Following a torrid performance in the first week of October, Bitcoin price trends have remained mostly calm throughout this month. In fact, this premier cryptocurrency witnessed a moment of bearish movement during the 'Uptober' month, which is widely regarded as a historically bullish month.

Bitcoin prices are likely to end the month in the red due to significant downward pressure in recent weeks. However, recent valuations indicate that the market leader may be gearing up for its next big price move next week.

Why BTC could make a big move next week

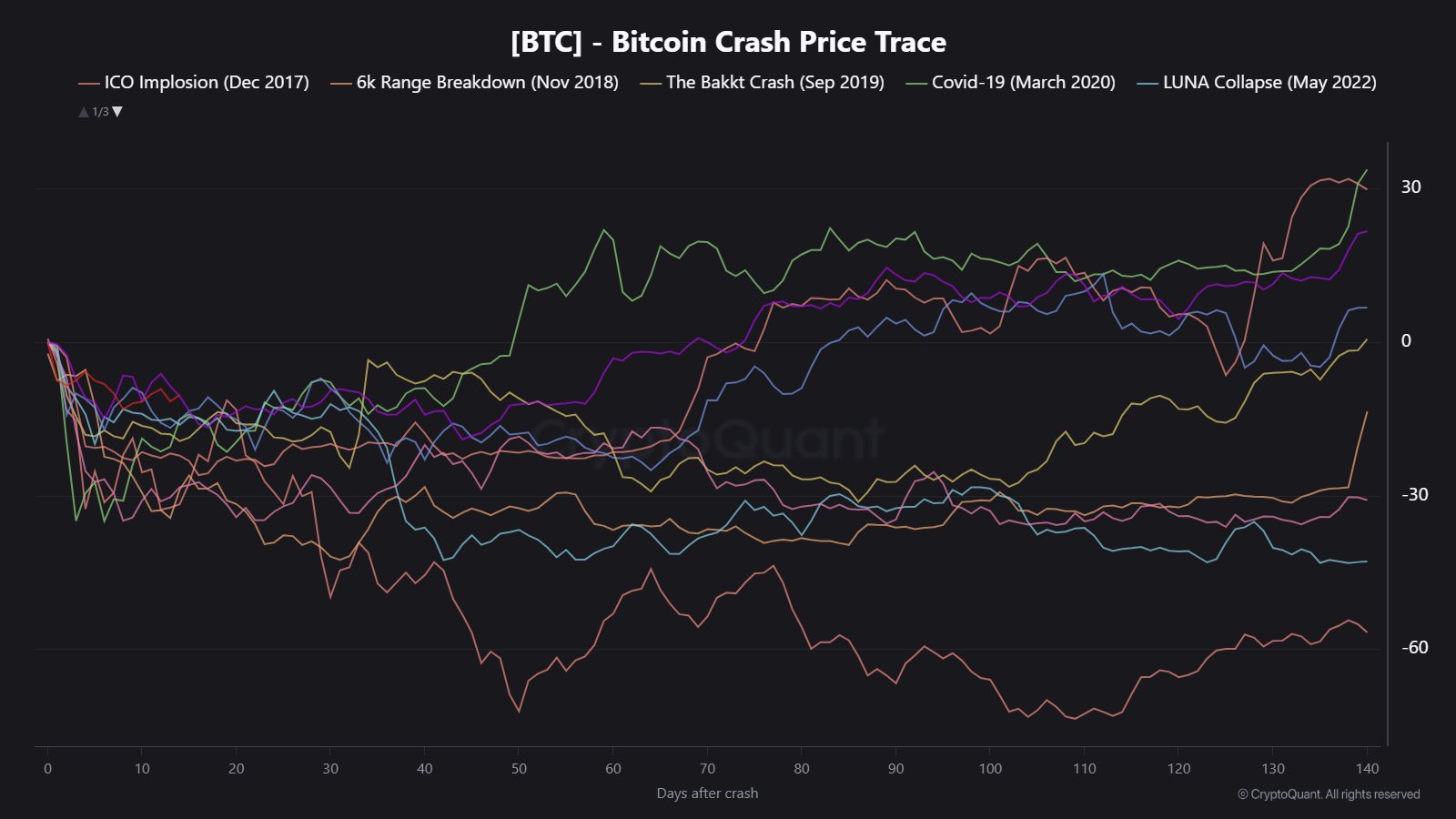

In a recent video on YouTube, cryptocurrency analyst Marthun shared an exciting hypothesis about the price of Bitcoin, saying that Bitcoin could make its next big move next week. This assessment is based on the Bitcoin Crash Price Trace, which monitors the behavior of BTC after significant price drops.

According to Maartung's analysis, after a sharp drop, Bitcoin prices tend to consolidate or move sideways for about two to four weeks before making the next big move. The same has been true for the leading cryptocurrency since it fell more than 16% on October 10th.

Martin noted that the market leader is now 14 days into this consolidation phase, meaning the next move could happen any time from now.

Source: @JA_Maartunn on X

Analysts further provided data clues, highlighting that market volatility is trending down for major cryptocurrencies. Martin believes this drop in volatility is a sign that investors are on the sidelines for the next big price move.

As of this writing, Bitcoin's value is around $111,690, reflecting an increase of just 0.6% over the past 24 hours.

Level to pay attention to next move

Martin went further and identified $112,500 as a key level to watch if Bitcoin price makes the next big move. This price level is the realized price for short term holders (STH) and often acts as a dynamic support and resistance level.

Usually, when the value of BTC is below this STH realized price, it means that the most reactive Bitcoin investors are in the red. These short-term investors are likely to offload their assets at the break-even price when Bitcoin price returns to its cost basis.

Ultimately, this decline will put downward pressure on the Bitcoin price, with the STH realized price (currently $112,500) becoming a significant resistance level.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.