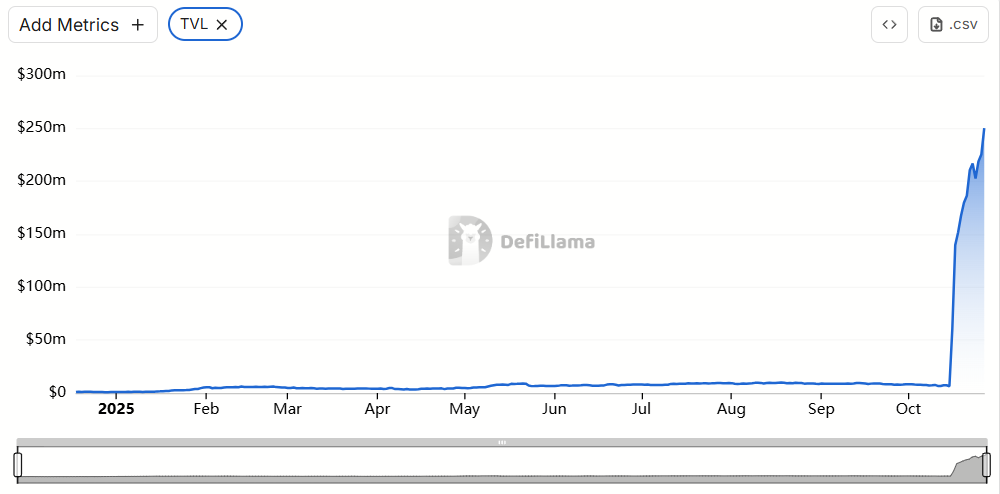

Ink, a Layer 2 (L2) blockchain launched by US cryptocurrency exchange Kraken in December 2024, has seen its total value locked (TVL) soar by nearly 3,800% in less than two weeks, rising from $6.42 million on October 15 to nearly $249 million at the time of writing.

TVL ink. Source: Defilama

But of the 30 protocols deployed on Ink, more than 97% of this exponential growth was due to a single product, Tydro, a non-custodial lending protocol built by the Ink Foundation as a white-label instance of open source DeFi giant Aave, according to data from DefiLlama.

The Ink Foundation announced the launch of Tydro on October 15th, calling the protocol Ink's “native liquidity layer” and revealing that it will also be directly integrated into Kraken.

The data further suggests that the surge in TVL continued immediately after Tydro’s launch, amplified by the nine-digit stablecoin mint by USDT0, a cross-chain version of USDT.

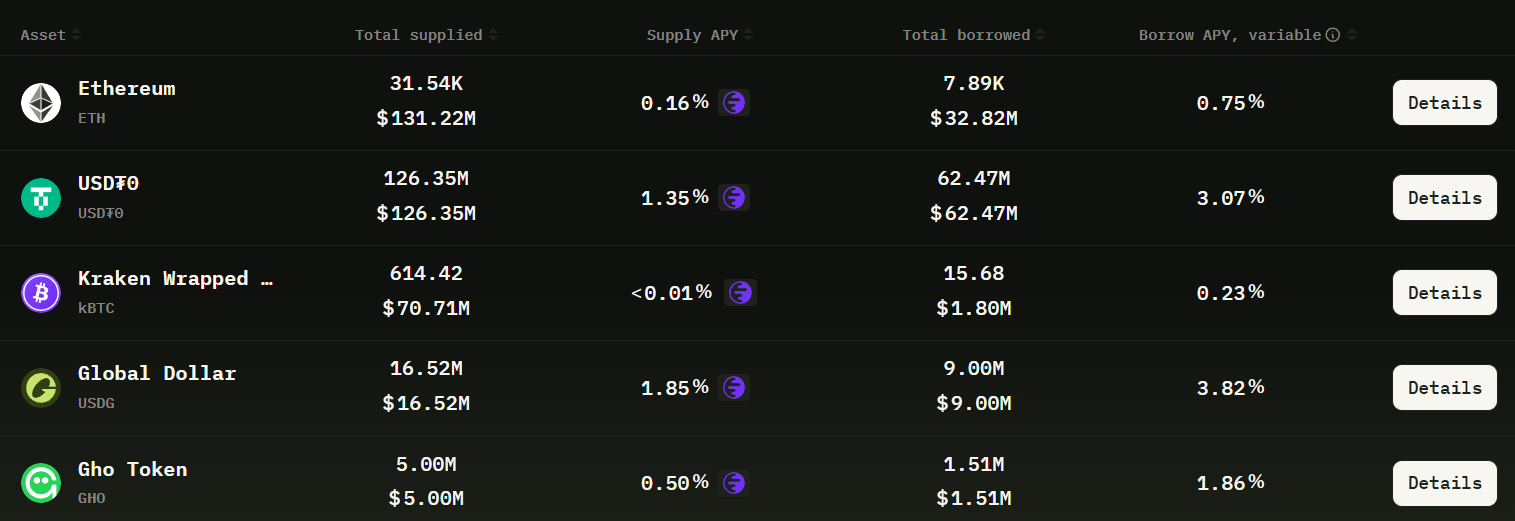

Tidro market. Source: Tydro

At the time of writing, Tydro's total market size for deployed assets exceeds $350 million, with $108 million in borrowed assets and $243.55 million in supplied assets.

