Bitcoin Miners facilities increased during H1 2025 as Iren, CIFR, CORZ, APLD and MARA lead the number of holders and capital flows.

Bitcoin mining stock and investor sentiment

The next guest post comes from bitcoinminingstock.io, One-stop hub for everything Bitcoin mining stocks, educational tools, and industry insights. Originally published on September 11, 2025, it was written by the author of bitcoinminingstock.io Cindy Fen.

Our team is working on the following important features, but we wanted to share a brief update on institutional activities in the Bitcoin mining sector. I've been watching since the end of last year.

In January, we made it public 2024 Bitcoin Mining Review It was co-authored with from. Digital Mining Solutions. In that report, It was mentioned The agency had “big bets” on the Colts, Wolf, Aylen and Hutt. So far, these names are commonly found Outperform Wide mining sector YTD.

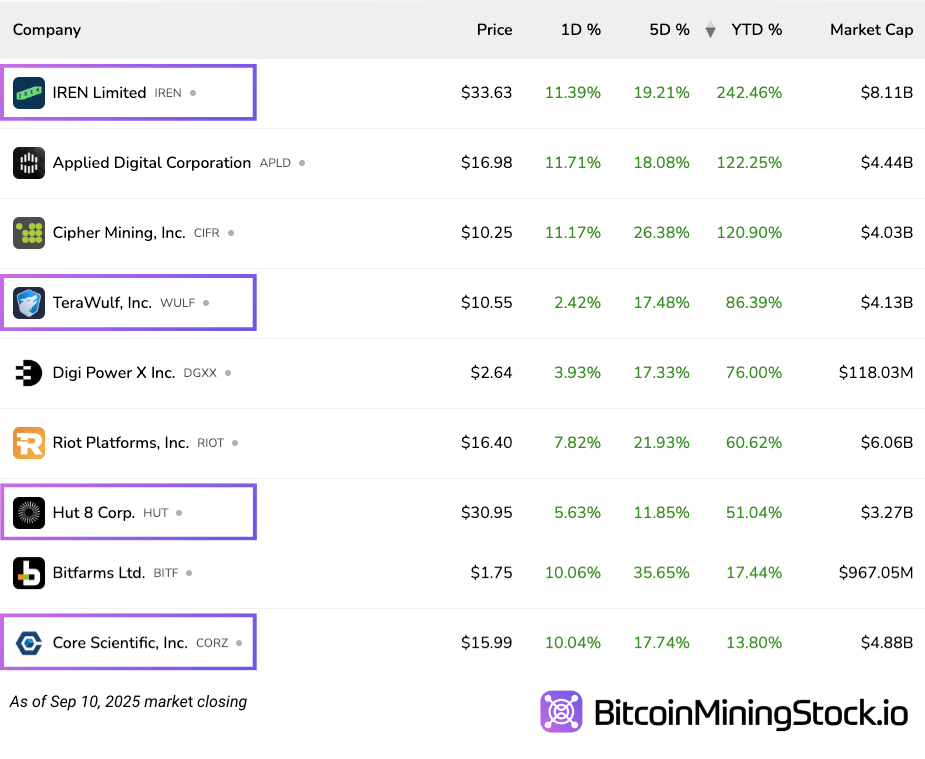

Top YTD Gains in the Bitcoin Mining Sector

The report also flagged three institutional trends.

- Institutional interest in Bitcoin miners was on the rise.

- The AI/HPC story was attracting attention.

- Large miners remained the default choice for facility capital.

It has a fresh round of 13F filings, so it's a good time to see what's changed and what still applies. And most importantly, the institutions are making new bets.

