WLFI tokens are making their highly anticipated debut today, unlocking 5 billion tokens and setting a stage of explosive price action as the transaction opens.

summary

- The volume of WLFI derivatives surged over $5 billion in 24 hours, with OI rising 25% to $850 million, showing high volatility first.

- Long/short ratios above 5:1 on Binance are making a big bet upside down on OKX short radar.

- Currently, around 5 billion WLFI tokens are in circulation, creating a market capitalization of between $1.6-1.7 billion at current prices, setting the stage of the battle between sales pressure and speculative demand.

The World Liberty Financial (WLFI) Token has officially been launched, making it the first exchange Binance has listed it. Transactions for the new Spot Pairs (WLFI/USDT and WLFI/USDC) begin today at 13:00 UTC on September 1, with deposits already open and scheduled to begin tomorrow. Other major exchanges have reviewed plans to list WLFIs such as Kucoin, Gate, Bithumb, Upbit, Kraken, OKX, HTX, MEXC, LBANK, BitRue, and made them available on all major trading platforms.

This list closely follows a community-driven decision to enable WLFI tokens to be traded. On August 22, the global Liberty Financial Community voted to unlock 20% of the supply held by early supporters at 12pm on September 1st, creating the first opportunity for these holders to move or trade tokens on CEXS.

You might like it too: Aave Horizon has exceeded $50 million in deposits since launch

WLFI Token Price Prediction

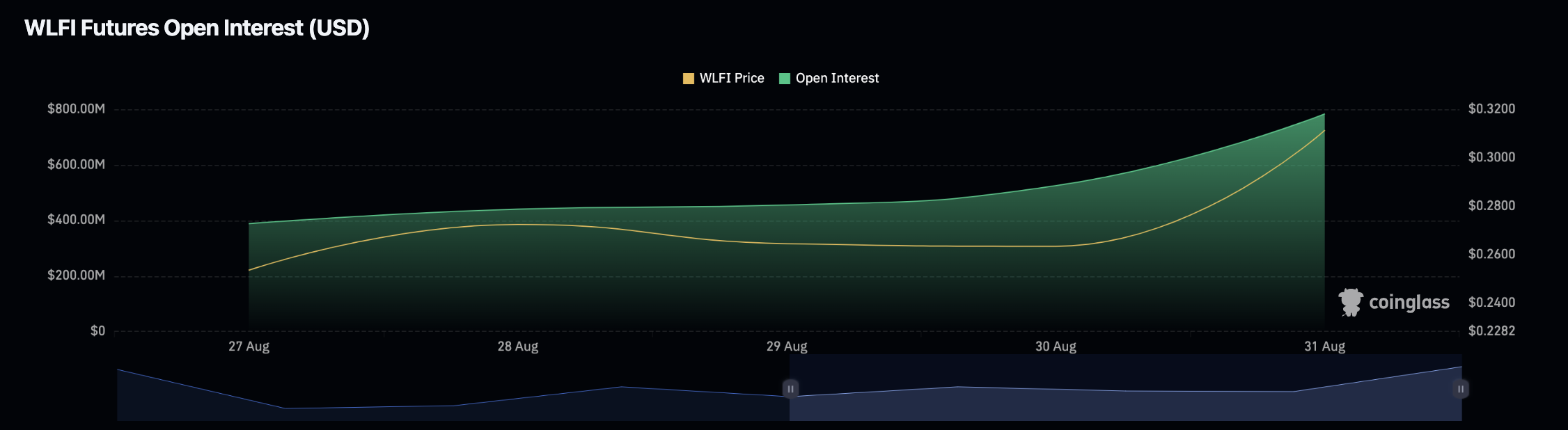

Based on Coinglass' derivative data, WLFI tokens are already gaining a lot of speculative attention. Futures trading volume has skyrocketed to $5 billion over the past 24 hours, exceeding +400%, and OI rose 25% to $850 million. Such an expansion of leveraged positioning usually indicates an increased volatility ahead.

The long/short ratio across the main exchange suggests a bullish slope. On Binance, the ratio between long and short accounts is above 5.4, while OKX shows a similar ratio above 6.3. Even among Binance's top traders, the long/short ratio stands firmly at 5.2, suggesting that market participants are positioned upside down.

In terms of price, WLFI futures have already been pushed up to the $0.30-0.32 range and are supported by steadily climbing. If momentum continues and speculative capital continues to flow, WLFI can realistically test the $0.40-$0.50 zone in the short term.

Source: Coignlass

Future unlocking is important for price discovery. The current price is around $0.32-0.34, with a circular market capitalization of around $1.6-1.7 billion. If WLFI trades for $0.50 after unlocking, the market capitalization of Cercute will rise to $2.5 billion, placing it firmly in the middle stage of CryptoCurrencies, but FDV rivals or outweighs some of the top 10 assets by size.

However, it is important to note that unlock introduces potential supply overhangs, as some early investors could benefit after burgeoning at $0.015 and $0.05 from previous private sale rounds. At the same time, it has been suggested that a surge in derivatives interest could absorb much of this sales pressure. The net effect could determine whether WLFIs will consolidate at $0.30 or make a critical move towards the $0.40-$0.50 range in the short term.

You might like it too: Multiple exchanges to list WLFI tokens for Binance, World Liberty Financial