Investors were surprised this week by revelations of fraud at Zions Bancorp and the collapse of auto sector finance companies like Tricolor and First Brands. When local banks fall into financial distress, liquidity becomes tight, creditworthiness declines, and speculative assets become heated up. When there is a whiff of financial instability in the market, cryptocurrencies are often the first to sell off.

Ethereum’s daily decline of 3.13% to around $3,825 reflects that sentiment. This is not just a technical setback, but a result of the market pricing in credit risk. Whenever a bank vulnerability surfaces, traders move capital from high-beta assets like ETH to cash, Treasury bills, or stablecoins pegged to the dollar.

If this bank stress worsens, a risk-off trend could push ETH towards the next support band around 3750 and potentially the 3400-3500 zone.

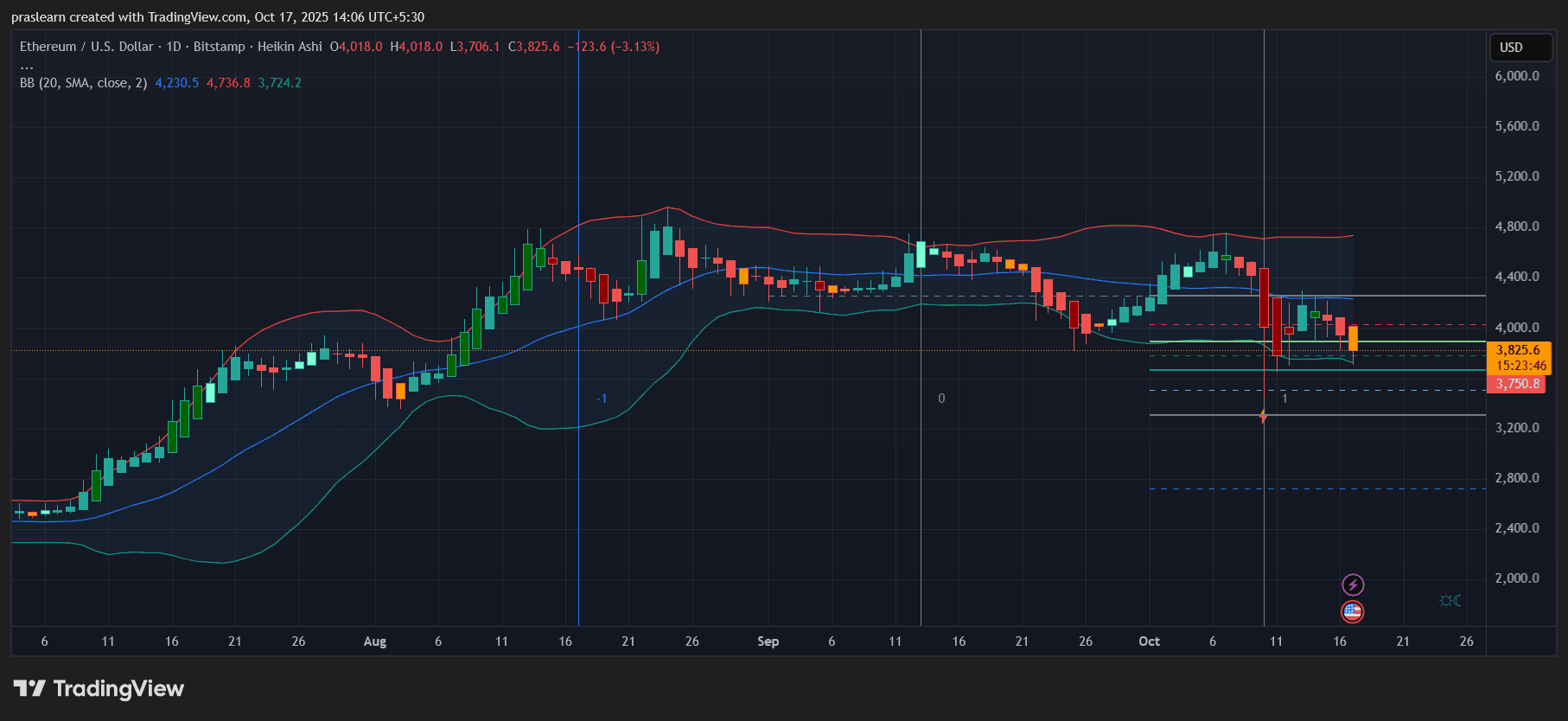

Ethereum price prediction: What the ETH price daily chart reveals

ETH/USD daily chart – TradingView

The Heikin Ashi candlestick has shown a clear loss of momentum since early October. The trend turned bearish after multiple failed attempts to regain the 4200 zone.

Bollinger Bands (BB 20,2) tells the story in numbers.

- The intermediate band around 4230 acts as a dynamic resistance.

- The lower band around 3724 is roughly in line with the current price, indicating that ETH is testing the lower envelope.

- The upper band of 4736 is now far out of reach, which is typical of a downtrend in momentum.

Ethereum price is showing two consecutive red candlesticks with long tops, confirming the rejection above 4000. A gradual decline in volume suggests weak buying interest, and recent lows confirm continued weakness.

The bias remains short-to-neutral unless ETH definitively closes above 4100.

Where is the next major level?

Immediate support includes: 3750which coincides with Bollinger's lower bound and the previous integration from early August.

If that fails, the next important area is: 3400–3450the historical demand zone may temporarily recover.

On the upside, ETH price needs to recover 4100 Overrides the current bearish structure. A close of the day above the middle band (around 4230) would be the first sign of buyers pulling back.

Macro risk: the bank contagion angle

This latest banking stress story is not isolated. Zion's $50 million write-down adds to a pattern of small cracks appearing in regional and subprime credit markets overall. When one lender exposes fraud, other lenders scramble to check their books. The ripple effects often tighten liquidity throughout the financial system, even if regulators intervene.

Historically, cryptocurrencies have thrived on liquidity and reliability. If you remove either, volatility will drop sharply. If more local banks disclose credit write-downs related to nonbank lenders, the Federal Reserve could face the dilemma of whether to ease policy to stabilize credit or keep policy tight to combat inflation. Both methods increase uncertainty. Traders usually sell first and have doubts later.

Ethereum price prediction: What should we watch next?

- bank profit report – An increase in loan loss provisions strengthens the bearish view on risky assets.

- US government bond yield – If yields continue to rise, capital will continue to flow out of cryptocurrencies.

- ETH 3750 zone – A daily break below that level could accelerate downside momentum.

Short-term (next 10-15 days): ETH price may trade in the following time periods: 3750 and 4100the volatility is lower, but with a negative bias. Medium term (next 30-45 days): $Ethereum could be retested if bank concerns deepen. 3400–3450followed by a relief rebound. 3900–4000.

In the long run, Ethereum's fundamentals remain intact, but the market is driven by liquidity, and liquidity is currently being drained from the system. We expect ETH to remain under pressure until credit markets stabilize.

Ethereum’s current price movements are not random, but are in response to real-world financial stress. The coming weeks will reveal whether this is a temporary swing or the beginning of further liquidity contraction that will push ETH closer to $3,400.