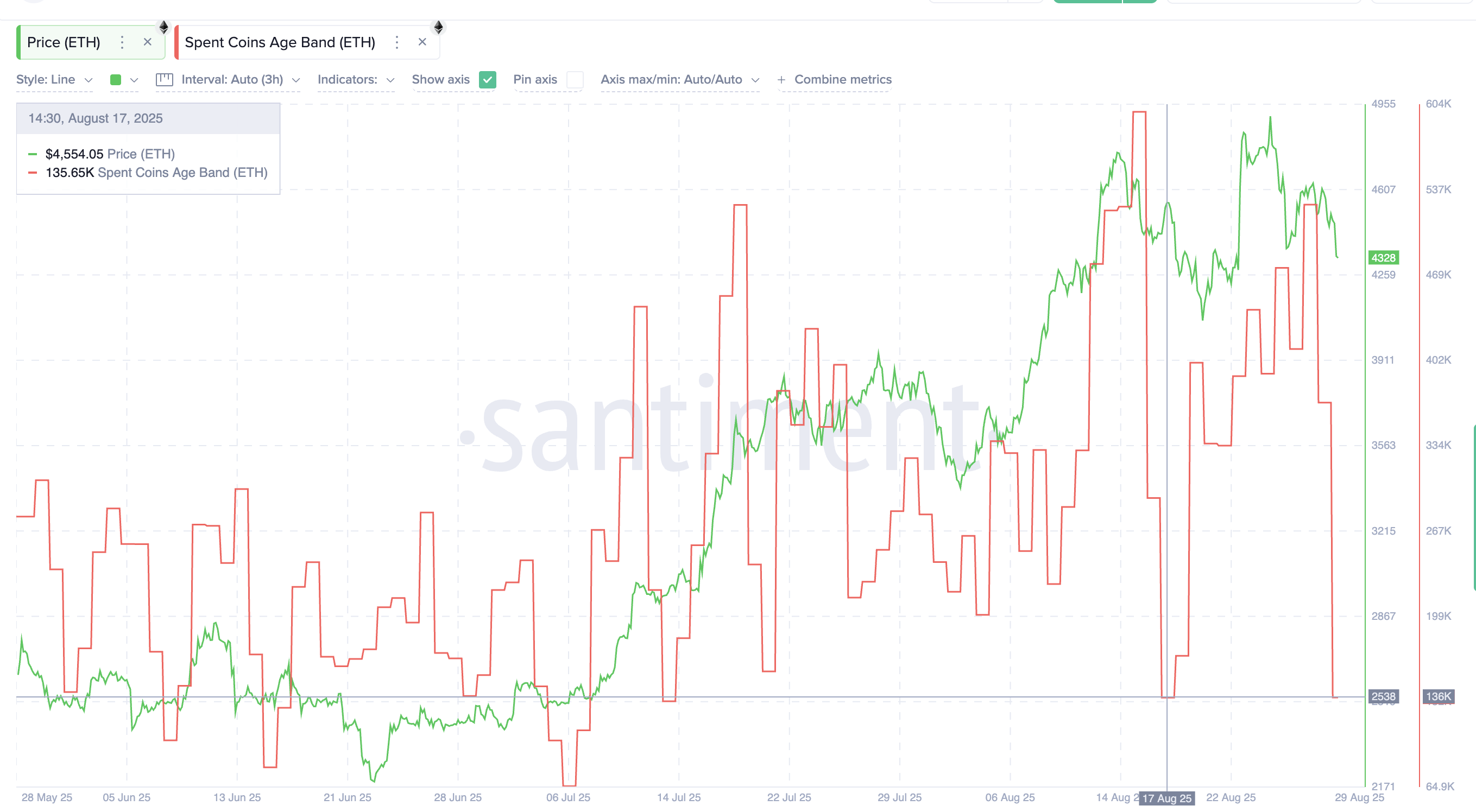

The used coin age bands tracking when long coins are on sale have fallen over a month of around 135,000 ETH. This means that long term holders are selling less. Profits eased sharply compared to the beginning of August when the metric was above 525,000 ETH. That's a 74% drop.

