The price of Ethereum has faced a sharp decline in recent days, dropping to a two-month low. ETH has fallen as market volatility has increased and investor confidence has declined.

Despite the downturn, past patterns suggest the trend could soon reverse, providing a potential path to recovery for the altcoin king.

Ethereum lands in Opportunity Zones

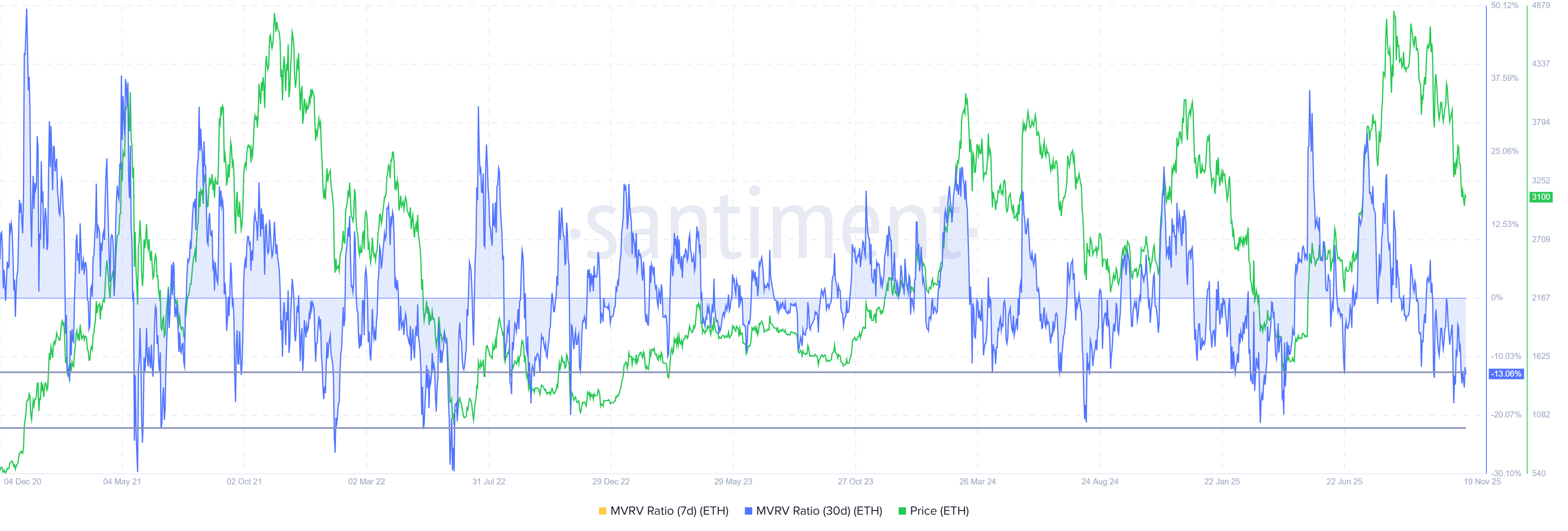

The MVRV ratio indicates a favorable setup for Ethereum. This indicator is -13%, which puts ETH firmly within the opportunity zone between -12% and -22%. Historically, this range has marked the point at which losses reach saturation and selling pressure subsides. Investors often view these levels as attractive entry points that support a price rebound.

Once Ethereum re-enters this zone, the situation will be similar to previous periods of strong recovery. Typically, reduced sales incentives and new accumulations help stabilize ETH.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