Currently, the highest supply APY (1.84%) on the protocol is not offered in USDT0, but in USDG, a stablecoin issued by regulated fintech Paxos and backed by a consortium including Kraken, Robinhood, Anchorage Digital, Bullish, and Galaxy Digital.

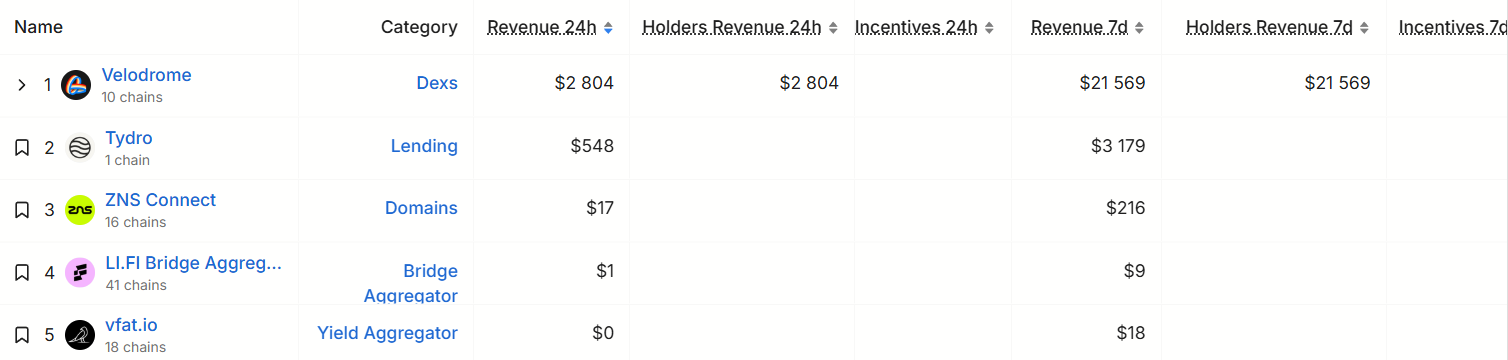

Ink protocol by weekly earnings. Source: Defilama

As a result, Tydro, which currently supports only five markets: ETH, USDT0, USDG, KBTC, and GHO, has become the second largest protocol on Ink in terms of weekly revenue, earning $3,179 since launch, trailing only decentralized crypto exchange Velodrome, which boasts over $21,000 in weekly revenue.

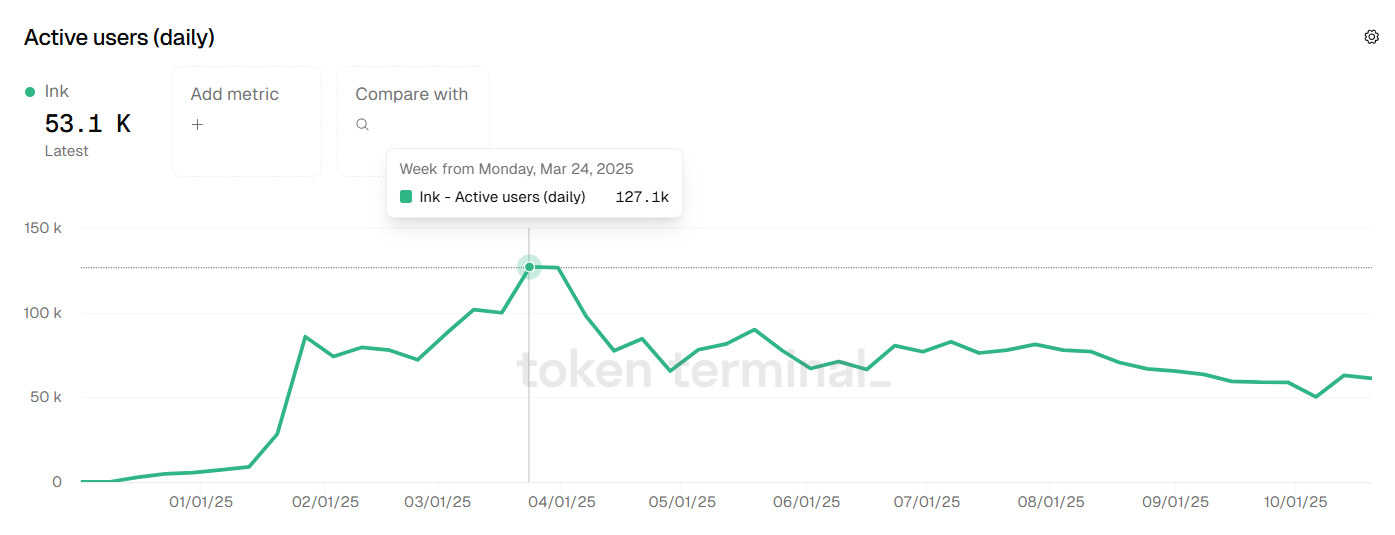

Daily active users of Ink. Source: Token Terminal

Despite TVL's parabolic expansion, network activity on Ink, which is built on Optimism's superchain, is on the decline. The number of daily active addresses has steadily declined over the past week from a peak of 127,100 users on March 24 to about 60,300 users, a drop of more than 50%, according to Token Terminal data. The decline in user activity has also led to a decline in network revenue, with daily rates recently dropping to less than $500 and total revenue last month being $11,600.