This is a technical analysis post by Omkar Godbole, CoinDesk Analyst and Chartered Market Technician.

Bitcoin BTC$110,715.03 It has fallen after Federal Reserve Chairman Jerome Powell's recent hawkish comments, but not after he questioned expectations for a December interest rate cut.

That's the message from the price chart, which shows that while BTC is facing selling pressure after Chairman Powell downplayed further easing in December, the price remains above the important 200-day simple moving average (SMA) near $109,250. At the time of writing, BTC was trading at $111,000, rebounding from the major averages.

It's encouraging for bulls that the stock is above its 200-day simple moving average (SMA), a long-term barometer of market trends, but is that enough? Probably the answer is no.

That's because prices are still well below the Ichimoku cloud, a technical indicator that helps gauge short-term market trends. Traders generally believe that trading under clouds is bearish in the short term.

This is a daily chart of BTC. (Trading View)

The longer Bitcoin stays below the cloud, the greater the risk it will fall below the 200-day SMA and the more likely it will fall below the psychologically important $100,000 level. This is exactly what happened in February, leading to an even more pronounced decline in the weeks that followed, with prices dropping to $75,000.

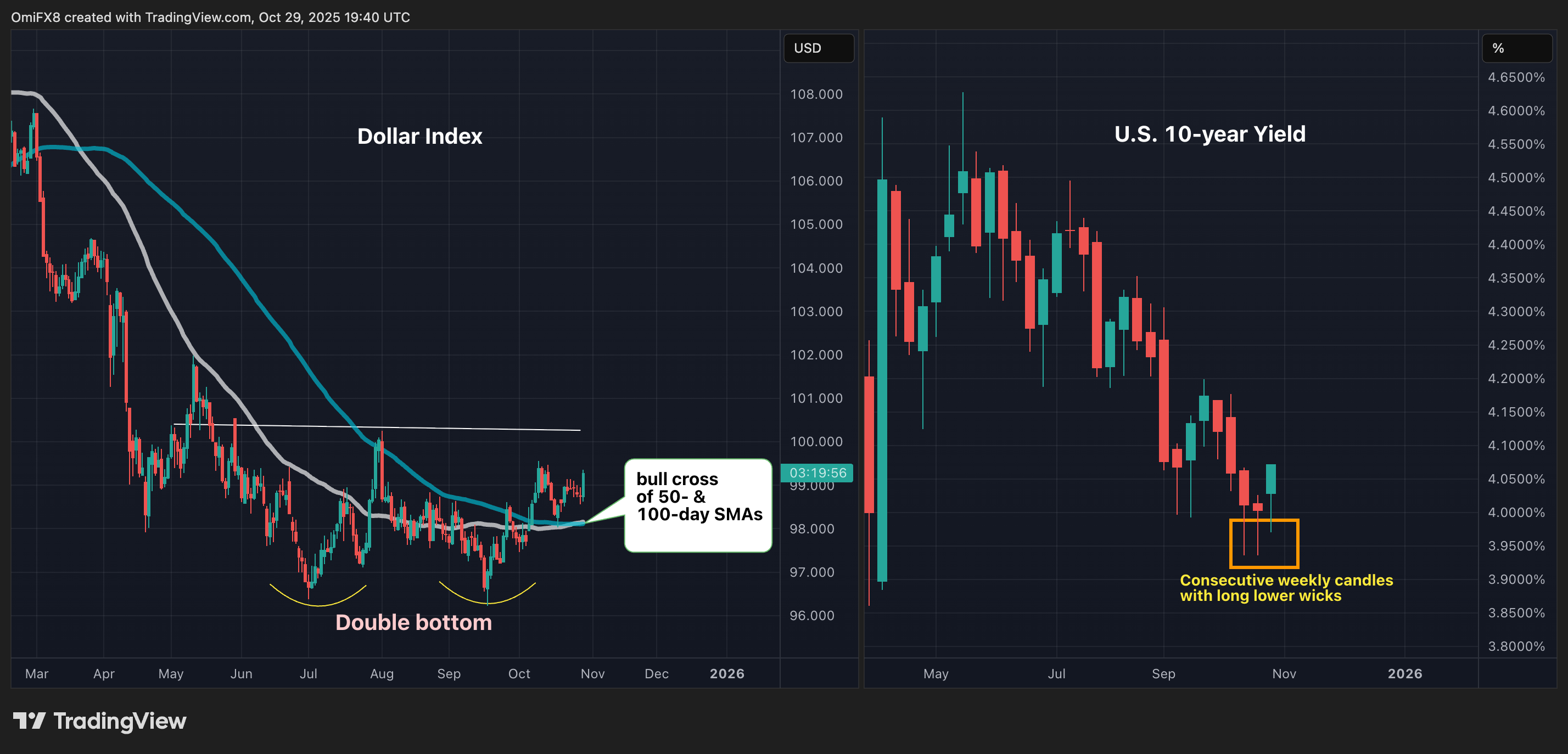

This downside risk is reinforced by two factors. One is the bullish crossover of the 50-day and 100-day SMAs of the dollar index. This suggests continued strength in the USD and could lead to a bullish double-bottom breakout marking the end of the broad downtrend since January.

Meanwhile, the 10-year Treasury yield has rebounded above 4%, confirming the end of the downtrend, as indicated by a series of long weekly candlesticks. Hardening of yields at the longer end of the curve typically strengthens the dollar and weighs on risk assets.

Chart of the dollar index and 10-year US Treasury yield. (Trading View)

Note that post-Fed, Deribit-listed BTC puts are once again trading at a 4%-5% volatility premium on the front end, according to data source Amber Data. This indicates that concerns about the decline in prices are increasing.

Taken together, these factors are alarming for Bitcoin bulls, who need a decisive break above the $116,000 Ichimoku cloud to restore bullish confidence and set the stage for further upside.