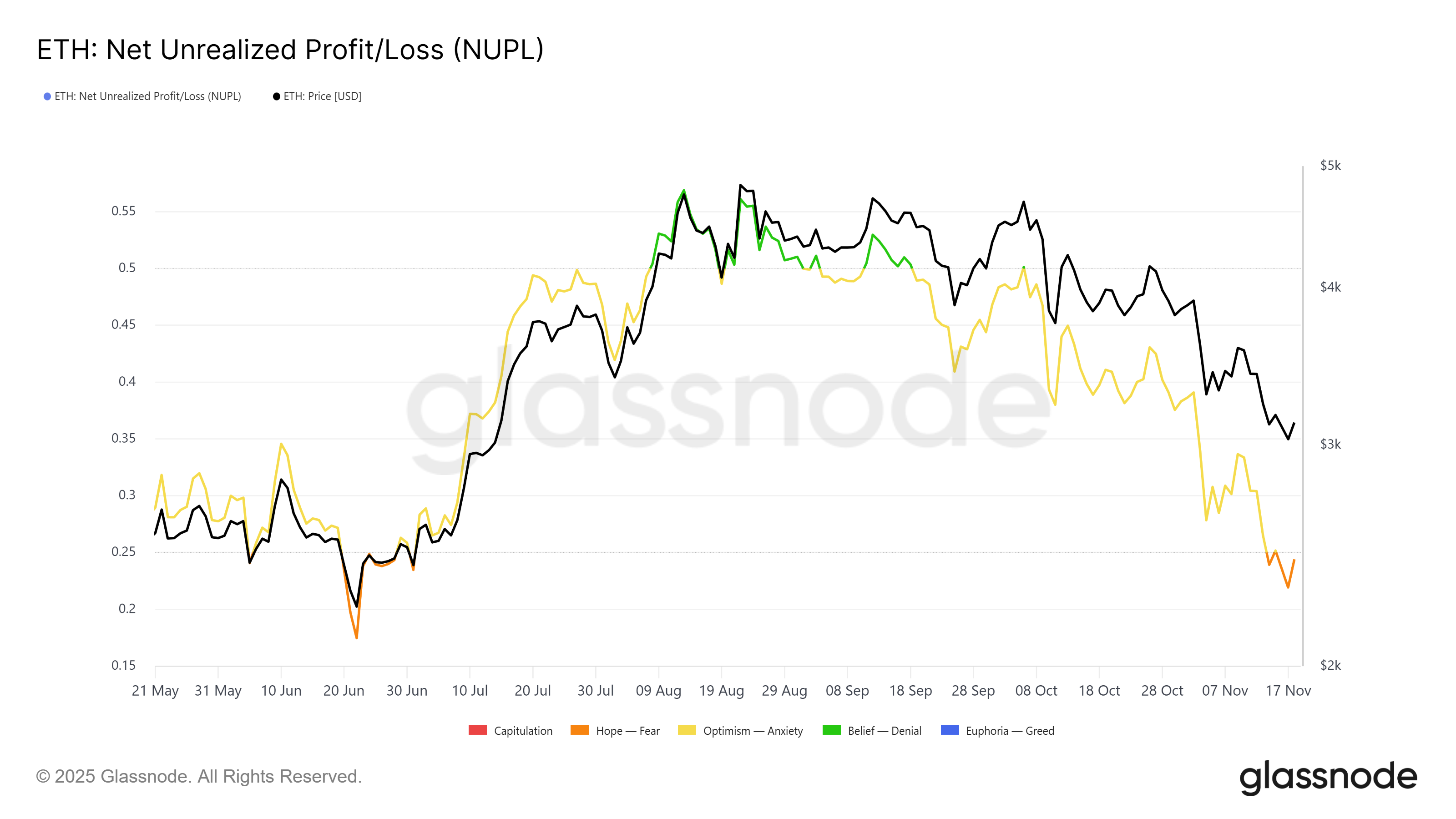

Ethereum MVRV ratio. Source: Santiment

Macro momentum indicators further strengthen the possibility of a rebound. Ethereum’s Net Unrealized Gain/Loss (NUPL) is below the threshold of 0.25. This zone reflects the growing anxiety among holders, a sentiment stemming from increased unrealized losses for ETH investors.

The last time we saw this, ETH returned to the optimism zone. This change marked a large reversal in price.

A similar move now would signal that the fear-based situation is becoming exhausted. If NUPL follows its historical trajectory, Ethereum could show renewed confidence and upward momentum.

ETH price may rebound

Ethereum is trading at $3,094 and remains above the key support level of $3,000 after the sharp drop. This is the first time in two months that assets have fallen this much. Maintaining support is essential to preventing further loss and preparing for possible recovery.

ETH is currently positioned below the $3,131 resistance level and is awaiting further upside. Supportive on-chain signals suggest a likely push towards $3,287. If the momentum strengthens, Ethereum could extend its rally and target $3,489 in the coming sessions.

ETH price analysis. Source: TradingView

If bearish pressure increases, Ethereum could fall below $3,000, invalidating the current bullish outlook. The drop in support could lead to stronger selling and ETH to fall towards $2,814. This scenario reflects broader vulnerabilities and could delay major recovery attempts.

The article “Ethereum falls near $3,000, but on-chain ‘opportunity zones’ hint at rebound” was first published on BeInCrypto.