Crypto market analysts are confident that Bitcoin's recovery could continue as it begins to rise from Friday's lows of just over $82,000.

Charles Edwards, founder of the Capriol Fund, posted on X on Monday that the tech stock and cryptocurrency markets have fallen sharply over the past two weeks “due to a market reversal on expectations of a rate cut.”

“Bitcoin is expected to see some upside as the market reverses,” he added.

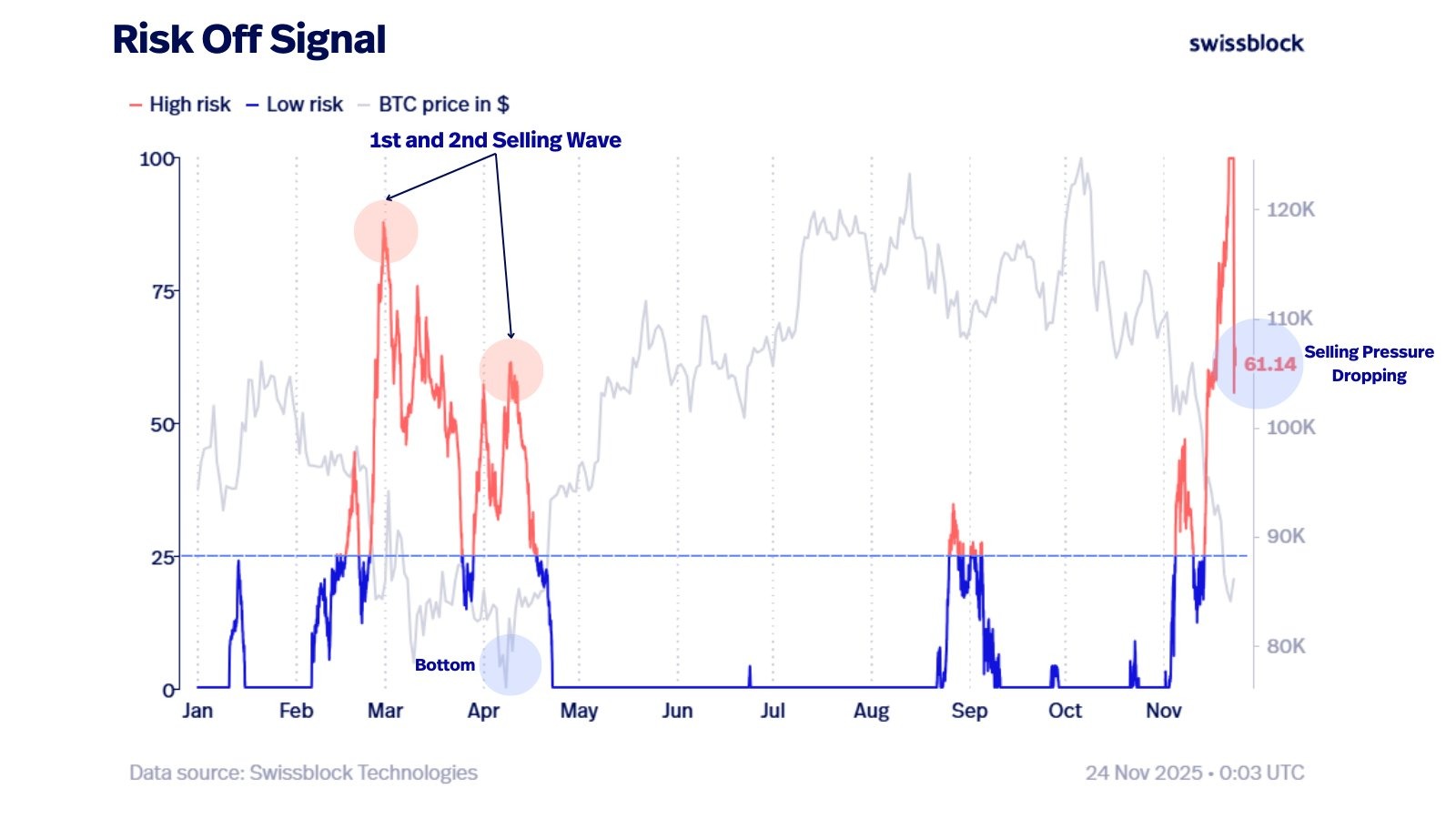

Analysts at asset management firm Swissbloc added that Bitcoin (BTC) has taken the first serious steps toward bottoming out.

“The risk-off signal has declined sharply, which tells us two things: selling pressure has subsided and the worst of the capitulation is likely over for now.”

They added that this week is important as they should “see selling pressure continue to ease.”

However, there is often a second wave of selling, weaker than the first, with prices holding onto previous lows, making this one of the most reliable bottom signals, Swissbrock said.

“That second wave usually signals sellers are exhausted and control has returned to the bulls,” the analysts added.

