In early November, Ethereum (ETH) lost more than 12% of its value. However, major holders bought the drop and amassed the second-largest cryptocurrency by investing around $1.37 billion in just three days.

This aggressive buying highlights strong conviction among large investors, even though the overall crypto market remains under pressure.

Ethereum whale gains momentum

BeInCrypto reported earlier this week that Ethereum recorded its biggest daily decline in months. The altcoin fell to a low of around $3,000 on Tuesday, its lowest level in nearly four months.

At the time of writing, ETH is trading at $3,384, reflecting a modest recovery of 1.45% per day, according to data from BeInCrypto Markets. Although the coin has yet to flip the $3,400 level into support, holders seem to view the decline as a buying opportunity rather than a reason for concern.

Ethereum (ETH) price performance. Source: BeInCrypto Markets

On-chain analytics firm Lookonchain reported significant accumulation by whales during the recession. The data revealed that eight major entities purchased a total of 394,682 ETH (worth about $1.37 billion) over the past three days.

The average purchase price was $3,462. Lookonchain identified the “Aave whale” as its largest buyer. The company purchased 257,543 ETH worth $896 million.

The second largest buyer was Bitmine Immersion Technologies, the largest corporate holder of ETH. The company acquired 40,719 ETH for approximately $139.6 million.

OnChain Lens data shows that Bitmine initially purchased 20,205 ETH from Coinbase and FalconX. We then received an additional 20,514 ETH from FalconX.

This latest move is in line with Bitmine's continued strategy of accumulating Ethereum during market declines. In late October, the company made a large purchase worth $250 million, and shortly thereafter invested another $113 million in ETH.

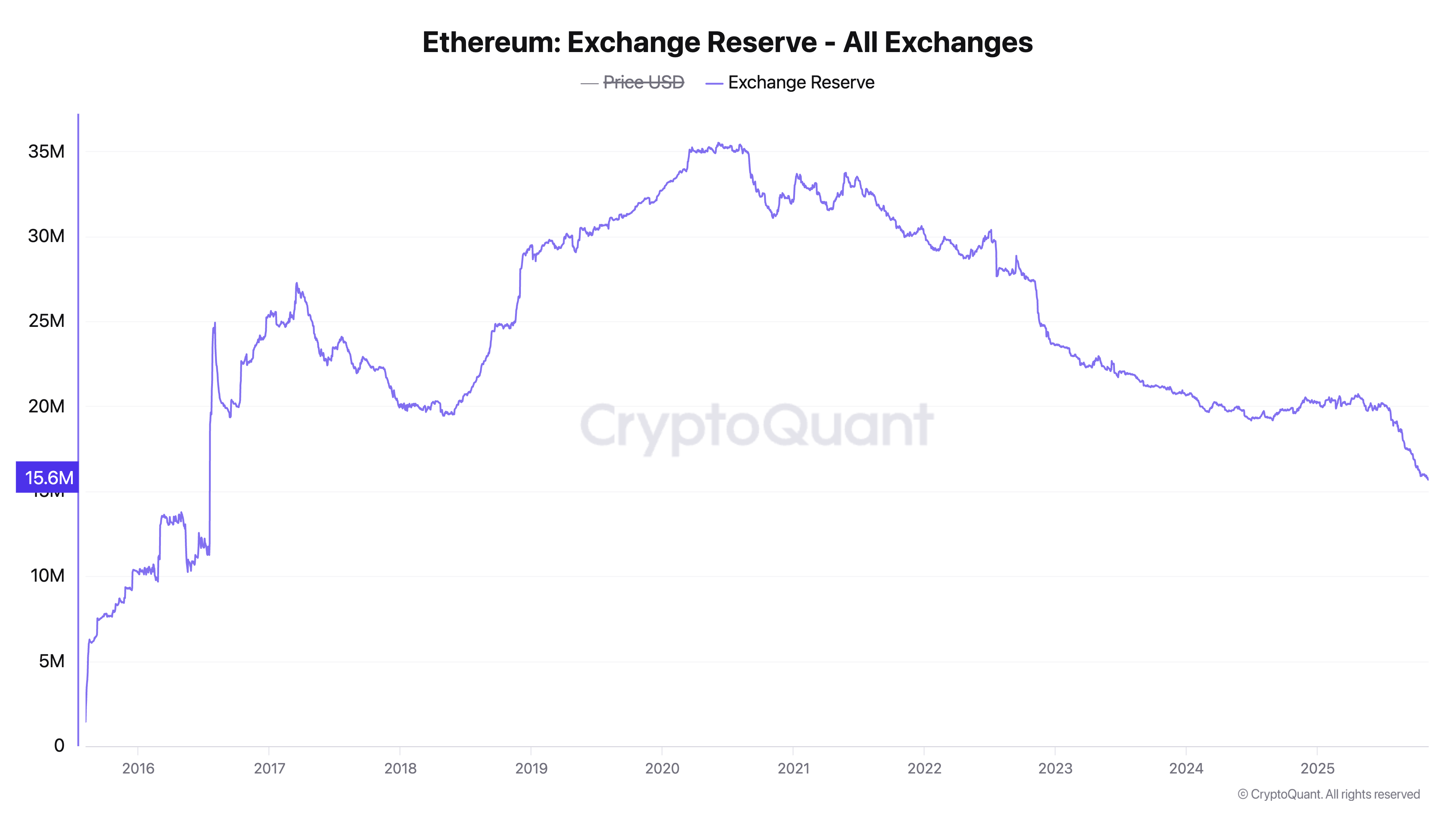

At the same time, broader network data reflects similar investor behavior. Ethereum’s foreign exchange reserves have fallen to their lowest level since 2016, according to data from CryptoQuant.

A decline in foreign exchange reserves typically suggests that investors are moving their Ethereum holdings from trading platforms to long-term storage, reflecting increased confidence in the asset's future. This trend reduces the amount of ready-to-sell supply, which could reduce selling pressure and support potential upward price momentum.

Reduced supply of Ethereum on exchanges. Source: CryptoQuant

On-chain metrics ETH flash buy signal

Santiment's on-chain analytics supports this trend. The data shows that Ethereum suggests a strong buying opportunity based on the Market Value to Realized Value (MVRV) metric.

Traders active in the past 30 days now have an average loss of 12.8%, Santiment said, indicating that short-term pain is spreading.

From a long-term perspective, traders who have been active over the past year have also fallen slightly into the red, with an average return of -0.3%.

“When an asset's short-term and long-term MVRV are both in the negative range, this historically indicates a strong opportunity to buy at low risk while there is 'blood in the streets,'” Santiment posted.

Overall, the combination of large whale accumulations, declining exchange reserves, and favorable on-chain metrics suggests that investor confidence in Ethereum is growing. If these trends continue, Ethereum could be poised for a price recovery once broader market conditions stabilize.

The post Ethereum Whales Buy $1.37 Billion of ETH Amid 12% Price Drop in November appeared first on BeInCrypto.