The engine is still spinning

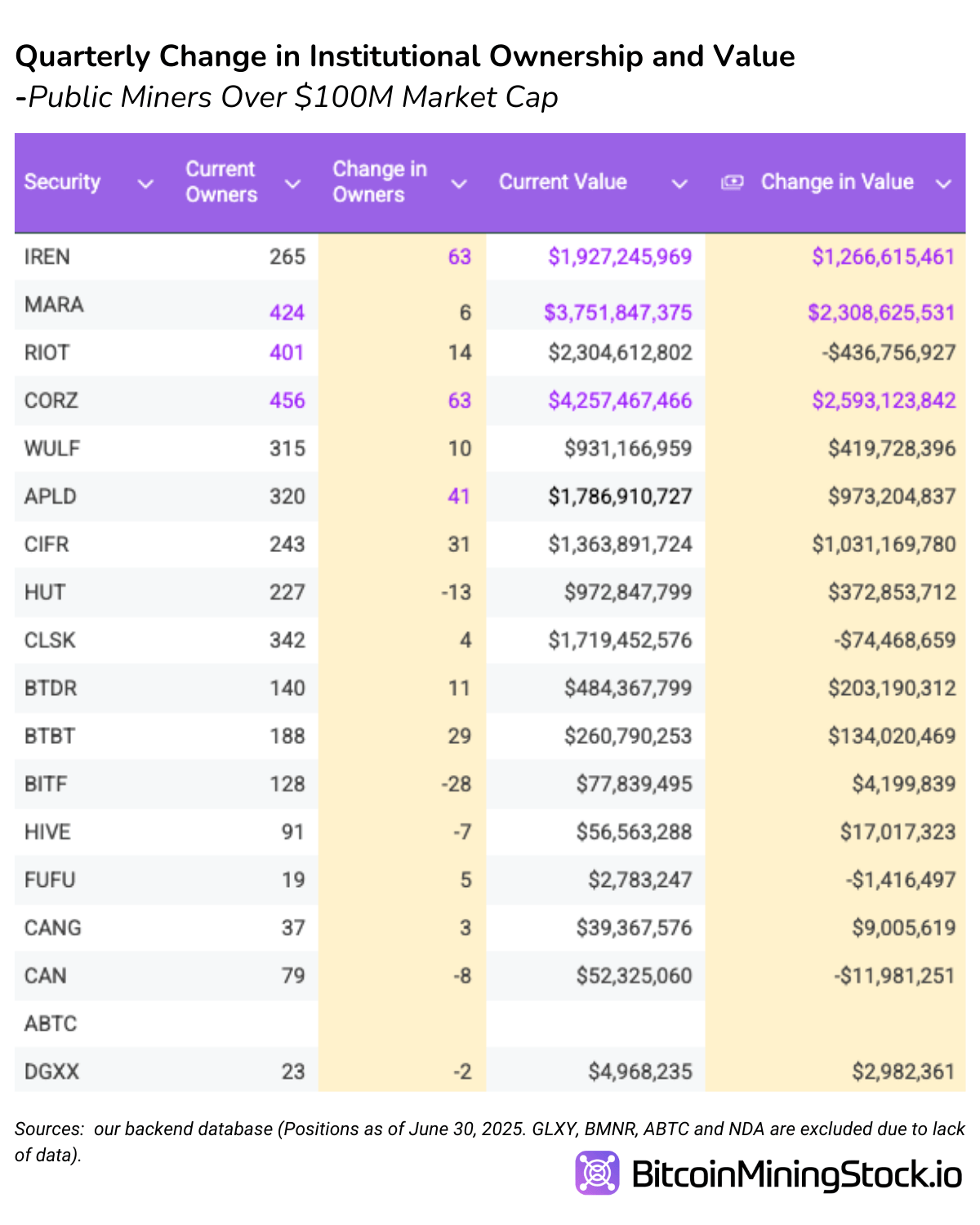

Miners with market capitalizations of over $100 million, most saw both an increase in institutional ownership and an increase in total capital invested. this Check the first trend: Overall, institutional interest in this sector remained strong throughout H1 2025.

But what's more clear is where The capital is flowing. Iren, Corz and APLD led the charges, each adding more than 40 new institutional holders. What do they have in common? All three are exposed directly to AI/HPC.

- Colts and APLD We signed a multi-billion dollar colocation deal with CoreWeave.

- ironhas yet to announce any major HPC transactions, but it is consistently updating the progress of GPU deployment and the AI-Reaid infrastructure market.

