According to Mert Mumtaz, CEO of Remote Procedure Call (RPC) Node Provider Helius, Crypto is called “Web 3.0.”

Mumtaz said Crypto is supercharged to function properly, including free information in a decentralized way, unchanging property rights, incentive alignment, transparency, and “friction-free” capital flows. Mumtaz added:

“The endgame of Crypto is about radically evolving the most impactful human inventions of all time. Capitalism. I said Crypto is Web 3.0, but that undermines it – it's actually Capitalism 2.0.”

sauce: Because it's mumta

In September, two US financial regulatory bodies, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), issued a joint statement tearing the potential of the domestic 24/7 capital markets.

If agents succeed in establishing a ever-present capital market, this move marks a significant and earthquake deviation from the legacy financial system that travels slow and closes on nights, weekends and most holidays.

Related: Tokenization could unleash growth in Latin American capital markets

US regulators show that 24/7 financial markets are coming

The SEC and CFTC outlined several points that could modernize the existing financial system, including always-on markets, regulatory frameworks for permanent futures contracts (futures contracts with no expiration dates), and event forecast market regulation.

“Certain markets, including forex, gold and crypto assets, are already trading continuously. If expanded further, the US market may fit into the evolving reality of the global and constantly occurring economy,” read a statement from the joint SEC and CFTC.

These proposals further intertwin the digital assets with traditional financial systems, moving legacy financial systems into the Internet capital markets via digital rails, including tokenizing real-world financial assets on the blockchain.

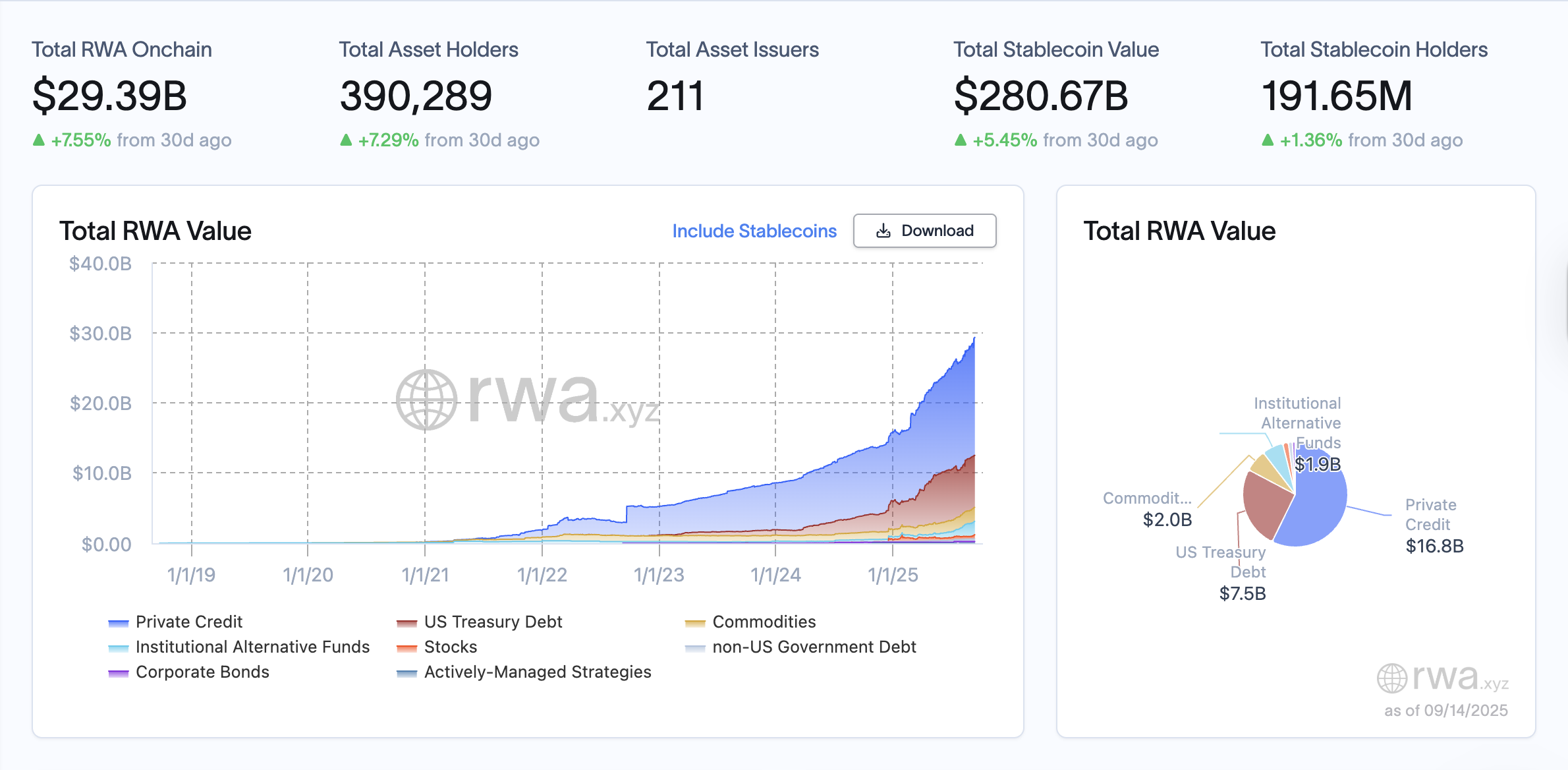

An overview of the real-world tokenized asset market, including Stablecoins. sauce: rwa.xyz

Tokenized assets include stocks, stupid credit, bonds, art, collectibles, and even stocks in the form of real estate, as well as Fiat currency.

In July, the Solana Foundation, the organization that oversees the development of the Solana blockchain network, revealed its roadmap for developing the Internet capital market until 2027.

The roadmap emerged among traditional financial companies, where several blockchain companies and traditional financial companies unveiled tokenized products, including mixed securities platforms that introduced tokenized stock trading for European users in July.

magazine: Can a tokenized inventory of Robinhood or Kraken really be decentralized?