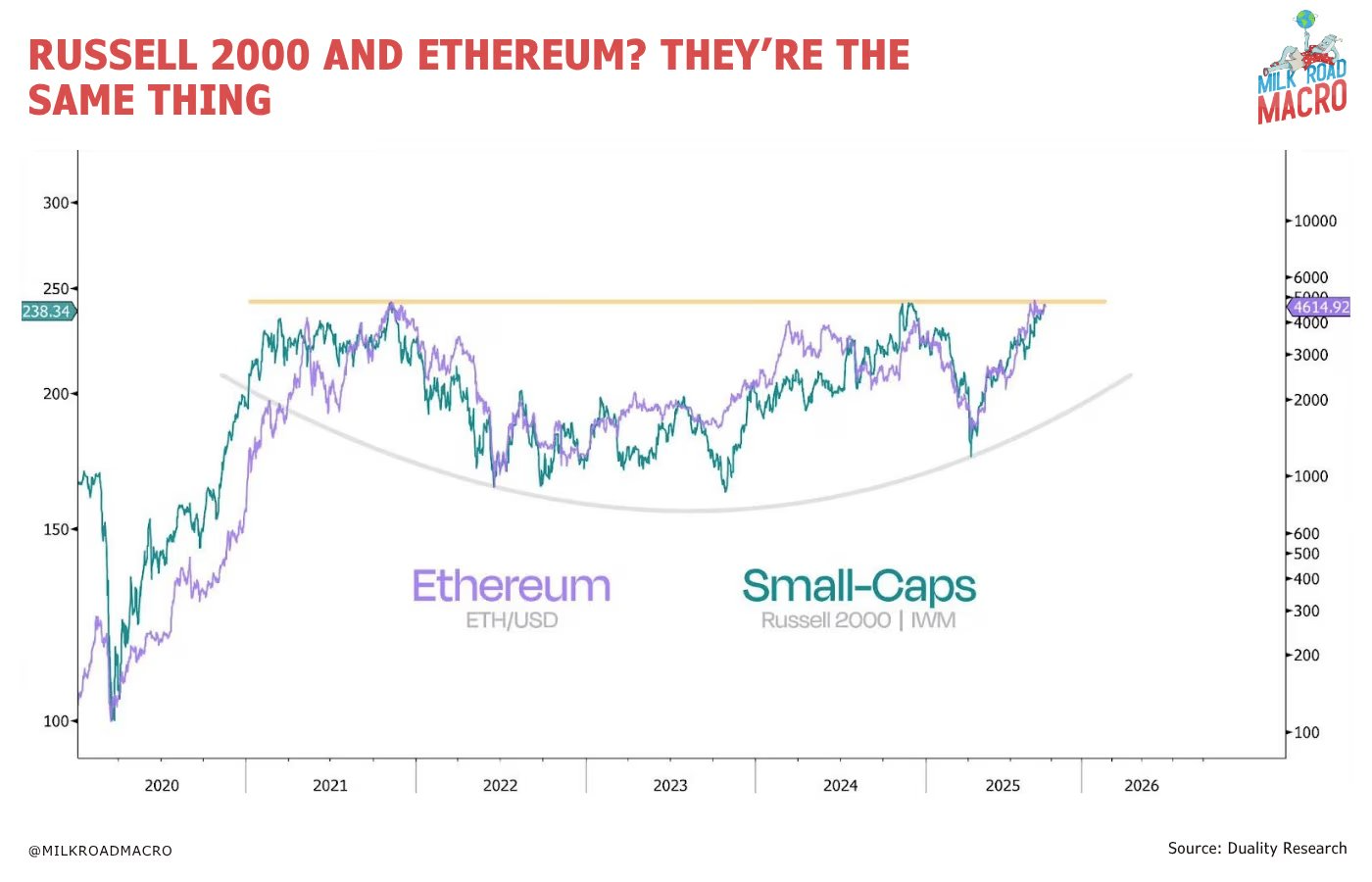

Ethereum is highly correlated with small-cap stocks, which are very sensitive to interest rates, and analysts say both could rise if there are further rate cuts.

Analysts at macro investor outlet Milkroad said Tuesday there is an “almost eerie” correlation between Ether (ETH) and the Russell 2000 index of small-cap stocks.

Both are highly sensitive to interest rates, with the possibility of up to four consecutive cuts, and analysts said they “expect them to rise in tandem.”

The Russell 2000 Index tracks the 2,000 largest publicly traded U.S. companies by market capitalization and is widely used to measure the performance of the U.S. economy.

The CME futures market currently projects a 95.7% chance that the US Federal Reserve will cut interest rates by another 0.25% at its October 29th meeting, and an 82.2% chance that it will cut rates in December.

“Unlike Bitcoin, Ether generates yield, which is extremely important in a world where interest rate cuts are not only priced in, but virtually guaranteed,” Justin Danesan, head of partnerships at crypto private markets firm Arctic Digital, told Cointelegraph.

sauce: milk road macro

ETH and the Russell 2000 also appear to be exhibiting a cup-and-handle pattern, a bullish continuation pattern that indicates a period of consolidation following a decline.

Rotation to risk assets

MN Fund founder Michael van de Poppe said on Wednesday that there are two reasons why ETH will soon reach new all-time highs.

First, the ETH/BTC trading pair “appears to have bottomed out” and is poised for a new rally after a relatively normal correction.

Second, gold has gone “very parabolic” after peaking above $4,000 per ounce, meaning it should fall at some point and “trigger a big risk-on switch.”

Related: Ethereum bulls tout supercycle, but Wall Street is skeptical

“Globally, as central banks move into easing mode, capital is likely to rotate into riskier assets with upside potential, and ETH fits that profile,” Danesan added.

New ether peak is near

“ETH has finally found stability above $4,350 and looks poised to break into all-time high territory,” chart analyst Matt Hughes commented on Wednesday.

“As long as that zone continues to hold as support, ATH is not far away.”

Hughes targets $5,200 as the next bull market for Ether, while analyst Poseidon said the cycle high would be $8,500.

Ether was correcting at the time of writing, dropping 6% on the day to trade at $4,430 and approaching a key support zone around $4,400.

magazine: Hong Kong is not the loophole Chinese crypto companies think it is