Ethereum benefits are eased: santiment

History shows that when this metric reaches the bottom, Ethereum often bounces back. for example:

- On July 7th, spent coins fell to 64,900 ETH, with Ethereum prices rising from around $2,530 to $3,862. This is a 52% jump.

- On August 17th, the same pattern led to a 20% move as ETH rose from $4,074 to $4,888.

Now, the latest drop to local lows may once again suggest that the wave of sales is waning.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

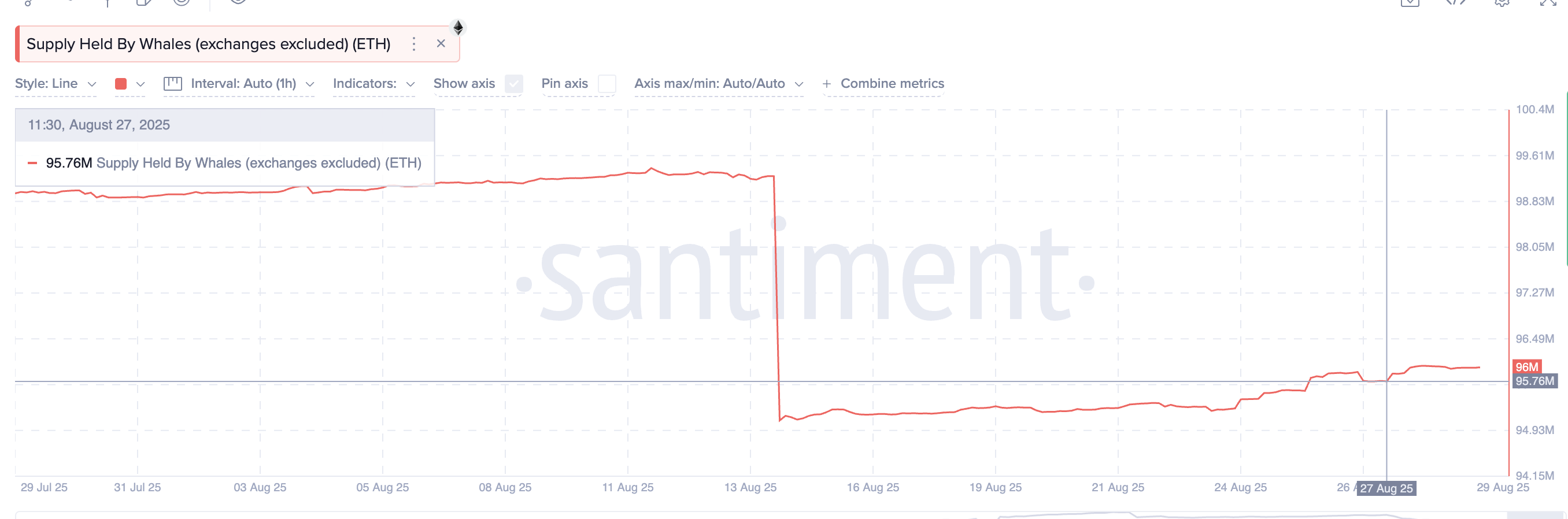

Additionally, the whales are quietly buying dip. The addresses holding over 10,000 ETHs are hidden from 9,576 million ETHs on August 27th at around 96 million ETHs today.

Ethereum whales are accumulating: santiment

At current prices, the whales have added around $1 billion worth of ETH in just two days. Together, mitigating profit booking and fresh whale accumulation will raise the next leg base to Ethereum.

