Ethereum's recent decline has captured the attention of the entire crypto market as the second-largest cryptocurrency struggles to recover from a 15% week-on-week decline. Continued bearish conditions have caused ETH to fall to levels not seen in recent months.

However, this sharp correction could signal the beginning of a recovery, as Ethereum appears to have reached a bearish saturation point.

Ethereum enters historic reversal point

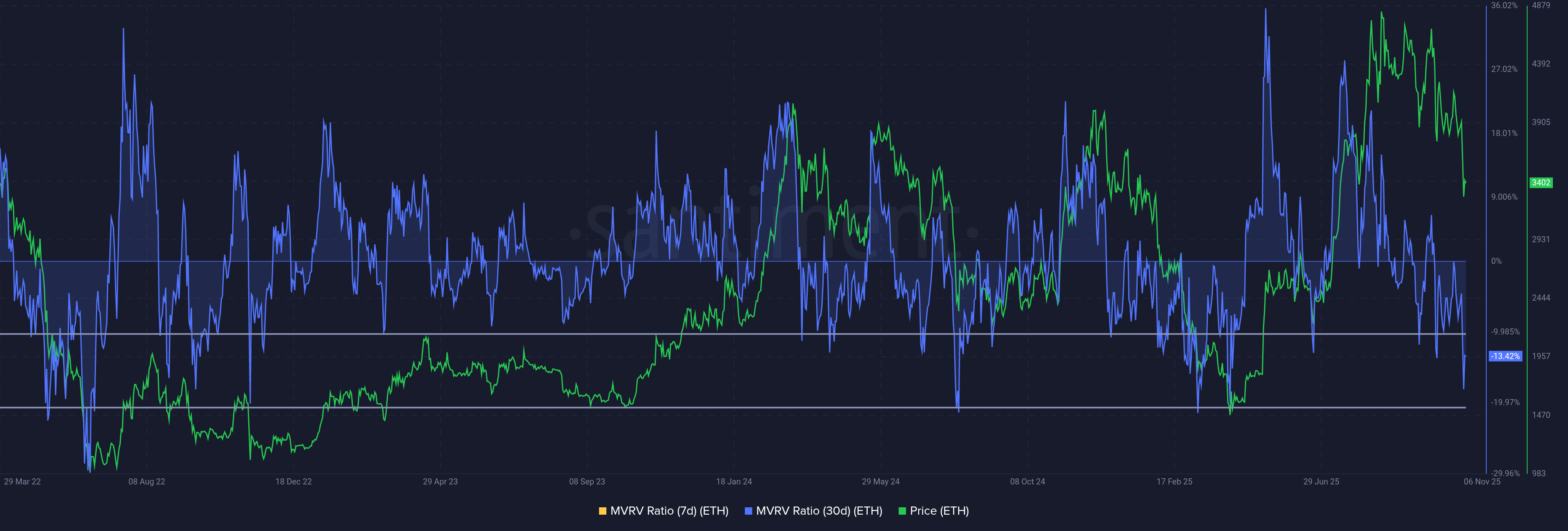

The 30-day MVRV ratio highlights that Ethereum has officially entered the “opportunity zone” for the first time in five months, a range historically associated with a potential reversal. This zone, defined between -10% and -20%, represents a period during which investors stop selling as losses deepen. Rather, they are often accumulated at a discount, supporting future recovery.

Historically, every time ETH enters this zone, it has rallied, indicating that investor sentiment is shifting from fear to accumulation. This trend often precedes bull markets as traders begin to expect prices to rise once market selling pressure stabilizes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV ratio. Source: Santiment

