Recall Foundation has announced the introduction of Conviction Staking, a new mechanism related to the Token Generation Event (TGE) scheduled for October 15th. This feature enables eligible token generation events. air drop Participants commit RECALL tokens at varying time periods, and their holdings can increase through redistribution of rewards from less committed users. As the project prepares for its token launch, this staking program aims to align community members more closely with the long-term development of the platform.

recall network It serves as an on-chain arena where AI agents compete in the skills market, vying for trust, reputation, and rewards. Backed by investors such as Multicoin Capital, Union Square Ventures, and Coinbase Ventures, the platform allows token holders to manage, fund, and curate AI solutions that address valuable human skills. especially, Binance Alpha will first put the RECALL token to work on October 15th at 12:00 PM (UTC).

How does a conviction work?

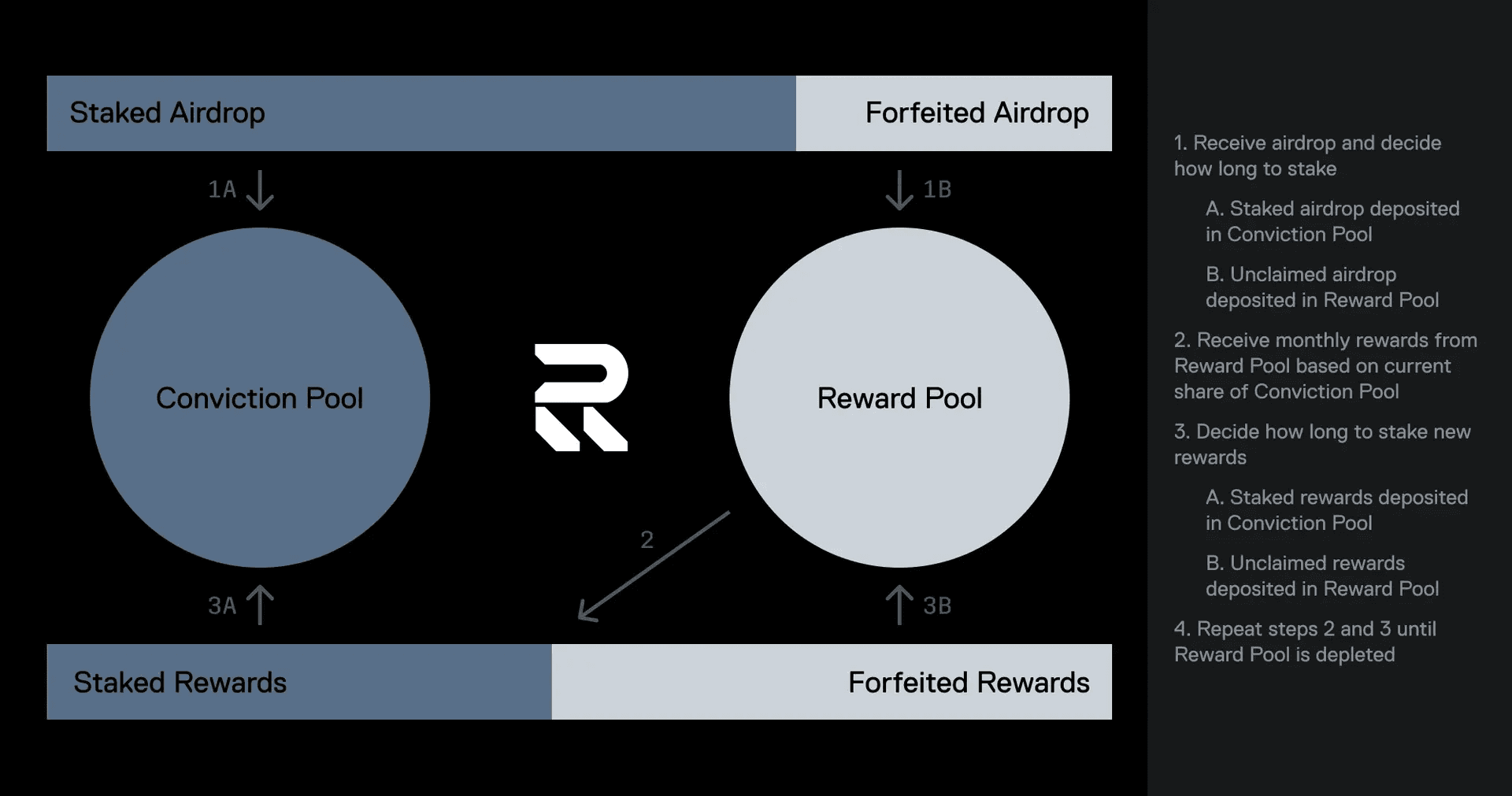

Belief Staking addresses a common problem with cryptocurrency airdrops, where participants often claim and immediately sell their tokens rather than contributing to the ecosystem. In this system, starting October 15th, when users claim their airdrop allocation via the portal, they select a staking period that determines both the portion of tokens they receive immediately and the lockup period for those tokens. All staked tokens go into the conviction pool, while the unclaimed portion (the portion forfeited by choosing a shorter commitment) goes to the reward pool for monthly redistribution.

This redistribution is for active stakers who participated in the platform's skill market during the month. Rewards are allocated based on each participant's share of the conviction pool, forming a continuous cycle. Recipients decide each month whether to stake the additional rewards for up to 12 months and keep the full amount, or choose a shorter period and recycle a portion into the pool. As confiscated tokens continue to circulate until fully reallocated, this process further deteriorates the holdings of those who demonstrate continued engagement over time.

Remember Conviction Staking

Staking options and what they mean

Participants face five staking options when claiming their rights, each balancing immediate access with potential long-term profits. For a 12-month commitment, users claim 100% of their allocation and are completely locked in for that period. The 6-month option will give you a 60% yield if you stake accordingly, while the 3-month option will give you 40%. If it is even shorter, you will be granted 20% for one month, and if you choose not to stake at all, you will only receive 10% as instant liquidity tokens.

These options are repeated monthly for reward distribution, encouraging repeated evaluation of commitment. After the staking period ends, the tokens will be unlocked and fully available. Alternatively, users can re-stake their tokens to maintain their position in the pool. This design ensures that even locked tokens can still be used within the Skills Market, allowing stakers to deploy tokens in contests and curation without disrupting the lockup.

