Bitcoin's price performance over the past two weeks has been a major cause for concern, as the value of Bitcoin continues to drift away from its all-time highs (currently down about 15%). As the flagship cryptocurrency slows, the latest on-chain data suggests groups of investors are exiting the market en masse.

An increasing number of short-term holders are letting go of their holdings.

In an October 18th post on the X Platform, on-chain analyst Dirkforst revealed that a significant number of short-term Bitcoin investors are beginning to unwind their positions and realize losses.

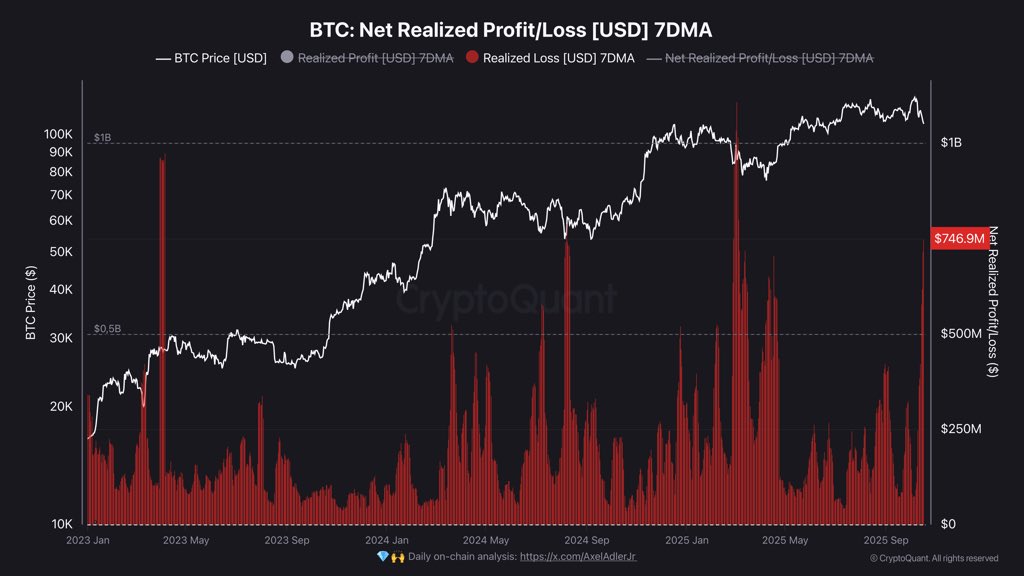

Darkfost's analysis was based on the net realized profit/loss metric, which tracks the net amount of profit or loss (in USD) realized on-chain. This indicator measures daily net profit or loss, in this case averaged over 7 days. This provides insight into whether more investors are selling at a loss or with their heads still above water.

According to cryptocurrency experts, realized losses for BTC investors have soared to levels of around $750 million per day, one of the highest levels of this current cycle. Interestingly, Dirkforst explained that the scale of these surrender events is easily comparable to what was seen during the summer 2024 correction.

What is notable about this surrender phase is perhaps what happens after. According to analysts, such events usually precede a regional bottom. What this means is that cryptocurrencies have a chance of rebounding in price after short-term holders (known as “weak hands”) relinquish their holdings to more confident long-term holders (“diamond hands”), an expectation that is consistent with historical trends.

But on the more cautious side, Dirkforst also issued a subtle warning that the dire opposite could also happen in an early market bear phase.

Possibility of Bitcoin whales increasing again

Confirming the positive redistribution theory, Abramchart’s Quicktake post on the CryptoQuant platform offers a glimmer of hope to Bitcoin market participants. Analysts highlighted significant inflows of over 26,500 BTC into Whale Accumulation wallets with reference to the Inflows to Accumulation Addresses (Dynamic Cohorts) indicator.

Coins are typically transferred from exchanges to these wallets for long-term holding, so when large amounts of Bitcoin like this size move around, it usually indicates an underlying institutional or whale accumulation.

Following historical patterns, this accumulation event is very likely to precede a continued bullish expansion in the flagship cryptocurrency. All of this trend serves as a hint that smart money is “quietly buying the push,” as Abram Charts explained.

As of this writing, Bitcoin's valuation is around $106,870, but there has been no significant movement in the past 24 hours.

Featured image from iStock, chart from TradingView