The Spot Solana exchange-traded fund (ETF) continues to attract investor interest, posting a fourth consecutive day of inflows amid “capital rotation” from Bitcoin and Ether funds.

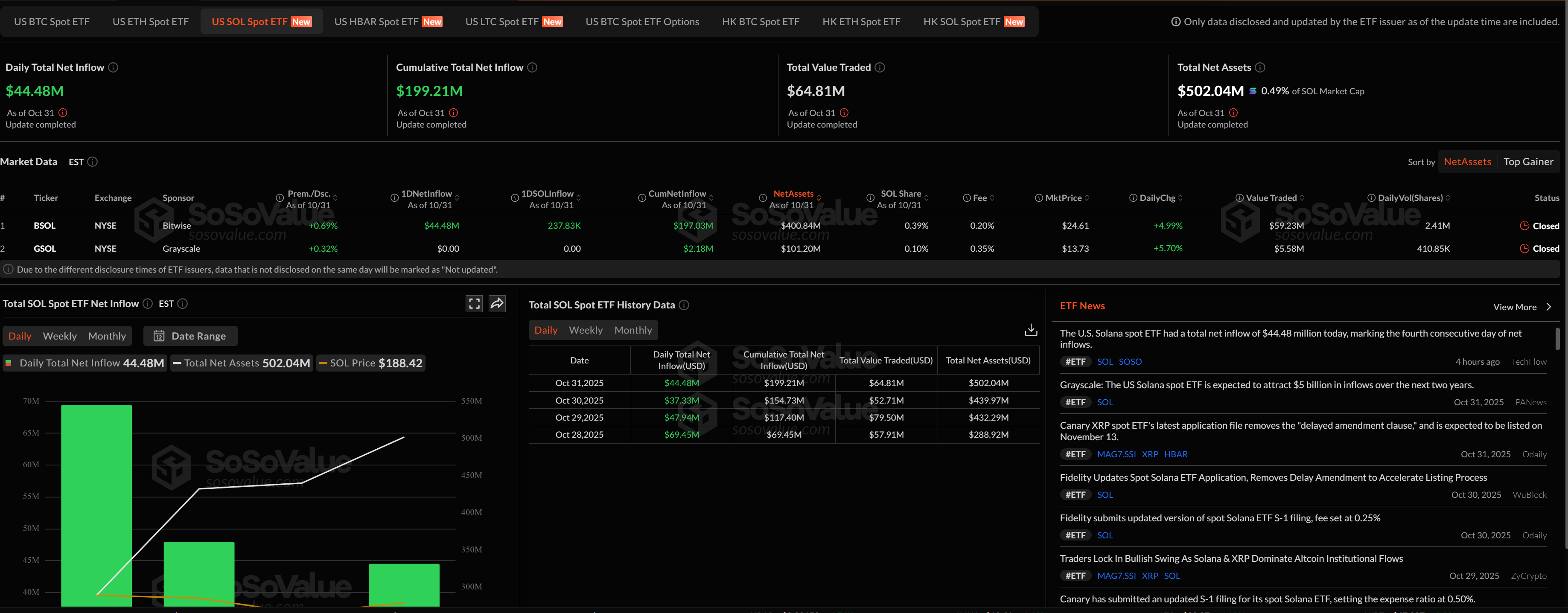

The Spot Solana (SOL) ETF added $44.48 million on Friday, bringing total inflows to $199.2 million and total assets to more than $502 million, according to SoSoValue data. Bitwise Solana ETF (BSOL) led the way, contributing the bulk of the new money with a daily gain of 4.99%.

In contrast, the Spot Bitcoin (BTC) ETF recorded net outflows of $191.6 million per day on the same day, continuing its trend of profit taking for a week. The fund had outflows of $488.43 million on Thursday and $470.71 million the previous day.

The Spot Ether (ETH) ETF also recorded outflows of $98.2 million, reducing cumulative inflows to $14.37 billion. The funding decreased by $184.3 million on Thursday and $81.4 million on Wednesday.

Money is flowing into the Solana ETF. Source: SoSoValue

Related: Uptober records 21 crypto ETF applications as Bitcoin rises

Solana ETF gains momentum

The move to Solana ETFs comes amid what market participants describe as a “turnover of capital.” Vincent Liu, chief investment officer at Cronos Research, told Cointelegraph that this trend highlights a growing appetite for new narratives and staking-driven yield opportunities.

“Solana ETF is surging on new catalysts and capital rotation while Bitcoin and Ether are seeing profit-taking following a strong rally,” Liu said. “This shift signals a growing appetite for new narratives and staking-driven revenue opportunities.”

Analysts suggest Solana’s momentum could continue next week as Bitcoin and Ether consolidate. “Unless macro news causes extreme volatility, Solana’s momentum is likely to continue into next week, and rotation will be maintained during the majors’ pause,” Liu added.

Related: ETFs will lead financial institutions to altcoins like Bitcoin: Analyst

New crypto ETFs enter the market

A new wave of crypto ETFs has hit the market this week, led by Bitwise’s Solana Staking ETF (BSOL). The ETF launched on Tuesday with $222.8 million in assets and offers investors exposure to Solana (SOL) with an estimated 7% staking yield.

Several other funds have also entered the market, including Canary's Litecoin (LTC) and Hedera (HBAR) ETFs, as well as Grayscale's Solana Trust conversion into an ETF. Meanwhile, Hong Kong approved its first Spot Solana ETF last week.

magazine: Bitcoin OG Kyle Chasse is one shot away from being permanently banned from YouTube