Bitcoin selling pressure is decreasing. sauce: swiss block

Bitcoin fell to $80,600 on Coinbase on Friday, its lowest since mid-April, according to TradingView. The decline widened to 36% from its all-time high of over $126,000 in early October.

Chance of Fed rate cut increases

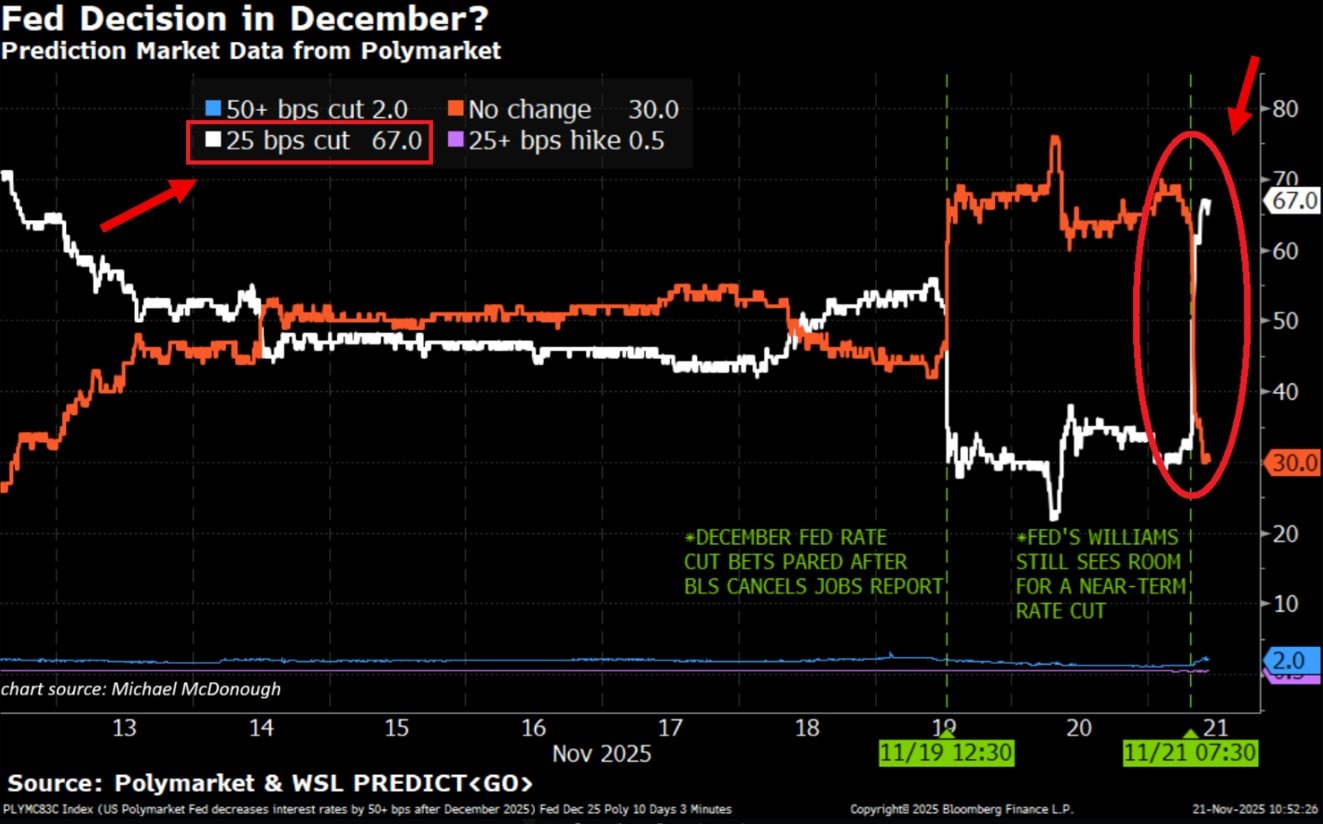

The probability that the Federal Reserve will cut interest rates in December fell to about 30% last week, but has since returned to 70%, Edwards said.

The odds of a 0.25 basis point cut at the central bank's Dec. 10 meeting are currently 69.3%, according to the CME Fed Watch tool, which tracks target rate probabilities.

Related: Bitcoin enthusiasts cheer as Fed nearly doubles chance of cutting interest rates in December

“Market expectations change dramatically in two days,” said Market Research

Expectations for Fed rate cuts have reversed toward 70%. Source: Global Markets Investor

Liquidity injection is imminent

“I wouldn't be surprised if the Fed announces something at its next meeting on 'reserve management'…essentially liquidity expansion,” market analyst Sycoderic said on Sunday.

Central banks will need to inject liquidity at some point, “or they will go bankrupt,” they added.

“If you're betting on a year-long bear market, you're basically betting on the U.S. going bankrupt.”

Lower interest rates and increased liquidity are typically bullish for high-risk assets such as cryptocurrencies, which have followed previous quantitative easing policies with strong gains.

magazine: Will Bitcoin reach $200,000 soon or in 2029? Scott Bessent hangs out at a Bitcoin bar: Hodler's Digest