The US sits on a financial cliff. As of September 2025, the country is facing a historic reality, as the total US debt is over $37.43 trillion. Nearly a quarter of all taxes it collects are consumed by providing services to pay interest on debt burdens.

Relentless march of US debt

Government bonds skyrocketed to $37.43 trillion, according to monthly updates from both the US Treasury Department and the Joint Economic Committee. This marks an increase of $2.09 trillion over the past year.

Interest alone for 2025 exceeded $478 billion, an increase of 17% from last year, according to CNBC.

This cost is projected to account for about 23 cents of the dollar collected by the IRS. This is an incredible percentage that has risen sharply as global interest rates normalize after years of quantitative easing.

Tariffs: Big numbers, small impact

In recent years, the US government has been earning record-breaking tariff revenue, particularly after a series of new import tariffs imposed under the Trump administration.

These tariffs are expected to strengthen the finances of the Treasury, which could reduce the country's deficit by $4 trillion over a decade.

But even such a windfall can barely blow the mountain of US debt for its citizens, increasing interest costs and outweighing increased tariff collection. The IMF warns that “the magnitude of the increase in tariff revenue is very uncertain,” but Eliant Capital posted.

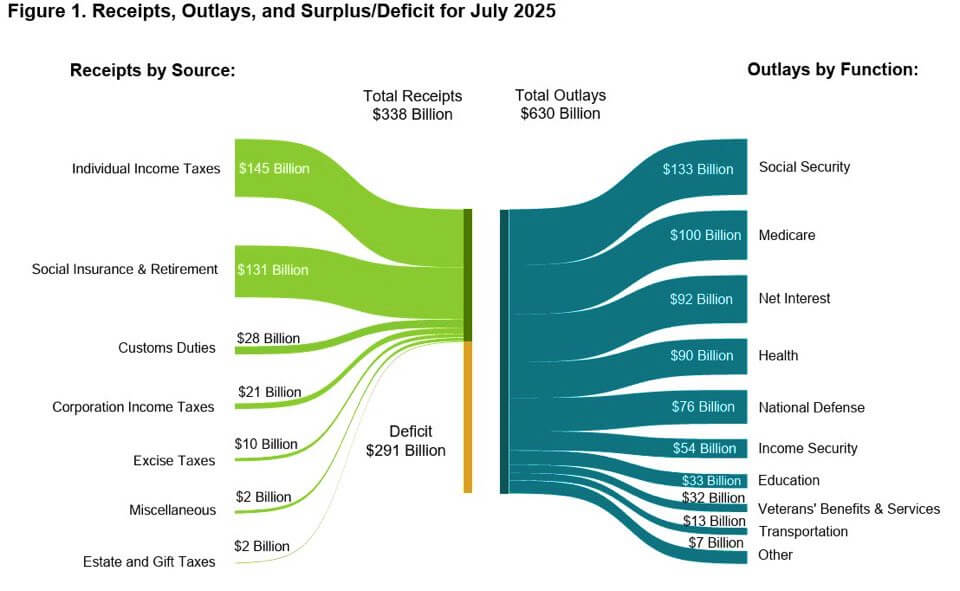

“Despite tariff revenue, the deficit in July was $29.1 billion, with the US spending $63 billion and collecting $338B billion, which was borrowed every $1.”

There's nothing to stop this train

Macro analyst Lyn Alden is now popularizing the paper “Stop this train,” a phrase borrowed from pop culture, which is now synonymous with the US debt dilemma.

Alden's analysis argues that sustained deficits and merciless spending are now in an age of fiscal control, and substantial fiscal reform is politically impossible. In her view, the relentless occurrence of debt is structurally embedded in the system, with only a paradigm shift (such as hard money) that can break the cycle. Alden said on Slate's Sunday:

“Structurally, there's very little way to stop it, and that's for (US debt) to grow beyond its target.”

Interest payments are currently the federal government's third largest spending category, according to the Peterson Foundation. They outweigh almost every other program except Social Security and Medicare.

As a share of revenue, federal interest payments will increase to 18.4% by the end of the year. This is at a level that has not been seen since the early 1990s.

Interest payments intensify the conversation about “hard money” as they consume constant stocks of federal revenue and traditional relief measures such as reduced tariffs and spending.

Bitcoin and other cryptos are increasingly seen as valuable alternatives in an era of sustained financial expansion.

As Alden's paper warns, nothing will stop this train. This realization is to encourage new attention to hard money solutions such as Bitcoin and Gold.

Investors are looking for alternatives like Bitcoin and Gold

Both gold and Bitcoin have seen strong demand as valuable alternatives amidst financial concerns and inflationary pressures.

As of mid-September 2025, gold was at an all-time high, trading at over $3,600 per ounce, up over 41% year-on-year.

Some analysts hope that Gold's rally will continue, projecting prices to $3,800 by the end of the year, as global liquidity will guide investors to safe shelters.

Bitcoin, which many call “digital gold,” trades around $115,000 to $118,000 from its rebounds of nearly $108,000 from its September low.

Bitcoin's price action was volatile, but many analysts, including Lyn Alden, expect to reach at least $150,000 by the end of this cycle.

As fiscal pressures increase, these options are seen as key safeguards for diverse portfolios in an age when US debt is out of control.