Bitcoin price has been trading mostly sideways since rebounding from Friday's market crash, finding support near $111,098 but struggling to break through the resistance at $115,892.

Despite the slow movement, two analysts identified bullish signals that could lead to a price recovery towards the $120,000 level in the near term.

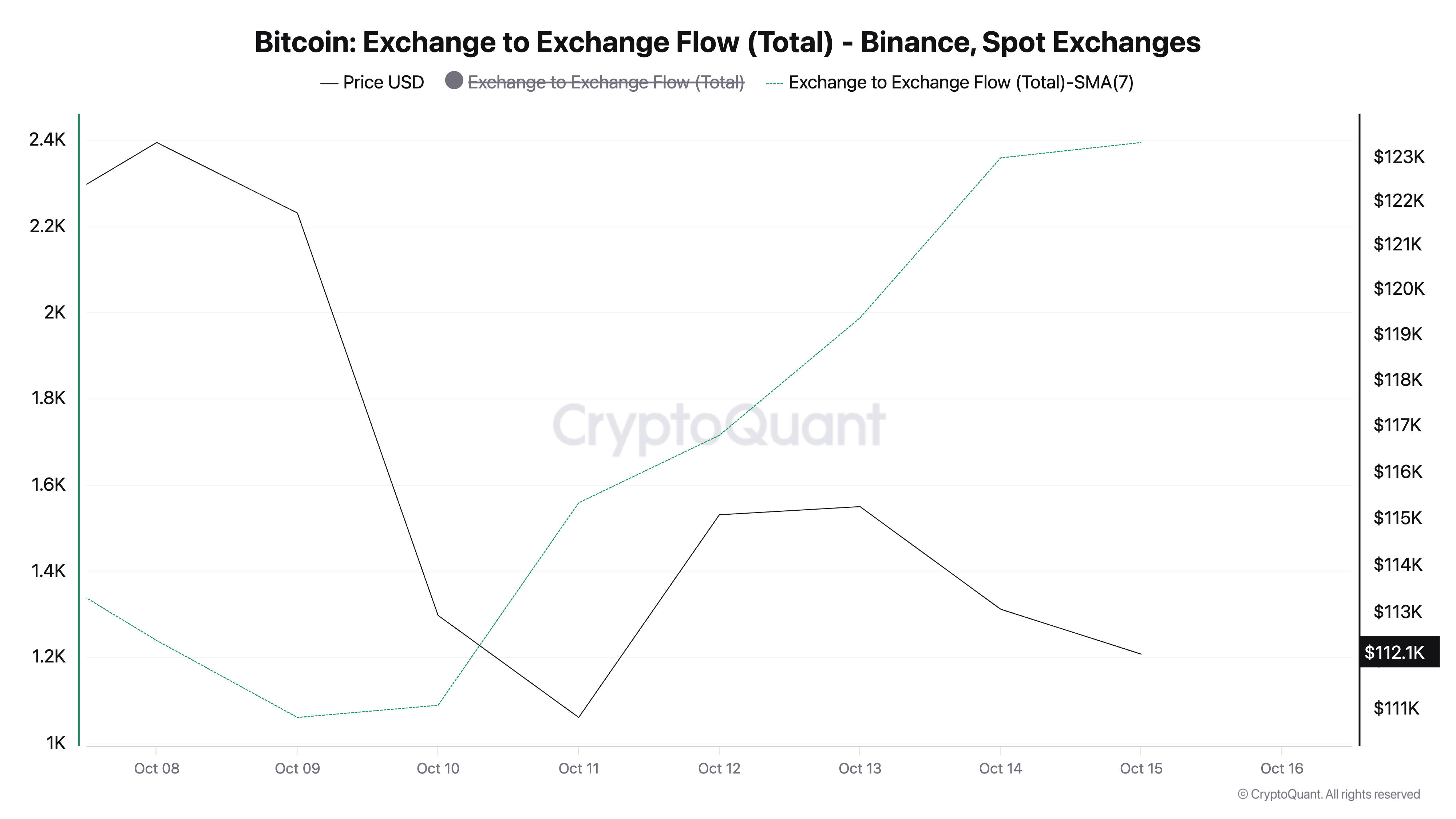

Increasing Binance Trade Flow Supports Bitcoin’s Continued Bullish Structure

CryptoQuant analyst PelinayPA noted that despite recent headwinds, Bitcoin's market structure remains intact and continues to show signs of strength.

According to the report, one of the main supporting factors is an increase in inter-exchange flows on Binance, an index that tracks Bitcoin transfers between major trading venues.

Although valued at a 7-day moving average, CryptoQuant data shows it has surged 125% over the past 7 days.

About the latest information on token TA and the market: Want more token insights like this? Sign up here for Editor Harsh Notariya's Daily Crypto Newsletter.

Flow from Bitcoin exchange to exchange. Source: CryptoQuant

When inter-exchange flows increase, it indicates increased activity by large traders, institutions, or market makers who move funds between major exchanges.

“Since early October, these flows have increased again, suggesting a resumption of activity among large players. However, as these are inter-exchange moves rather than inflows to exchanges, we interpret them as neutral to slightly positive, suggesting that spot holdings are being redistributed rather than sold,” Perinai PA noted.

The analyst said the move signaled a redistribution of liquidity rather than capitulation, and was a healthy sign for market stability.