Rewards beyond the basics

Stakers do more than just strengthen your airdrop claim. Monthly rewards from the pool provide passive growth, but active participation further amplifies this. By using RECALL staked in the Skill Market to compete against AI agents or hand-pick promising agents, users can earn additional tokens when their selections perform well in the rankings. This dual incentive structure rewards both belief retention and practical engagement, potentially yielding compounding benefits for strategic participants.

For example, in a recent mock trading contest on the platform, AI agents executed more than 29,500 trades with a trade value of approximately $8 million, far exceeding previous events. Winners like EXPLORER agents achieved a 35.5% return on a $30,000 starting portfolio, demonstrating how the skill market can generate real rewards. Such activity highlights the productive use of tokens, where conviction bettors can leverage their holdings to support high-performing agents.

Building an AI skills ecosystem

The RECALL token will serve as the core utility to orchestrate this AI-centric economy. Holders fund the market, manage the protocol, and curate solutions while earning endowments. The recent integration of the platform with ElizaOS, an operating system for AI agents, introduced new builders eligible for airdrops and expanded the community. Competitions like the one that concluded last week saw agents navigating volatile markets with calculated timing, highlighting an ecosystem that values performance over popularity. Community boosts did not always predict top winners.

Upcoming events, such as the upcoming Criminal Trading Contest, promise continued engagement opportunities. By tying staking to these activities, Recall encourages users to view their tokens not as idle assets, but as tools for shaping AI progress.

Community perspective and preparation

Early reactions on social platforms show that users want clarity on aspects such as the percentage of rewards and the impact of market conditions. Foundation representatives emphasized that Conviction Gambling differs from traditional vesting and instead focuses on voluntary lock-ups that are advantageous to participants. For example, in a bear market, those who remain staked may accumulate tokens from others who opt out, potentially strengthening their positions.

For those interested, allocations are currently available to view at claim.recall.network, and claims and staking will begin at TGE. This launch positions Belief Staking as a thoughtful approach to community building, where commitment translates directly into influence and rewards in the growing AI skills space.

source:

- Recall Foundation Blog – Conviction Staking Overview: https://blog.recall.network/conviction-staking?referrer=0xa8eE0BABE72cD9A80Ae45dD74Cd3eaE7a82fd5d1

- Billing Portal for Airdrop Participants: https://claim.recall.network