NFT trading activity showed signs of booming in the third quarter of 2025, breaking the long period of decline that characterized the years following the hype.

After two years of shrinkage and shifting narratives, the on-chain market has found new footing in cheap railroads, loyalty programs, and sports-related assets traded for utility over status, rather than fine collectibles or speculative art.

NFT transaction volume increased in the third quarter of 2025, with sales reaching an all-time high.

As Ethereum's scaling upgrade moved activity to L2, Solana focused on throughput and compression, and Bitcoin's inscription matured into a collectibles culture that waxed and waned along with the fee market, the center of gravity shifted to cheaper rails and practical use cases.

Prices and distribution, no longer profile pictures, now define the boundaries of growth.

Post-Denkun economics reset the map. Ethereum’s EIP-4844 reduces rollup data costs, pushes L2 transaction fees to the cent level, and enables gasless or sponsored flows for mainstream-facing mints.

Following the upgrade, L2 fees have dropped by over 90%. That change is already visible in the operation of the Mint and the rise of Base as a distribution rail.

At Solana, compression enables high-volume issuance for loyalty and access use cases, with provisioning costs for 10 million compressed NFTs at approximately 7.7 SOL and median transaction fees of nearly $0.003 even under load.

Bitcoin registrations will open up another lane linked to the menpool cycle and miner revenue, with more than 80 million registrations by February 2025, making it the top three NFTs in terms of lifetime sales.

The demand side is showing signs of recovery, albeit with caution.

According to data from DappRadar, NFT transaction volume in the third quarter nearly doubled from the previous quarter to $1.58 billion, with revenue reaching $18.1 million and the highest number of transactions in the quarter.

Sports NFTs stand out, with sales up 337 percent sequentially to $71.1 million, with schedulable utility, access, and loyalty benefits driving spending regardless of minimum price. Summer brought snapbacks before the cooldown.

Based on CryptoSlam's tally, monthly sales in July 2025 reached $574 million, the second highest of the year, but fell by about 25% month-on-month in September as broader crypto risk appetite retreated.

This pattern confirms the decline in average sales value and shows how GMV is tracking the beta of cryptocurrencies despite holding up unique users and utility categories.

Distribution is doing more work than just fees. Wallets with embedded passkeys and sponsored rates eliminate the onboarding friction that held up previous cycles. Coinbase Smart Wallet supports Passkey and Gas Sponsorships on supported apps, and Phantom reported 15 million monthly active users in January 2025, a base routed to Mint Funnels on mobile and social.

It is a complex chain of cultural and social flows that influence issues. Bass is a great example.

This year, Bass overtook Solana in NFT volume by several metrics, as cheap mints, Zola's high-volume mint rhythm, and Furcaster-adjacent funnels stacked up. This slope explains why creators start with the allocation calculation and work backwards to their fee profile when considering where to drop.

Royalties are no longer a source of revenue.

Creator compensation has collapsed from its peak in 2022 as marketplace wars have made royalties optional in large parts of the market. Royalty income hit a two-year low in 2023 and never recovered to previous levels, Nansen said.

The opposite trend is the rise of venues aligned with enforcement agencies. Magic Eden and Yuga Labs will launch an Ethereum marketplace to enforce creator loyalty in late 2023, building a protected lane for brands that can command it.

This equilibrium is a bifurcated market, with low take rates and primary sales, IP deals, and retail partnerships accounting for most of the profits for creators, while walled gardens capture the premium drop when contractual enforcement is in place.

Market share where incentives drive order flow remains in flux. At Solana, Magic Eden and Tensor trade leadership in a duopoly that fluctuates depending on compensation schedule and program design, often holding about 40 to 60 percent share each over time.

This is more a function of the incentive epoch than a structural change, and can cause stock charts to look like regime shifts with later mean reversals. It's important for creators to negotiate distribution as part of their launch plans, rather than defaulting to a single venue.

Where your users actually go will give you a short-term roadmap.

Sports, ticketing, and loyalty programs are expanding as rewards are schedulable and recurring, and on-chain primitive TokenGate access is already built into existing ticket sales and e-commerce flows.

DappRadar's third-quarter breakdown shows sports volume outpacing the market, and that's before full-season or league-wide programs even begin.

The game is evolving more quietly. Messari said Immutable's zkEVM stack and live metrics demonstrate a steady increase in transactions and a security-on-ETH, UX-on-L2 design aligned with asset custody and recurring secondary fees.

IP and licenses are another bridge from JPEG to the consumer channel. Pudgy Penguins' expansion into over 3,000 Walmart stores has created a live pipeline from NFTs to physical retail and licensing cashflow.

Costs and UX per chain are now easier to read for creators deciding where to ship next. ETH L1 still holds provenance and valuable art, with variable gas and optional royalties in most venues.

ETH L2 offers cent-level fees from Dencun onwards, plus sponsored or gasless flows and social funnels on Base and Farcaster.

