Protoss has repeatedly warned that the Bitcoin (BTC) treasury’s peak had passed by late May, and that warning has proven accurate.

Indeed, the industry continues to fall further out of favor with investors, as evidenced by the relentless decline in these companies' most important metric, multiples to net asset value (mNAV).

Investors are communicating their confidence in management's ability to continue to increase BTC per share through the mNAV they pay when purchasing common stock.

Unlike traditional companies that focus on selling products and services to customers, BTC treasury executives like Strategy (formerly MicroStrategy) founder Michael Saylor believe that by accumulating BTC, they can accumulate additional BTC by leveraging that treasury department to financialize it.

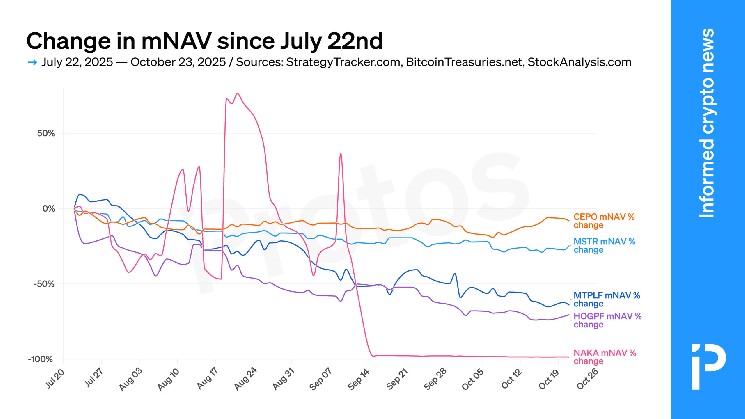

Tracking the mNAV of all treasury companies is complicated by lengthy merger documents, share exchanges, and thousands of pages of Securities and Exchange Commission filings, but Protos has summarized the mNAV of the five largest BTC treasury companies in the chart below since July 22nd.

Taken together, these depict a clear downward trend.

In the years leading up to 2025, investors paid more than 1x mNAV for the few BTC treasury companies in existence. For example, from 2021 to 2024, Strategy Inc. enjoyed mNAV of more than 2x for several months and averaged mNAV of well over 1x.

In other words, investors paid the company more than their BTC holdings, even though profits and other business operations were minimal. They bid up Mr. Saylor's stock because they believed he could cash out the Treasury by selling credit products at favorable prices and scales.

Overseas, smaller metaplanet types of the Japanese strategy enjoyed even higher high single-digit and even double-digit mNAV multipliers in 2024.

By early 2025, many listed companies have decided to convert to BTC Treasury.

Bitcoin financial company bubble in early 2025

Riding the momentum of Strategy, Metaplanet, and Tether's wildly successful Twenty One (originally traded as CEP, soon to be XXI), mania peaked in May with David Bailey's nakamoto (originally KDLY, now NAKA).

At one point, investors paid a historically high mNAV of 23x for Nakamoto, which, for context, has now fallen to less than 1x.

Undaunted, companies continued to pursue mergers, special purpose acquisition companies, or more complex business combinations for many more months, earning lower and lower premiums with each successive and overwhelming new product launch.

Currently, over 200 listed companies hold a combined 1 million BTC on their balance sheets. Some companies trade for less than 1x BTC Treasury.

Despite this, the ratio of their BTC holdings to common stock prices has continued to deteriorate since May.

Read more: BTC outperformance drives strategy mNAV to 19-month low

Many mNAV trackers, such as BitcoinTreasuries and StrategyTracker, provide historical references to mNAV premiums for these companies. With few exceptions, premiums peak in May or at launch and then slowly decline over time.

In many ways, the five companies listed above represent a sector that will continue to disappoint investors in the second half of 2025.

It remains to be seen whether there will be renewed interest in BTC financial companies.