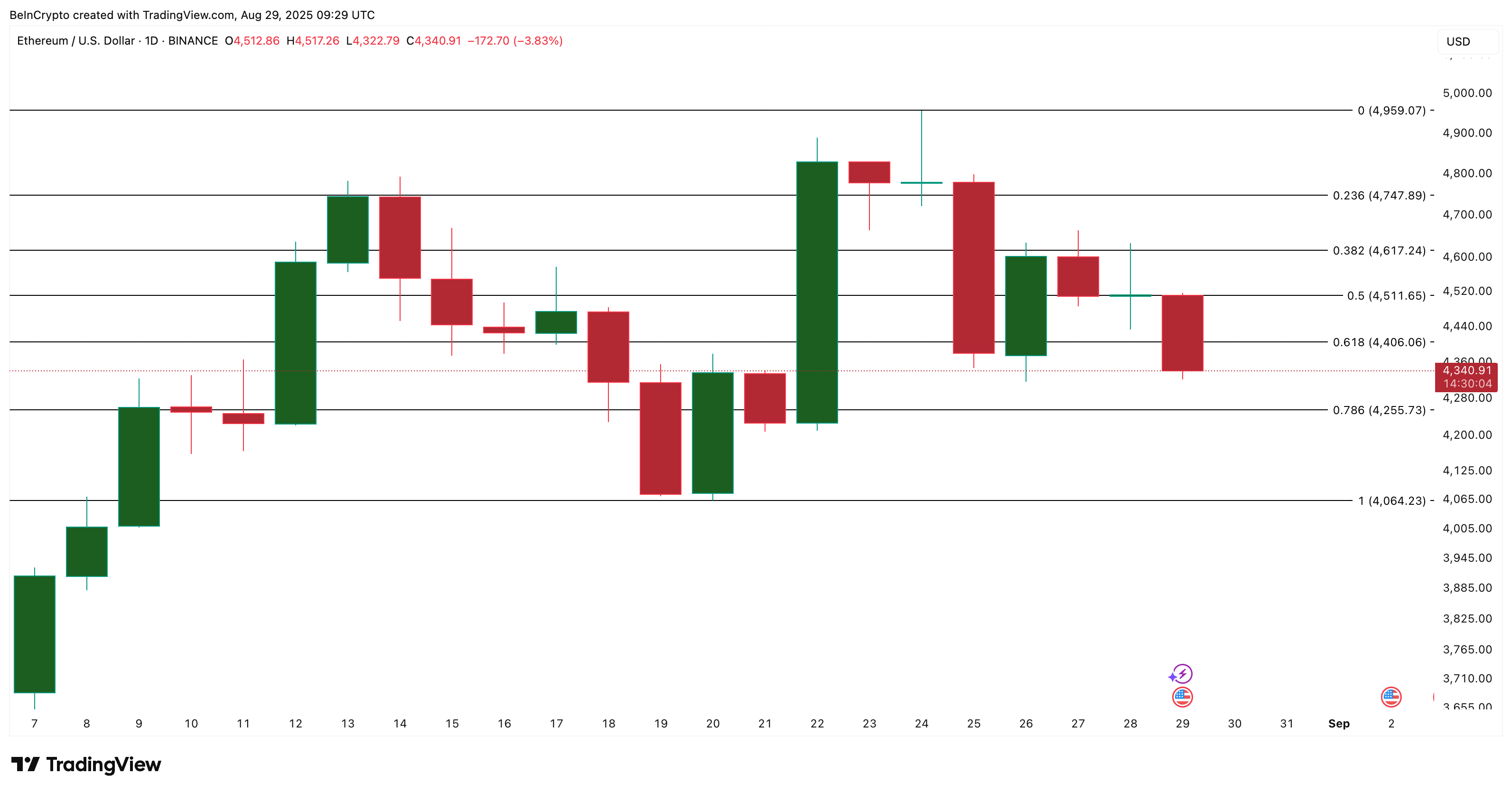

Ethereum price action and liquidation maps are arranged at key levels

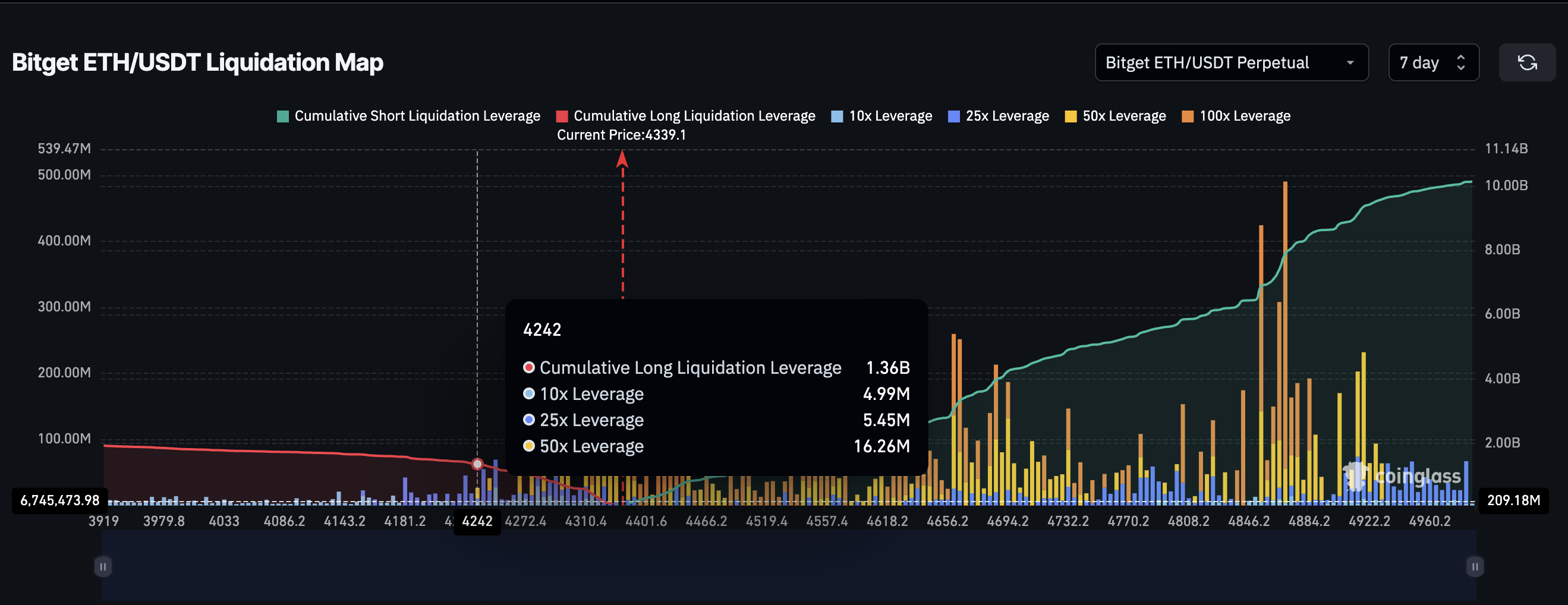

Beyond the on-chain signal, the chart also matches the uptrend view. In the Bitget Clearing Heatmap, short position stacking starts at $4,400, with levels becoming a pivot where the level is important.

If ETH manages daily candles above $4,406, it could cause liquidation of these shorts and force traders to raise the price of Ethereum and push them for a higher push.

The liquidation mapping shows where the traders placed heavy leverage positions (longs and shorts) and where price-level liquidation occurs.

Ethereum liquidation map: Coinglass

On the downside, immediate support is around $4,255, consistent with the $4,242 level on the liquidation map. This is the level at which the most utilized long positions are settled.

So if Ethereum prices are held at $4,255, a dip reversal could occur as leveraged downside risk weakens.

If the ETH price is broken below that, the next key level is $4,064. Dips under this level can turn trends upside down in the short term.

Ethereum Price Analysis: TradingView

The alignment between the liquidation cluster and the price chart level increases reliability in these zones. That means that traders are all looking at the same number, making the response at these points even stronger.

For now, the path is clear. It will regain $4,406 over $4,255, strengthening the reversal case. Failing at these levels, there is a risk that Ethereum prices will expand its penetration.

Post Ethereum Dip could be temporary and it was slow to buy a billion dollar whale and reduce profits first with Beincrypto.