Bitcoin consolidation: the calm before the volatility

The $Bitcoin market will take a breather this weekend. After a few days of sideways trading between $106,000 and $108,000, the BTC dollar appears to be entering a severe consolidation phase. This type of move often precedes a big breakout, and traders keep a close eye on which direction the next candlestick will light.

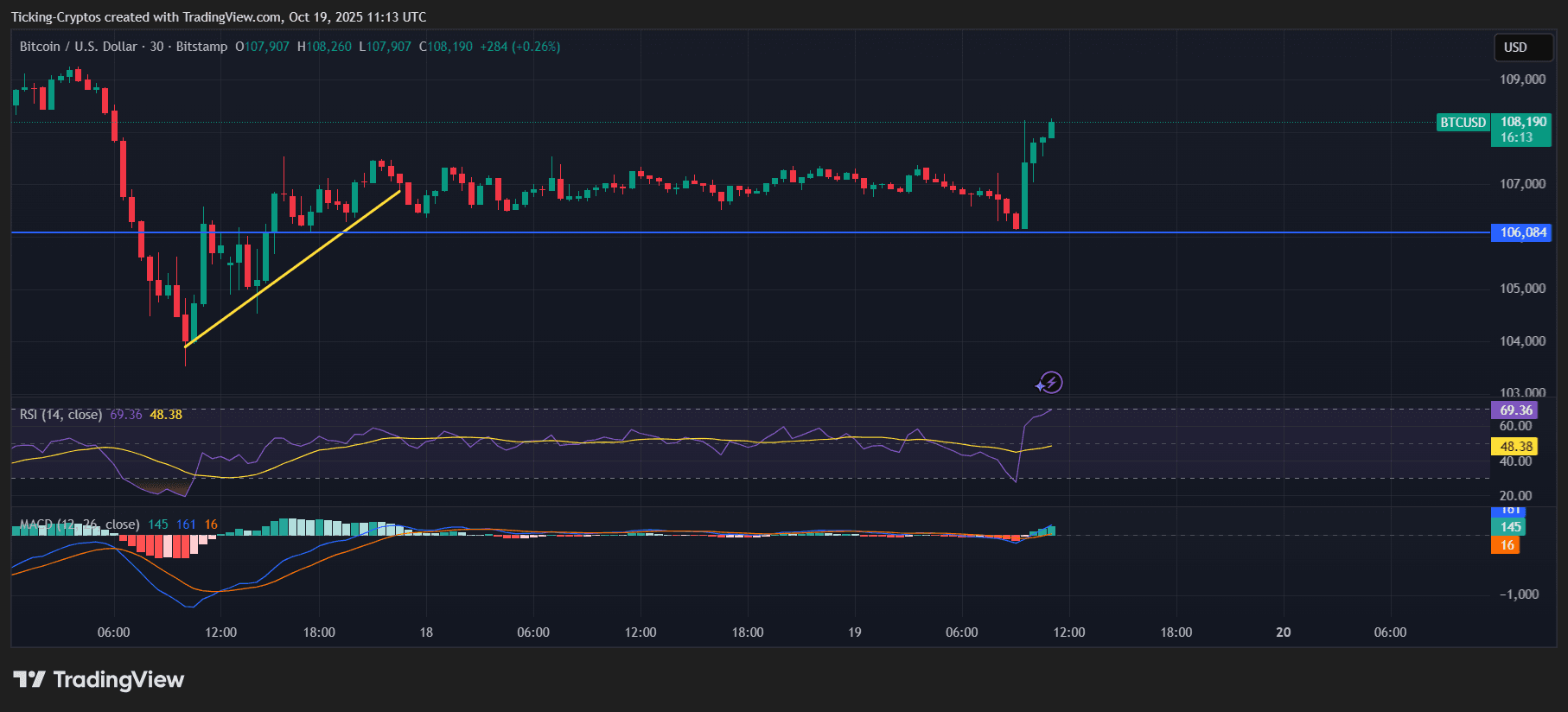

BTC/USD 30 Minute Chart – TradingView

Short-term charts show Bitcoin repeatedly testing the $106,000 support zone, a level that has acted as a strong downside multiple times this week. Meanwhile, the intraday recovery has struggled to break above $108,000, creating a narrow trading channel that traps price movements.

Bitcoin price analysis: buyers defending key levels

as BTCUSD 30 minute chart As shown, Bitcoin briefly reached $106,136 earlier today before rebounding sharply and forming a clear reversal candlestick. This pullback reflects active buying interest at that level and is a classic sign of accumulation. Momentum indicators remain neutral, suggesting a balanced battle between bulls and bears. of RSI I'm hovering around 50, MACD shows a flattened histogram and confirms the integration stage.

BTC/USD 30 minute chart – TradingView

For traders, this calmness can be deceptive. Compression of volatility at current levels usually leads to expansion. In other words, the quieter you are, the more powerful your next move can be.

Bitcoin price prediction: $106,000 support, $112,000 resistance

- Immediate support: $106,000 – Breaking this level could send Bitcoin backsliding towards $104,500 and even $102,000, closing the previous liquidity gap.

- Immediate resistance: $108,500 to $109,200 remains the first hurdle for bulls.

- Breakout target: If BTC manages a daily close above $109,200, it will likely move higher towards $112,000-115,000.

However, a break below $106,000 could invalidate the short-term bullish outlook and send BTC into a correction phase.

Market conditions: low volumes and high uncertainty

Weekend sessions often have lower volumes, and this one is no exception. A lack of activity from financial institutions has kept volatility under control, but this calm could come to an abrupt end when markets reopen on Monday.

Macro factors such as the US Federal Reserve's interest rate cut discussions and geopolitical tensions in Eastern Europe continue to weigh on overall market confidence. However, Bitcoin’s resilience around $107,000 suggests that traders are still buying the push rather than running to safety.

The future of Bitcoin: a breakout on the horizon

Bitcoin's sideways pattern suggests a moment of equilibrium, but this equilibrium rarely lasts long. With compression evident across short-term time frames, we are increasingly likely to see a strong move next week.

BTC could reach its target if momentum turns to the upside at the beginning of the week $112,000 to $115,000 Before the end of the month. Conversely, failure to sustain the $106,000 level could trigger a sweep of the lower liquidity zone and test the $104,000 area.

For now, Bitcoin is still in a waiting state, calm, stable, and full of potential energy.