Nearly half of exchange-traded fund (ETF) investors plan to buy crypto ETFs, according to a report from brokerage firm Schwab Asset Management, which is in line with investors who said they would buy bond ETFs.

In a report on ETFs and Beyond released Thursday, Schwab found that 52% of survey respondents plan to invest in U.S. stocks and 45% are interested in crypto ETFs, tied for second place with U.S. bonds.

Eric Balciunas, a senior ETF analyst at Bloomberg, said on Thursday's XPost that the result was surprising given the incomparably large size of the bond market.

“It was also shocking that cryptocurrencies became tied for second place with bonds as an investment destination for people,” he said. “Cryptocurrencies account for 1% of the ETF’s total aum (assets under management), while bonds account for 17%, largely outweighing the weight.”

sauce: Eric Balchunas

Schwab surveyed 2,000 individual investors between the ages of 25 and 75, half of whom had bought or sold ETFs in the past two years and had at least $25,000 in investable assets.

Millennials are showing high interest in crypto ETFs

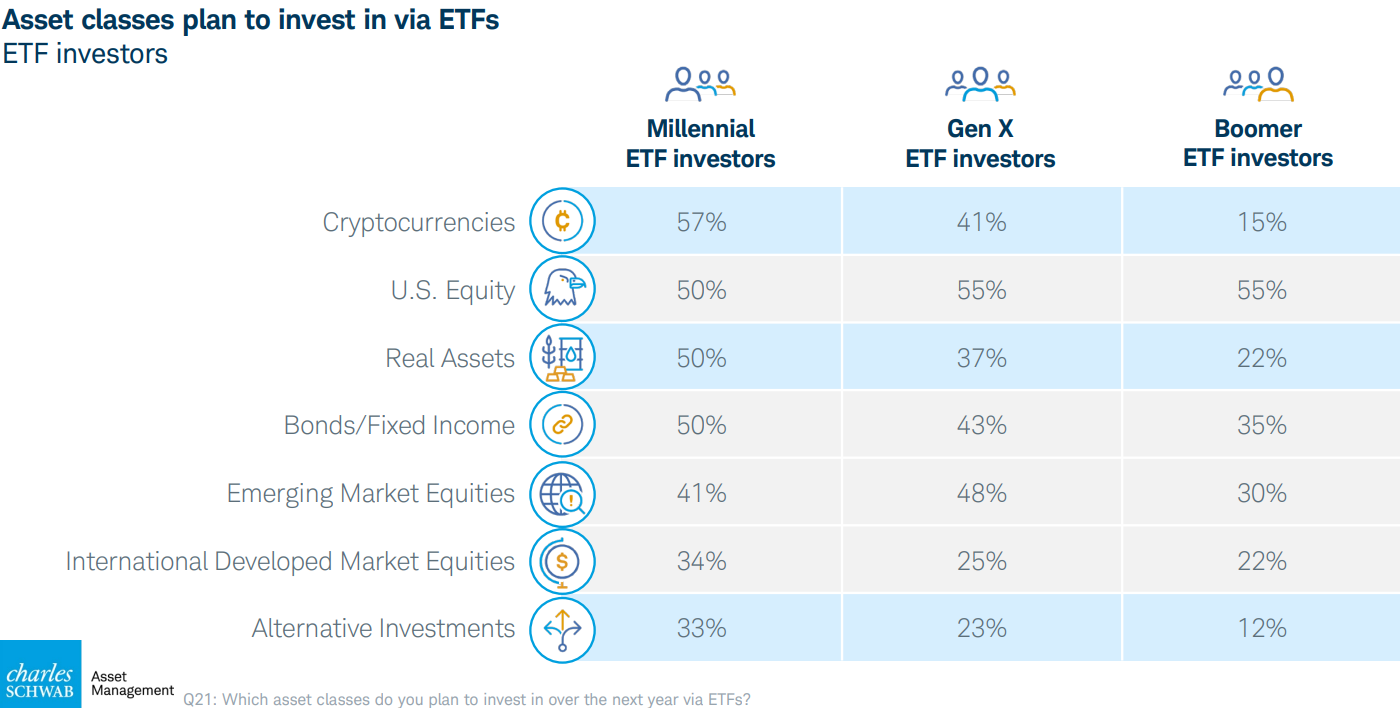

The report found that millennial investors (those born between 1981 and 1996 and between the ages of 29 and 44) show more interest in crypto ETFs than other age groups.

Approximately 57% of Millennial respondents indicated plans to invest in cryptocurrencies through ETFs, compared to 41% of Gen X respondents born between 1965 and 1980.

Millennial investors showed higher interest in crypto ETFs than other age groups. sauce: Schwab Asset Management

Baby boomers born between 1946 and 1964 were the least interested in crypto ETFs, with just 15% saying they planned to invest in them.

Overall, Balciunas said, “the whole survey is very optimistic” about ETFs in general, and younger generations in particular “basically everyone plans to increase their usage.”

Low cost and ease of access drive adoption of ETFs

Low cost and ease of access were found to be the main drivers for ETF adoption, with 94% of respondents saying ETFs help lower costs in their portfolios.

Related: US Spot Bitcoin ETF loses over $2 billion in second-worst outflow streak in history

Also, about half of ETFs strongly agree that they allow investment in more niche or targeted strategies and provide access to other types of asset classes apart from long-term portfolios.

“The investment world is undergoing rapid transformation as retail investors gain access to new asset classes, investment strategies and vehicles,” said David Bottsett, managing director at Schwab Asset Management.

“ETF investors are at the forefront of this evolving landscape. They rely on ETFs, which now outnumber individual stocks in the U.S., not only for low-cost core portfolio investments, but also to explore an expanding world of investment opportunities.”

magazine: Good luck suing crypto exchanges and market makers over the flash crash