Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the impact on Ethereum, Solana and other existing payment-focused chains.

While many experts see this as an opportunity to expand user adoption and enhance cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. While Tempo could be a key catalyst for the Stablecoin market, it also runs the risk of reshaping the competitive landscape of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market attention by unveiling the concept of payment-first blockchain called Tempo. The announcement promptly sparked debate on the “payment-first” model. This is a design that prioritizes stable transfer and payment experience rather than focusing on multipurpose smart contracts like Ethereum.

At the macro level, payment-first blockchain provides new users (merchants and Stripe customer base) with a direct path to access stove coins and payments on the chain, without going through multiple bridges or complex Layer 2 (L2) solutions. This explains why the Fintech giant prefers Layer-1 (L1) over L2.

Interestingly, many people have compared the tempo with Libra. Tempo is an unfortunate project that was once led by Meta (formerly Facebook). However, Crypto currently enjoys greater political and institutional support, so the tempo may have better odds.

“The striped tempo chain is the Libra V2, but it has a political climate that doesn't choke it down in a crib,” said Ryan Adams of Bankless.

That said, Tempo's true value depends on whether it attracts meaningful payment volumes or whether it can become a “another chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” but some argue that its technical foundation may not match the current state of the market, given that other platforms offer far more than what Tempo is proposing.

“There may be business reasons for the Stripe L1, but in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Other experts have expressed concern about the project's claims of “neutrality” regarding stubcoins and gas tokens within tempo ecosystems. Regulatory risk remains as Stablecoin issuers may face conflicts of interest or lack confidence in the chain's framework.

“There's a reason why a successful L1 only accepts their own native token for gas. The counterparty risk of doing it in other ways is high and only grows if the chain is successful…”

The impact of tempo on the crypto market

Some perspectives highlight that “chain fragmentation” could benefit cross-chain interoperability protocols as demand for bridges and oracles increases. As a result, infrastructure players such as bridges, Oracle providers such as chain links (links), and on-chain payment service providers can make the most profits as services become essential for value transfer across the ecosystem.

However, while stubcoin's growth is generally a positive signal for crypto, and new stripe users can still take advantage of Ethereum debt, analyst Ignus warned that it would be difficult to interpret this as a bullish signal for ETH.