This reinforces the idea that The AI/HPC story remains the most powerful institutional pull The entire public mining sector. Institutions are clearly rewarded with companies that can monetize their data center infrastructure beyond Bitcoin.

Dollar Flow talks the same thing. Corz, Mara, and Iren Leading on increasing value institutional investment, followed by CIFR and APLD. Mara Although it stands out as the only top-gainer without valid AI/HPC exposure, it remains the largest public miner in both hashrate and Bitcoin Treasury sizes. That's probably why it continued to receive major capital inflows. The agency wanted pure Bitcoin beta exposure on a large scale. For a long time, Mara held the top spot in market capitalization, but until recently BMNR and Aylen had been overtaken.

Not everyone is gaining love

At the same time, not all miners continued walking. You can lose BITF, HUT and institutional ownership, but you have seen net reductions in the value of Riot, CLSK and institutional holdings.

In some cases, this is consistent with a decline in stock performance. For example, the can is -65.60% ytd. CLSK and BITF showed marginal growth in YTD (+4.99% and +6.17%, respectively) and lagged behind their peers on a similar operational scale.

The shed is an interesting case. Despite losing 13 institutional owners, there is still a strong YTD return. It may reflect a turnover, an increase in retail activity, or a rebalance due to funds, but it does not appear to be a fundamental issue of trust. Incidentally, Hut has actively placed its position as an energy infrastructure platform instead of Bitcoin miners. They packaged the entire computing segment as an independent company, American Bitcoin.

Riot, CLSK and BITF have also announced their HPC exploration, but no one has ever reported any energyized capacity or signature transactions.

The ownership percentage reveals deeper positioning

Looking at institutional ownership as a percentage of outstanding shares, several patterns emerge.

- Colts (78.44%); CIFR (76.06%) and APLD (71.36%) have the highest institutional penetration.

- In a small cap, BTBT It is outstanding with 65.52% institutional ownership.

- in contrast, BTDRdespite its market capitalization exceeding $1 billion, it only has 22.18% institutional ownership.

In general, firms with larger market caps see stronger institutional participation. However, exceptions such as BTBT and BTDR show how important the story and vision are.

especially, CIFR, BTBTand iron Also, the maximum was shown The percentage increases Ownership for the second quarter of 2025. All three are leaning heavily towards promoting HPC/AI ambitions, and the agency responds clearly.

So what has changed and what hasn't happened?

The most recent data confirms what we proposed in our annual report: the agency has Exposure continued Their capital is not evenly distributed in the Bitcoin mining sector. Bigger Miner (Market Cap) Continuing to attract a large portion of the influx within that group; Priority is concentrated in companies with signed AI/HPC Contract or visible GPU deployment. That explains why Aylen, Colts, CIFR and APLD led the field With both new institutional owners and fresh capital allocations.

Mara stands out as an exception. Nevertheless, without the HPC strategy, it holds its position as the top non-HPC bet driven by the largest hash rate and sectoral Bitcoin Treasury. In contrast, smaller cap names, people without AI exposure, or companies headquartered outside the US continue to struggle to gain the same level of institutional trust.

Looking aheadthe focus shifts from positioning to delivery. For miners exposed to HPC, the question is whether they can hit contract milestones quickly enough to activate capabilities, expand revenues and maintain institutional convictions. For Latecomers, the challenge is to carve out a clear story and back it up with hard numbers.

It is also worth noting that companies with already high institutional ownership may begin to face restrictions simply because many of their floats are already institutionally held. Meanwhile, miners with low facility ownership but reliable infrastructure and power capabilities are available for reevaluation if the right catalysts emerge. In other words, the institutions show where their beliefs are; The market remains liquid. Ultimately, the run separates the leader from the laguard of the previous quarter.

Methodology and limitations

This update is based on the latest 13F filing backend aggregation as of June 30, 2025. The figures reflect the long fair position reported by US institutional filers, excluding derivatives, swaps, and most non-US filers. 13FS appears backward, so the position displayed may differ significantly from where the institution is standing at the time of writing.