Louisiana Rep. Cleo Fields is currently under tight scrutiny over two extremely timed stock deals. In July, Fields purchased a share in Bitcoin mining company IREN. Since then, stock prices have risen significantly.

Fields also bought Oracle shares a few weeks before the company announced it would oversee TikTok's US algorithms. Both deals took place just before news that caused a massive rise in their respective stock prices.

Timely Bitcoin mining stock purchases by lawmakers

Following the exponential rise of Louisiana Rep. Cleo Fields' investment portfolio following a series of timely stock purchases, a persistent debate over whether lawmakers will use their position for insider trading resurfaced this week.

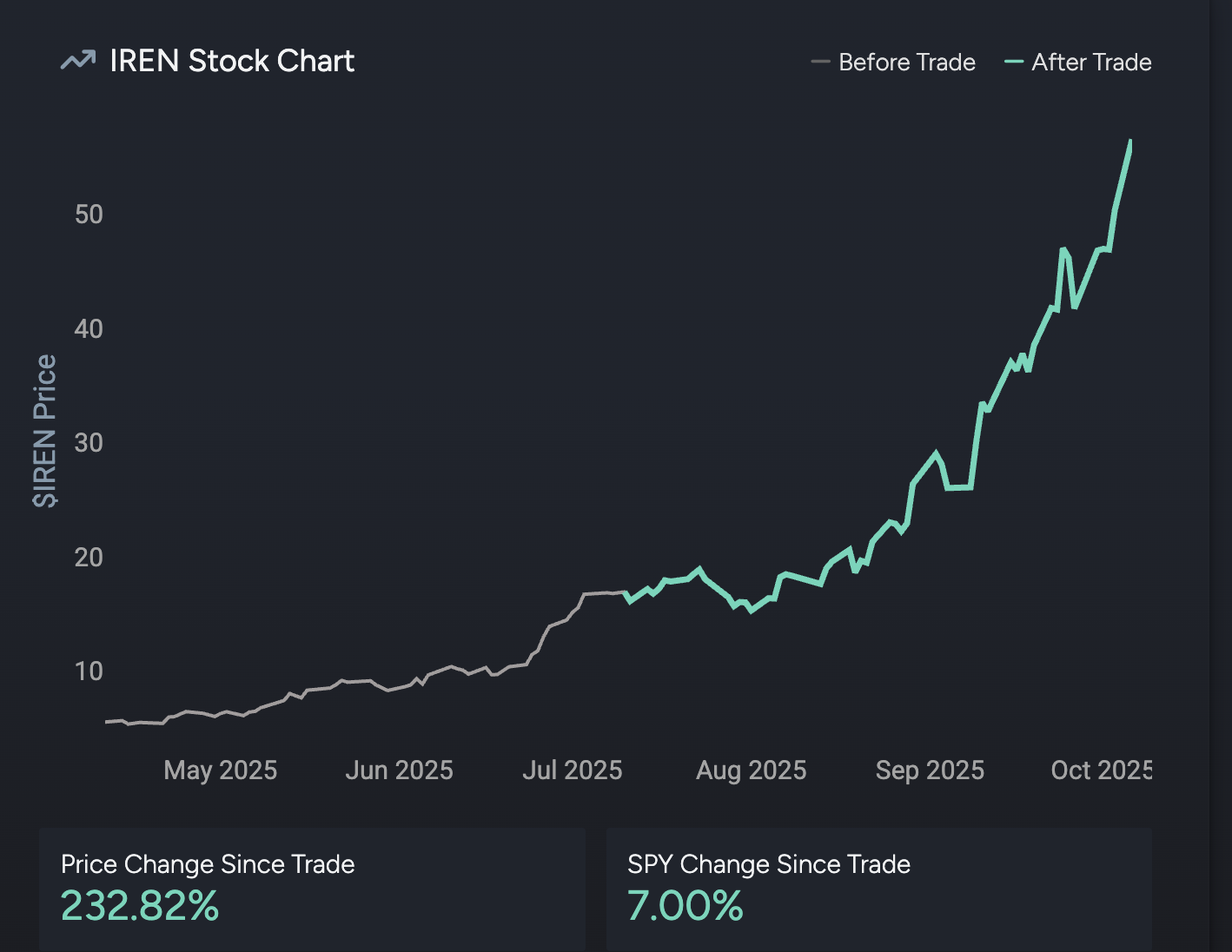

Fields traded between $15,001 and $50,000 worth of IREN stocks on July 10, according to data from stock data company Quiver Quantitative. Since then, IREN's share price has risen nearly 233%.

IREN's stock price has risen nearly 233% since July. Source: Quiver Quantitative.

IREN is a Bitcoin mining company that has recently actively expanded its operations to provide high-performance computing capabilities for artificial intelligence.

The company has made a series of announcements that have attracted much attention from investors. In August, IREN announced it had achieved Nvidia Preferred Partner status, allowing priority access to the latest GPUs in high demand.

IREN is pledging to double its GPU capacity to 23,000 units by early 2026. With this aggressive expansion, it aims to exceed $500 million in annual revenue. In addition to its partnership with Nvidia, IREN has acquired a massive supply of AMD GPUs.

Fields' investments have attracted particular attention for his position on the House Financial Services Committee. The committee oversees key financial sectors such as banking, housing, insurance and securities regulations.

Fields also serves on three subcommittees: capital markets, financial institutions and monetary policy, and oversight and investigation.

Neither Fields nor the House Financial Services Committee immediately responded to BeInCrypto's request for comment.

While Fields' acquisition of IREN may seem like a coincidence or planned strategy, some of his previous investments have strengthened public surveillance that Louisiana lawmakers may be making financial decisions based on insider trading.

Fields' well-timed investment patterns