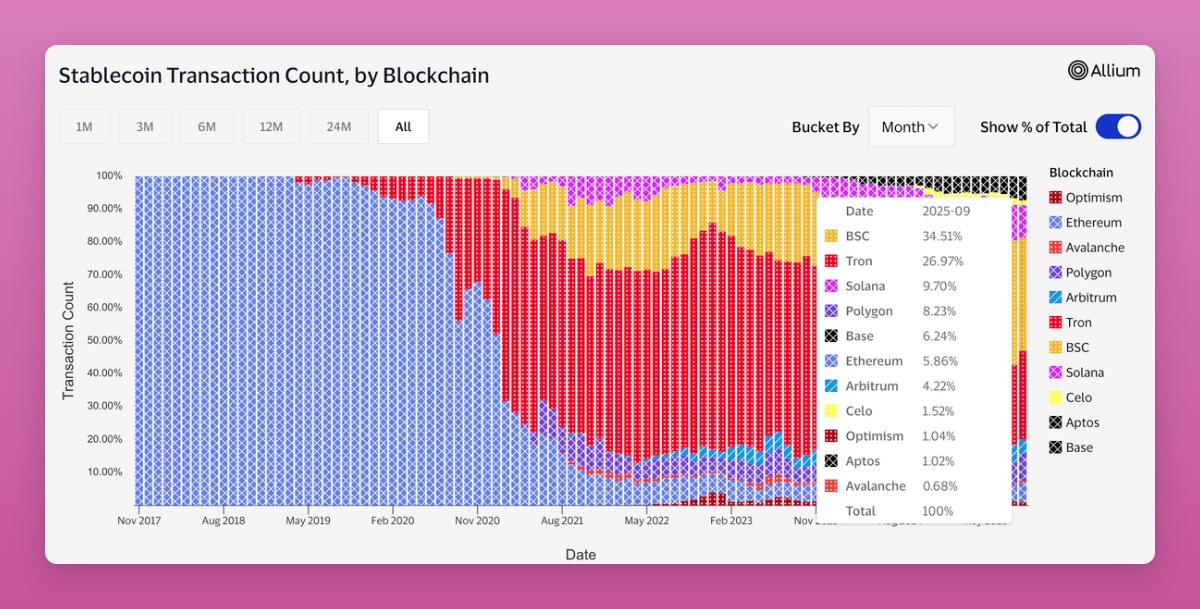

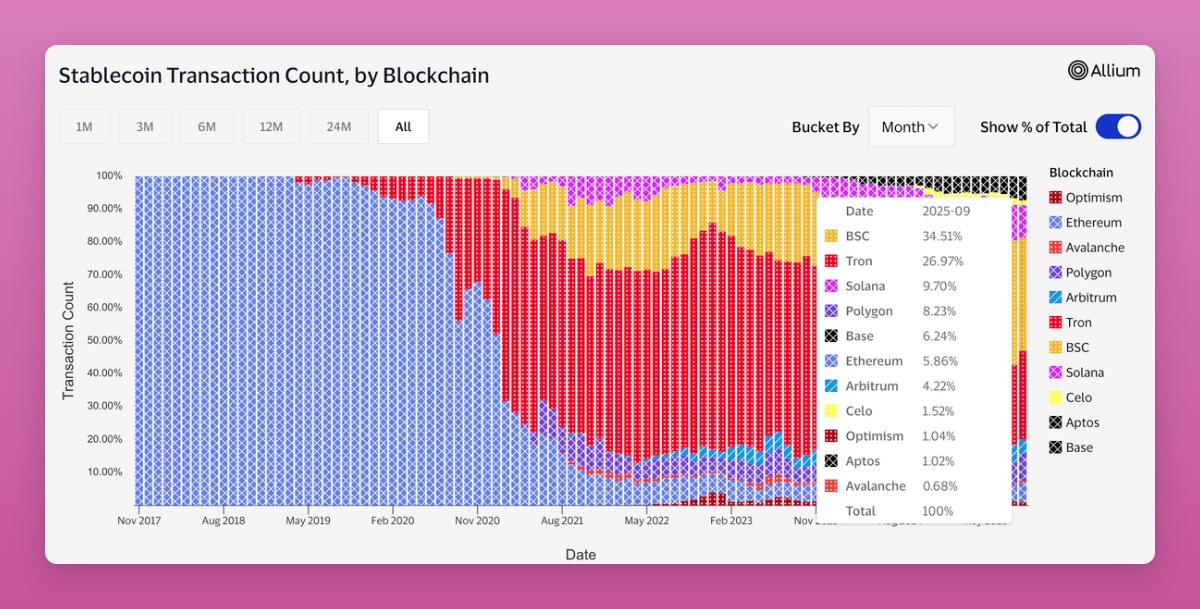

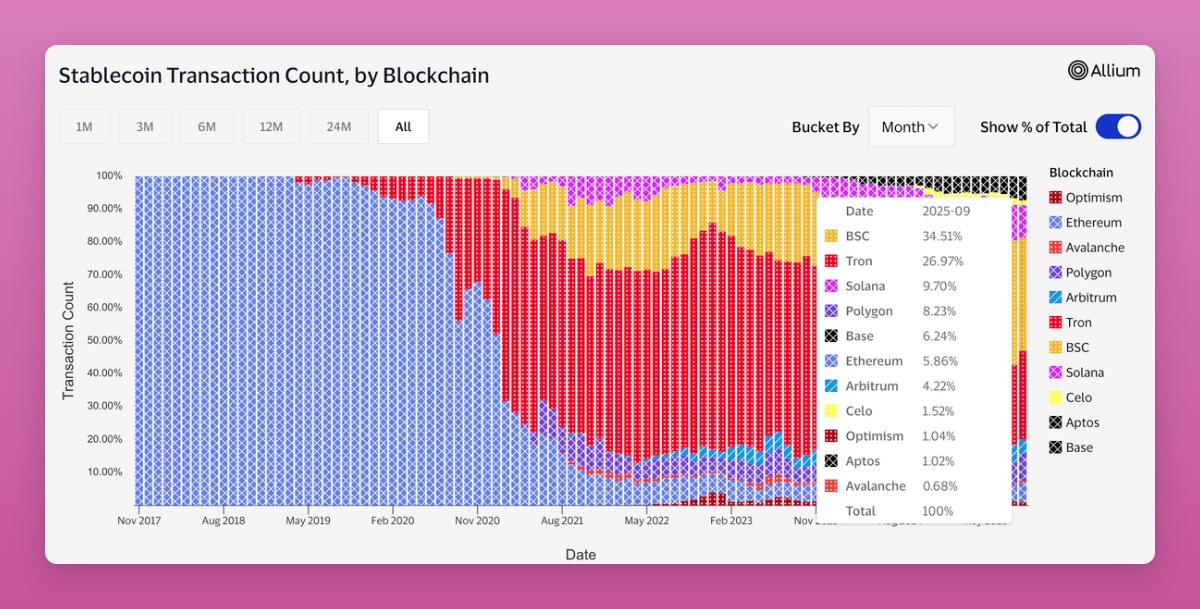

Most Stablecoin transactions occur in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete directly with these ecosystems. Still, experts predict that Ethereum will be a big winner in the new stubcoin economy.

Stablecoin transactions via blockchain. Source: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum and Solana in the payment niche. If Tempo successfully captures liquidity and seller recruitment, the Stablecoin flow could be significantly redirected.

Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the impact on Ethereum, Solana and other existing payment-focused chains.