Solana compression brings millions of mints into dollar-level budgets with mobile-first wallet reach. Bitcoin Inscription is lined with rare collectibles, and the high fees are a feature, not a bug. The table below summarizes the current process from minting to trading.

The macro mix is also changing.

The annual run rate for 2025 is $5-6.5 billion, with average first-half sales in the $80-$100 range, which sets the base from which next year's scenarios will spread.

Using CryptoSlam's monthly sales as a backbone and dividing DappRadar's categories by color, we see a bearish GMV of $4-5 billion if the crypto beta stalls and average sales are compressed. Fee-focused use cases are concentrated in Solana and ETH L2, ETH L1 art is stable, and Inscription tracks Bitcoin's fee cycle.

A base case in the $6 billion to $9 billion range requires embedded wallets and social mint rails to continue to scale, as well as sports and live events expanding beyond seasons and brands testing new drops in royalty-enabled venues.

A bullish case of $10-14 billion would require gradual changes in mobile distribution, including normalization of mint flows with base and passkey, Phantom trending above 20 million monthly actives, ticketing pilots moving into mainstream programs, and gaming assets being used regularly.

In all three bands, the share composition leans towards ETH L2 and Solana, with ETH L1 being narrow and Bitcoin holding steady in the collectibles lane.

Six toggles determine how quickly that flow occurs.

- Wallet UX and distribution will be key metrics, measured by passkey adoption, sponsorship fees, and MAUs for Phantom and Coinbase smart wallets.

- Loyalty enforcement footprints are important for premium drops, including the OpenSea policy pivot and the health of the Creator Alliance market on Ethereum.

- Sports and ticketing partners moving from pilots to season-long programs convert one-time GMV into schedules.

- Base and Zora's pace will be seen in Base's share in NFT GMV alongside monthly mints and Farcaster Frames, indicating whether the social funnel will persist.

- Adoption of Solana compression will be tracked by mints compressed and cost per million assets, indicating whether loyalty and media programs move from experiment to default.

- Bitcoin's fee cycle and its relationship with inscriptions and runes will continue to shape collectible prices as the memory pool fills.

Two risks remain the same. Wash trading and spamminting still distort GMV and sales numbers. Therefore, focusing on average sales and organic filtered dashboards is a safer approach.

Market incentives, especially in the Solana duopoly, can make the stock chart look like a regime change if it is nothing more than an airdrop cycle, so launch plans need to factor in large inflows from the beginning. Another operational constraint is revenue design.

Royalties are largely voluntary in the open market, with primary sales, IP licensing, and retail bearing more of the burden, while mandatory venues create a premium lane that is available to some brands and unavailable to most.

It looked like 2023 would be the end, but the transition has begun.

The JPEG boom is over, rails are getting cheaper, use cases are aligning with tickets, sports, gaming, and IP, and wallets and distribution stacks are starting to converge where users are already.

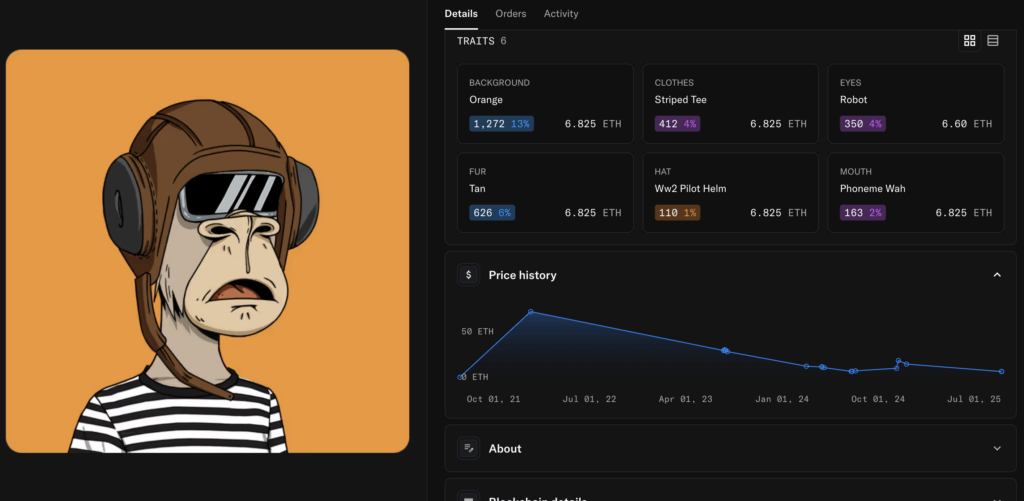

Blue Chip's flagship NFT, Bored Ape Yacht Club, remains at risk for those who invested six figures in AWS-hosted JPEGs. The NFT below sold for over 74 ETH in 2021, but is now worth just 9 ETH, down 87% in three years.

Speculation may be over in the non-fungible space, but will this finally allow the underlying technology to gain traction in real-world public interest applications? Time will tell, but not for those carrying the bags, but there are silver linings.

The third quarter ended with $1.58 billion in deals and 18.1 million sales, and the mix is already moving in that direction.