Good morning, Asia. This is what makes news in the market:

BTC is pinned to nearly $111,000 with volatility compressed to lows for several months. Traders know what can break the tranquility: US inflation data in September and the Fed's fee decisions a week later.

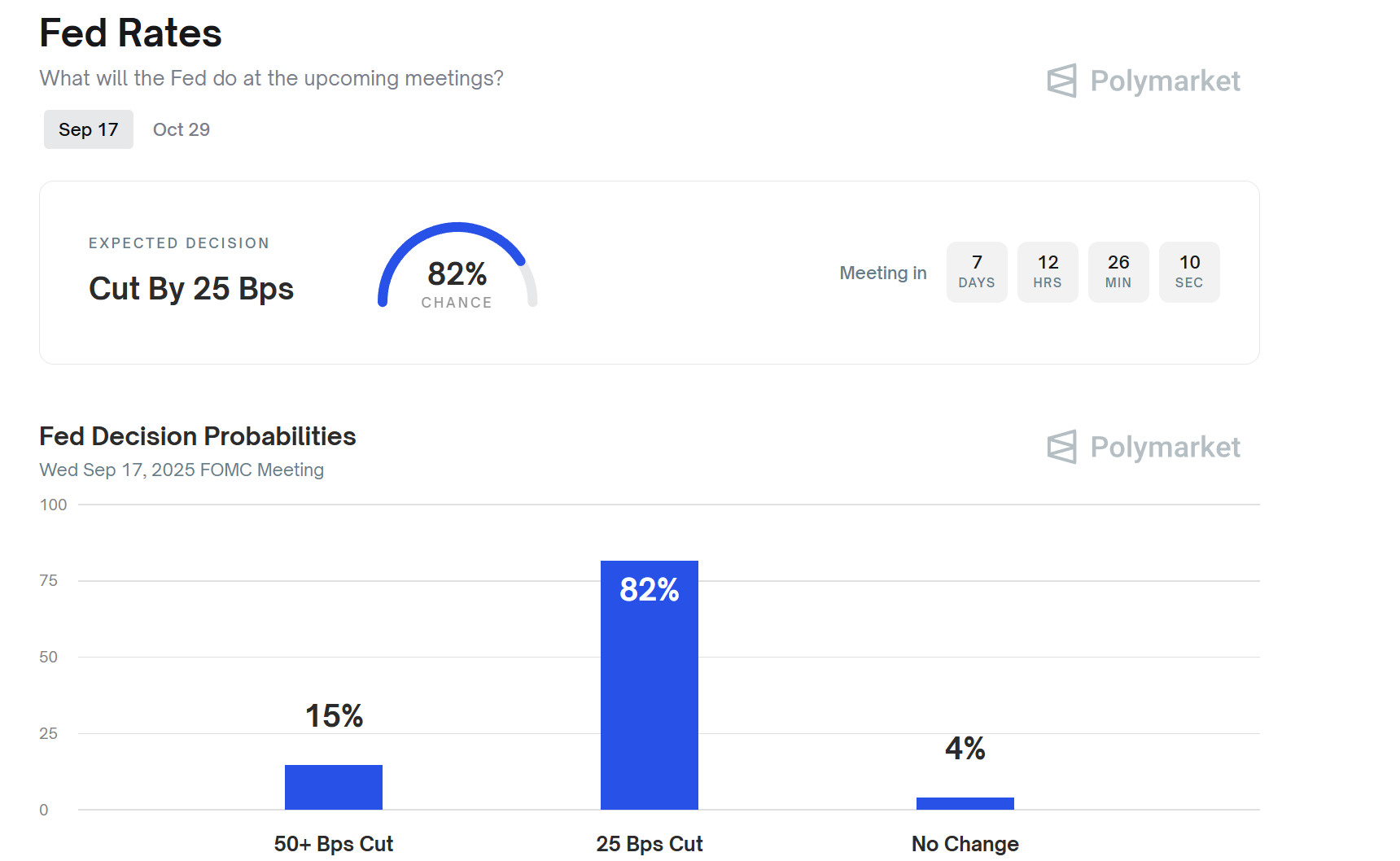

The forecast market is leaning heavily towards easing. Polymarket Bettors allocated an 82% chance of a 25 base point cut on September 17th, leaving only slim odds with deeper movements and no change. Beyond that, the expectations for October will be destroyed, and the probability of another cut or pause is almost even. The differences explain why it is unlikely that volatility will remain so despite the absence.

“The market often settles just before moving. Bitcoin is trading in one of the toughest ranges in months, with overall cryptocurrency compressing to a multi-month low.” “At the 11th of the US inflation data and the Fed's highly anticipated rate decisions on September 11th, this quiet period sets the next critical phase of movement. It is clear that the catalyst is an inverse surprise from the Fed, a Dovish signal, or that history is prevalent in digital assets.”

If the cut is low when you draw the money market, the opportunity cost of sitting in cash increases.

“The real debate right now isn't whether or not reductions will come, but whether liquidity developments will shift to BTC, ETH and even more risky assets,” the company told Coindesk.

In other words, the Fed's cuts may grab the headlines, but the actual deal is whether bystanders will turn into digital assets.

Market movements

BTC: Bitcoin is trading between around $110,812 and $113,237, slightly immersed, reflecting short-term volatility in changing investor sentiment and the broader crypto market dynamics.

ETH: ETH ranges from around $4,279 to $4,379, indicating stable demand and new investors' interest. However, the range is limited by modest ETF flows and traders waiting for the next Fed move.

gold: Gold is rallying to hit highs, driven by US Federal Reserve cuts, weakening the US dollar and increasing expectations of new safe demand.

Nikkei 225: Most Asia-Pacific shares opened on Wednesday, with Japan's Nikko 225 up 0.2%. Investors have shown that the expected CPI drop of 0.2% and PPI of 2.9% is low, waiting for China's August inflation data.

S&P 500: U.S. stocks closed at a record high on Tuesday, with the S&P 500 rising 0.27% to 6,512.61, with investors passing a record salary revision that cut 911,000 jobs from previous figures.