While many experts see this as an opportunity to expand user adoption and enhance cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. While Tempo could be a key catalyst for the Stablecoin market, it also runs the risk of reshaping the competitive landscape of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market attention by unveiling the concept of payment-first blockchain called Tempo. The announcement promptly sparked debate on the “payment-first” model. This is a design that prioritizes stable transfer and payment experience rather than focusing on multipurpose smart contracts like Ethereum.

At the macro level, payment-first blockchain provides new users (merchants and Stripe customer base) with a direct path to access stove coins and payments on the chain, without going through multiple bridges or complex Layer 2 (L2) solutions. This explains why the Fintech giant prefers Layer-1 (L1) over L2.

Interestingly, many people have compared the tempo with Libra. Tempo is an unfortunate project that was once led by Meta (formerly Facebook). However, Crypto currently enjoys greater political and institutional support, so the tempo may have better odds.

“The striped tempo chain is the Libra V2, but it has a political climate that doesn't choke it down in a crib,” said Ryan Adams of Bankless.

That said, Tempo's true value depends on whether it attracts meaningful payment volumes or whether it can become a “another chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” but some argue that its technical foundation may not match the current state of the market, given that other platforms offer far more than what Tempo is proposing.

“There may be business reasons for the Stripe L1, but in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Other experts have expressed concern about the project's claims of “neutrality” regarding stubcoins and gas tokens within tempo ecosystems. Regulatory risk remains as Stablecoin issuers may face conflicts of interest or lack confidence in the chain's framework.

“There's a reason why a successful L1 only accepts their own native token for gas. The counterparty risk of doing it in other ways is high and only grows if the chain is successful…”

The impact of tempo on the crypto market

Some perspectives highlight that “chain fragmentation” could benefit cross-chain interoperability protocols as demand for bridges and oracles increases. As a result, infrastructure players such as bridges, Oracle providers such as chain links (links), and on-chain payment service providers can make the most profits as services become essential for value transfer across the ecosystem.

However, while stubcoin's growth is generally a positive signal for crypto, and new stripe users can still take advantage of Ethereum debt, analyst Ignus warned that it would be difficult to interpret this as a bullish signal for ETH.

Most Stablecoin transactions occur in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete directly with these ecosystems. Still, experts predict that Ethereum will be a big winner in the new stubcoin economy.

Stablecoin transactions via blockchain. Source: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum and Solana in the payment niche. If Tempo successfully captures liquidity and seller recruitment, the Stablecoin flow could be significantly redirected.

Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the impact on Ethereum, Solana and other existing payment-focused chains.

While many experts see this as an opportunity to expand user adoption and enhance cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. While Tempo could be a key catalyst for the Stablecoin market, it also runs the risk of reshaping the competitive landscape of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market attention by unveiling the concept of payment-first blockchain called Tempo. The announcement promptly sparked debate on the “payment first” model. This is a design that prioritizes the transfer and payment experience of Stablecoin, rather than focusing on multipurpose smart contracts like Ethereum.

At the macro level, payment-first blockchain provides new users (merchants and Stripe customer base) with a direct path to access stove coins and payments on the chain, without going through multiple bridges or complex Layer 2 (L2) solutions. This explains why the Fintech giant prefers Layer-1 (L1) over L2.

Interestingly, many people have compared the tempo with Libra. Tempo is an unfortunate project that was once led by Meta (formerly Facebook). However, Crypto currently enjoys greater political and institutional support, so the tempo may have better odds.

“The striped tempo chain is the Libra V2, but it has a political climate that doesn't choke it down in a crib,” said Ryan Adams of Bankless.

That said, Tempo's true value depends on whether it attracts meaningful payment volumes or whether it can become a “another chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” but some argue that its technical foundation may not match the current state of the market, given that other platforms offer far more than what Tempo is proposing.

“There may be business reasons for the Stripe L1, but in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Other experts have expressed concern about the project's claims of “neutrality” regarding stubcoins and gas tokens within tempo ecosystems. Regulatory risk remains as Stablecoin issuers may face conflicts of interest or lack confidence in the chain's framework.

“There's a reason why a successful L1 only accepts their own native token for gas. The counterparty risk of doing it in other ways is high and only grows if the chain is successful…”

The impact of tempo on the crypto market

Some perspectives highlight that “chain fragmentation” could benefit cross-chain interoperability protocols as demand for bridges and oracles increases. As a result, infrastructure players such as bridges, Oracle providers such as chain links (links), and on-chain payment service providers can make the most profits as services become essential for value transfers across the ecosystem.

However, while stubcoin's growth is generally a positive signal for crypto, and new stripe users can still take advantage of Ethereum debt, analyst Ignus warned that it would be difficult to interpret this as a bullish signal for ETH.

Most Stablecoin transactions occur in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete directly with these ecosystems. Still, experts predict that Ethereum will be a big winner in the new stubcoin economy.

Stablecoin transactions via blockchain. Source: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum and Solana in the payment niche. If Tempo successfully captures liquidity and seller recruitment, the Stablecoin flow could be significantly redirected.