In September, Fields bought between $80,000 and $200,000 worth of Oracle stock in a week.

The move frowned upon at the odd timing of these purchases. Fields made his first two deals on September 17th and 18th. The following day, Oracle announced that it had been chosen to oversee the TikTok algorithm for the US. By September 22nd, Oracle's share price had risen 3%.

Fields is not the only lawmaker whose stock trading activities are subject to public screening.

Wide range of parliamentary trade issues

Congressional lawmakers' involvement in stock transactions has long been pointed out as a conflict of interest, and many lawmakers have been criticized by the public.

There are generally two areas of concern. One is a suspicion of violation of the Congressional Information Trading Suspension Act (STOCK) Act, which focuses primarily on the timely disclosure of stock transactions.

Congress should prohibit lawmakers from trading stocks while they are in office.

Americans have the right to know that elected officials are making decisions in the best interests of the people, not to enrich themselves. pic.twitter.com/fTIMgjayJO

— Campaign Legal Center (@CampaignLegal) September 20, 2025

Rep. Nancy Pelosi and her family have consistently been subject to strict media surveillance over a possible conflict of interest. This attention is especially due to the timing of stock transactions and large-scale transactions made by her spouse, much of which is being made at technology companies such as Nvidia and Microsoft.

In May, Rep. Marjorie Taylor Green was accused of insider trading in connection with the share purchases of Apple, NVIDIA and Amazon before President Donald Trump announced the suspension of tariffs.

The list continues. In response to growing public dissatisfaction with stock trading among elected lawmakers, the House last month introduced a bill banning lawmakers and their families from trading or holding individual stocks.

The Congressional Trust Restoration Act combines multiple ethical proposals into one law. The bill requires newly elected lawmakers to sell all ownership of individual stocks, options, futures and goods shortly after oath of office.

Severe penalties for violations include fines equal to 10% of the value of assets and waiver of profits arising from the investment.

The post He bought Bitcoin mining stocks a few days before the 250% surge – lucky or shady? It first appeared in BeInCrypto.