A new proposal to overhaul Polygon’s tokenomics is gaining momentum on the project’s governance forums and social media as investors express frustration with POL’s sharp decline in performance compared to the broader crypto market.

The proposal, authored by activist token investor Venture Founder, calls for significant revisions to Poirigon's (POL) supply model, including the removal of the 2% annual inflation rate and the introduction of a Treasury-funded buyback or burn program to alleviate ongoing selling pressure.

“These changes are aimed at aligning POL’s supply dynamics with current technical and strategic realities, strengthening investor confidence, and preventing further token value declines and network stagnation,” Venturefounder wrote in a forum post.

Under the current model, Polygon's 2% annual inflation adds approximately 200 million new POL tokens to the market each year. The author argues that this is what is creating sustained downward pressure on prices. The proposal proposes either moving to a 0% inflation target to establish fixed supply or adopting a tapering schedule that lowers inflation by 0.5% each quarter until it reaches zero.

The authors cite BNB (BNB), Avalanche (AVAX), and Ether (ETH) as examples of tokens that have benefited from deflationary and fixed supply models, and argue that a similar approach could strengthen POL's value proposition.

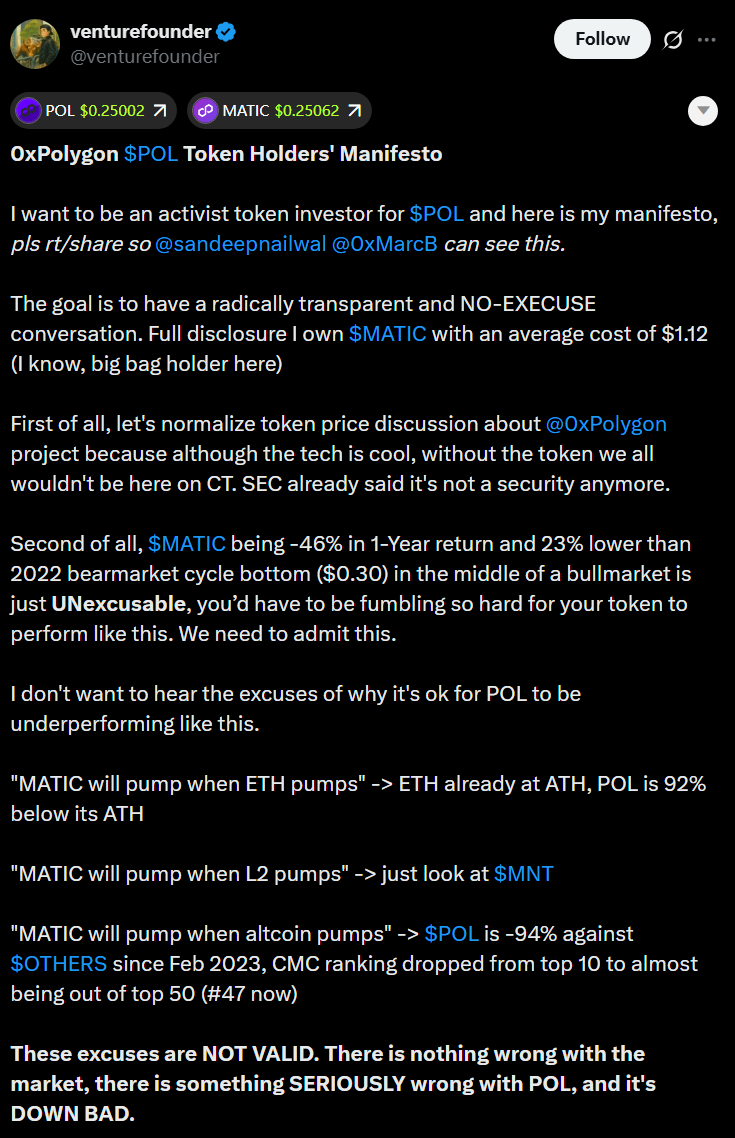

The proposal is based on a widely distributed manifesto posted on X by Venturefounder that garnered more than 25,000 views. In the post, the investor called POL's 46% decline over the past year and current trading levels below the 2022 bear market lows “inexcusable” in what many believe is a crypto bull market led by Bitcoin (BTC) and Ether.

sauce: venture founder

“These excuses are invalid,” the venture founder wrote. “There's nothing wrong with the market. There's a serious problem with POL, and it's a very bad situation.”

In addition to the inflation issue, the manifesto criticized a series of strategic failures by the Polygon team beyond 2022, and called for more transparent communication and faster delivery of key infrastructure such as Agglayer.

This proposal elicited active engagement from within the Polygon ecosystem. Polygon co-founder Brendan Farmer responded to the discussion, and Polygon Labs CEO Marc Boiron acknowledged the proposal on social media.

Disastrous price performance of POL. sauce: cointelegraph

A forum thread has been left open with community members discussing the feasibility of funding validator rewards without inflation, the sustainability of buybacks, and the overall impact on network security.

Polygon faces reliability challenges as competition increases

Once one of the most highly regarded Ethereum scaling solutions, Polygon built its reputation on powerful innovations, from the rollout of zkEVM to the ambitious AggLayer framework designed to integrate multiple chains. However, despite these advances, investor confidence is waning and competition from new layer 2 ecosystems such as Arbitrum, Optimism, and Base is increasing.

In 2024, Polygon began transitioning its native token from MATIC to POL as part of a broader governance and tokenomics review aimed at strengthening community participation and securing the network. This transition introduced a 2% annual emissions schedule to fund verifier compensation and ecosystem incentives.

Despite recent struggles, Polygon maintains a strong developer community, especially among builders seeking technological maturity and enterprise-grade infrastructure.

As Cointelegraph recently reported citing surveys from Mexico, Brazil, Peru, and Bolivia, developers in Latin America continue to prefer Polygon and Ethereum to new protocols for deploying decentralized applications.

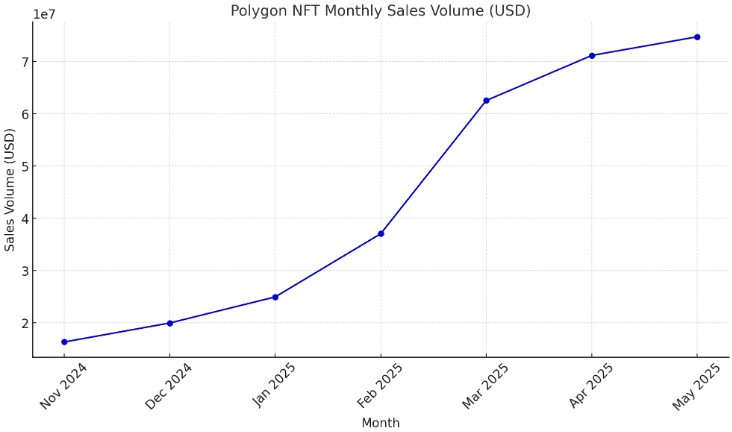

Polygon is also focused on tokenizing real-world assets (RWA). In a recent example, tokenization infrastructure provider AlloyX launched a tokenized money market fund on Polygon. This growth in RWA activity has helped drive broader on-chain engagement, including a milestone of over $2 billion in NFT sales for Polygon.

Polygon NFT sales. Source: Cointelegraph