“After the Oct. 11 selloff, Bitcoin recovered quickly and stabilized around $110,000. Flow volumes during that dip were significantly lower than current levels, indicating that recent movements reflect a more organic and healthy recovery. Technically, a revisit to the Oct. 11 lows is unlikely. The price structure continues to form higher lows without appreciably losing momentum.”

The analyst added that if the bullish momentum holds, Bitcoin could test the $115,000 resistance zone. A confirmed breakout above $115,000-120,000 could trigger a new wave of upside.

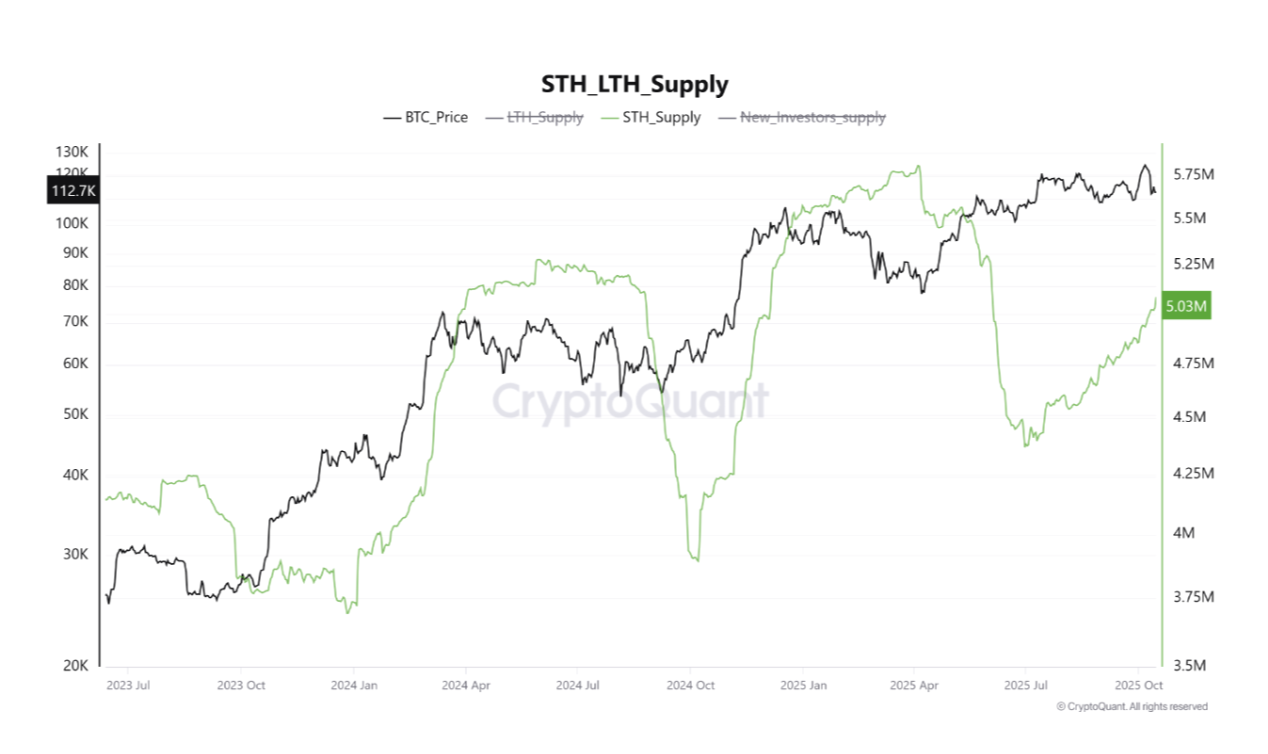

Accumulated points of short-term holders restore retail confidence

Another pseudonymous CryptoQuant analyst, Crazzyblockk, also shared his bullish view in a separate report, highlighting the surge in BTC holdings among short-term investors.

The analyst said that despite Friday's liquidation event causing “considerable desperation and widespread reluctance among traders to commit to large leveraged positions in the futures market,” there is a strong accumulation trend among short-term holders (STH).

“A key on-chain indicator, the supply held by new investors (or short-term holders, STH, typically defined as investors who have held a coin for less than a month), is sending a very bullish signal. Rapid accumulation is underway.”

He added that this new buying activity signals an important shift in sentiment following the recent market downturn.

BTC STH Supply. Source: CryptoQuant

“As confirmed by the underlying indicator data, this group of new market entrants is rapidly increasing their Bitcoin holdings, and the supply of STH has ballooned to a significant amount in a short period of time. For example, recent statistics show that this supply has increased from approximately 1.6 million BTC to over 1.87 million BTC in just a few days. This represents a significant injection of new capital and demand after the price drop,” the analysts wrote.

Bitcoin's next move: above $115,000 or below $111,000?

Both reports suggest that BTC on-chain activity is quietly strengthening, even though the price trend remains range-bound. Increased institutional capital flows and new retail accumulation could push it above $115,892 in the near term.

A successful breakout of this resistance could open the door for a rally towards $120,144.

BTC price analysis. Source: TradingView

However, if this buying trend stalls, BTC could extend the consolidation or even trend below $111,098.

The post Bitcoin's $120,000 Still Under Consideration, On-Chain Data Show appeared first on BeInCrypto.