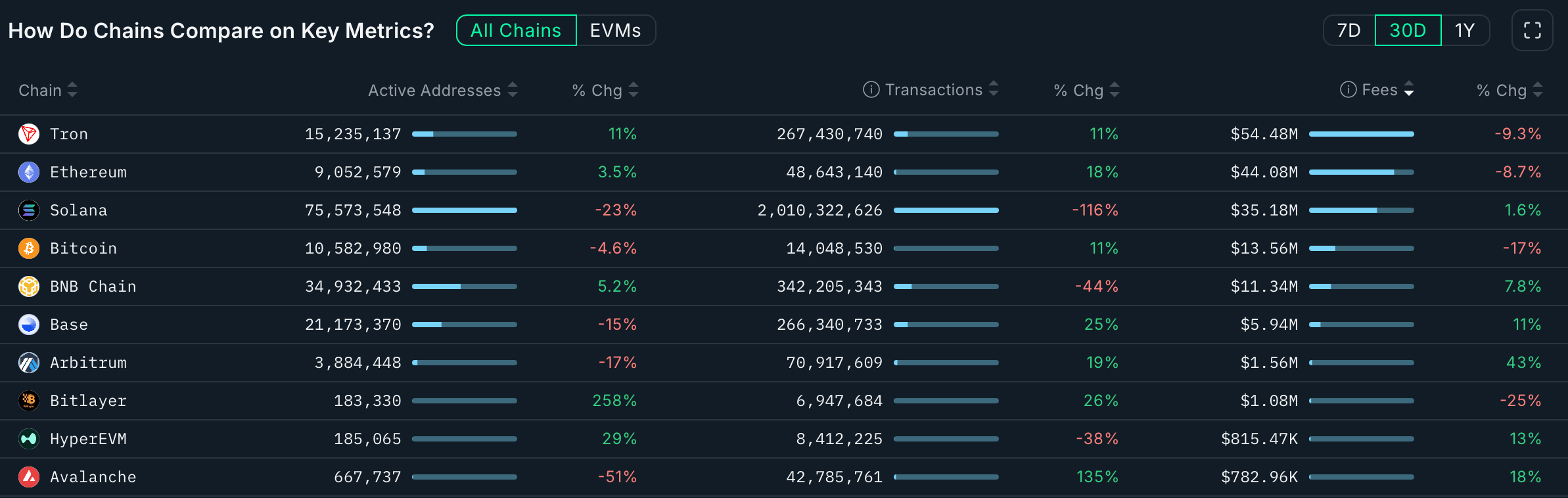

Over the past 30 days, blockchain networks have been showing active changes across addresses, transactions and prices. Solana remains a giant in terms of active wallets of over 75.5 million, but that was a massive 23% drop.

Cryptochain Metrics from August 7th to September 7th, 2025

Nansen Analytics shows that Tron isn't far behind in user engagement, boosting 15.2 million active addresses by 11%, while Bitcoin sat at 10.6 million addresses, but only at –4.6% red. Ethereum recorded 9 million addresses, up 3.5% since September 7th.

Source: nansen.ai

Transaction counts tell a different story. Solana dominated over 2 billion transactions during the recorded timeframe, but that figure showed a strangely steep –116% swing. Tron has processed more than 267 million transactions, matching user growth with 11%.

Ethereum rose 18% since the start of August after 248 million transactions. Layer 2 (L2) chainbase jumped to 25% activity with 266 million transactions, while L2 Arbitrum recorded 271 million with 19% profit.

As for fees, Tron raked the pack for $54.5 million, which fell 9.3%. Ethereum was not too late at $44 million, so it soaked 8.7%. Adding to this, Solana brought in $35.2 million, rising just 1.6%, while Bitcoin attracted a 17% drop at $17.6 million.

Both the BNB chain and the base pulled out solids totals at $11.3 million and $5.9 million respectively, but Arbitrum tallied a $1.6 million commission, jumping 43%. At the same time, the new, small chain stood out with its wild proportion swing. Bitlayer surged 258% on active addresses, and even a 25% decline, earning a 26% increase in trading.

Hyperliquid's HypereVM also rose 29% by address, but transactions fell 38% and prices increased 13%. Avalanche had a tough month for users, slipping through 51%, but avalanche trading activities have swelled at 135%, with commissions rising by about 18% over the same period.

Overall, the data draws a variety of pictures. Legacy Giants such as Tron, Ethereum and Bitcoin saw traction, but despite the decline in Solana's base, new participants such as Bitlayer and Hyperevm were shaken dramatically. The activity is very alive across the board, but it depends on whether the leader measures in wallet, transaction, or fee generation.