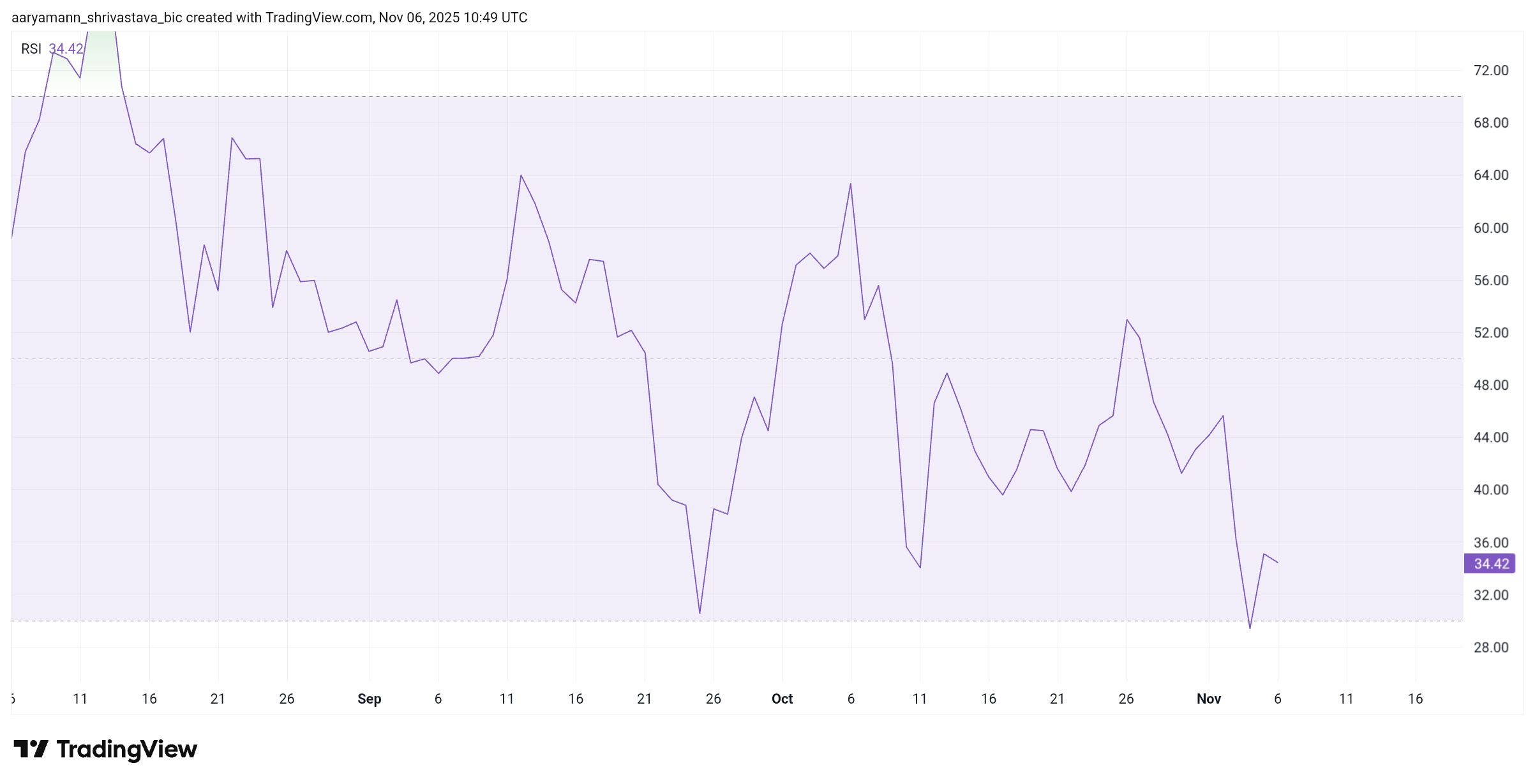

On a macro scale, Ethereum’s Relative Strength Index (RSI) supports this optimistic outlook. The RSI is currently hovering around 30.0, indicating that ETH is approaching an oversold condition. Assets near this threshold often experience reversals as selling momentum weakens and buyers begin to re-enter the market.

If ETH falls further below the 30.0 RSI level, it could trigger a strong technical rebound. Such signals usually attract traders looking for short-term profits while improving their long-term prospects. The combination of low MVRV and near-oversold RSI strengthens the possibility of a bullish reversal in Ethereum in the coming days.

ETH RSI. Source: TradingView

ETH price has a bullish future

Ethereum's price has recorded a significant week-on-week decline of 15% to $3,397 at the time of writing. To recover, ETH will need to regain $3,800, a level that previously served as an important support zone.

If this momentum matches the technical indicators, Ethereum could rise above the $3,489 resistance, break through the $3,607 barrier, and then target $3,802. If investor accumulation continues, this rally will further strengthen.

ETH price analysis. Source: TradingView

However, if investor sentiment weakens, Ethereum could fall below the support at $3,367 and drop to $3,131. This decline will invalidate the bullish theory and prolong ETH’s consolidation phase.

The post Ethereum enters “opportunity zone” after 5 months; what does this mean for price? appeared first on BeInCrypto.