On September 12, 2025, Bitcoin was traded between $114,834 and $115,269 near the top of the daily range as traders measured momentum to known resistance levels.

Bitcoin

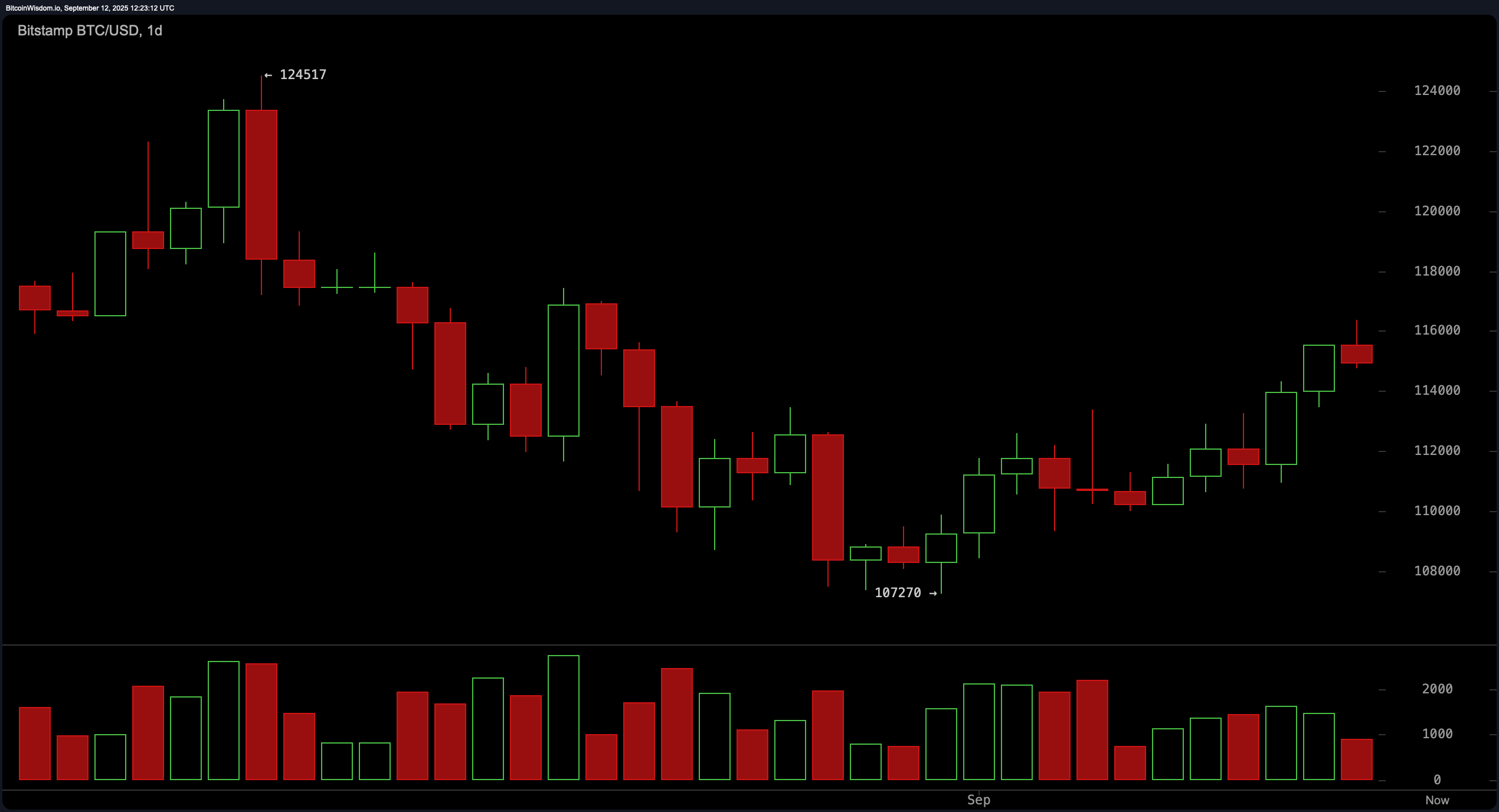

On the daily Bitcoin chart, prices are recovered from early September DIPs, nearly $107,270, and surpass the stairs towards the $116,500-$118,000 area that closes the rally in August. This structure shows consecutive high lows and higher highs, but participation was eased with the latest push. This insists on confirmation before hoping for continuance. The decisive day ending of more than $118,000 opens at $124,000. Failure to clear that zone is at risk of rotation from $113,500 to $114,500 support windows carved by recent pullbacks.

BTC/USD 1-Day Chart via BitStamp on September 12th, 2025.

The four-hour Bitcoin chart remains the same, beginning at around $110,021 from September 7th, with a swing drop tucked into shelves near $116,358. The momentum was constructive with impulsive candles, but the ceiling remains nearby, refusing to advance several times. A clear of $116,358 puts 118,000 in view. As momentum stalls again, historically high-level entries for 113,500-114,000 have historically been formed in retrace, and previous demand emerges, making it easier to define invalidation.

BTC/USD 4-hour chart via BitStamp on September 12th, 2025.

The hour-long view shows a clean break from $113,460 per Bitcoin area, followed by a mild countertrend sequence with lower-highs, like volume taper. For daytime participants, the $114,500-$115,000 pocket serves as the first reaction zone for monitoring inverted candles and updated sales. If the bounce continues to stop anywhere from $116,300 to less than $116,500, it remains cautionary to trim the risk to that band until the width and volume expand enough to resolve the range.

BTC/USD 1-hour chart via BitStamp on September 12th, 2025.

The oscillator is mixed and slightly constructive. The relative strength index (RSI) is 56 (neutral), the stoch oscillator (Stoch) is 93 (neutral), the commodity channel index (CCI) is 196 (neutral), the mean directional index (ADX) is 16 (neutral), the great oscillator (AO) is -467 (neutral), and Moveme divg (MoMe). (MACD) level is -152 (bully). In summary, this blend prefers a careful bullish attitude, close to support and patience in resistance until momentum is confirmed.

The trend filter leans upwards in the time frame. Exponential Moving Average (EMA) 10 is $112,826 (bullish), Simple Moving Average (SMA) 10 is $112,252 (bullish), EMA 20 is $112,610 (bullish), SMA 20 is $111,386 (bullish), EMA 30 is 112,940 (bullish), and SMA 30. $113,122 (bullet), SMA 50 is $114,554 (bullet), EMA 100 is $111,028 (bullet), SMA 100 is $112,328 (bullet), EMA 200 is $104,964 (bullet), and SMA 200 is 102,206 (bullet). The market supports constructive outlook while exceeding $113,000, and holds $118,000 for its next important inflection.

Bull Verdict:

Bitcoin has secured a clean landfill of over $113,000, followed by $116,358, followed by $118,000, a higher lower structure and broadly bullish motor average (EMA), and a simple moving average (SMA) stack for the 10-200 period, supporting a continuation of $120,000-$124,000. Confirmation is that once you expand the volume, closures for an hourly or four-hour period exceed $116,500. Risk changes when prices lose $114,000 during the day or when daily closures fall below $113,500.

Bear Verdict:

As the assembly continues to stagnate under $116,300-116,500 and prices roll between $114,500-113,500, a combination of midrange relative strength index (RSI), Subzero Awesome Oscillator (AO), and negative momentum (MOM) reduces the tape to $112,000-110,000. Confirmation will end at under $113,500 each day due to increased turnovers. This view is invalidated by improving the breadth and with sustained acceptance of over $118,000.