Bitcoin's open interest has declined as the cryptocurrency's price has fallen over the past month, with analysts claiming that Bitcoin could bottom out and trigger a “new bullish trend.”

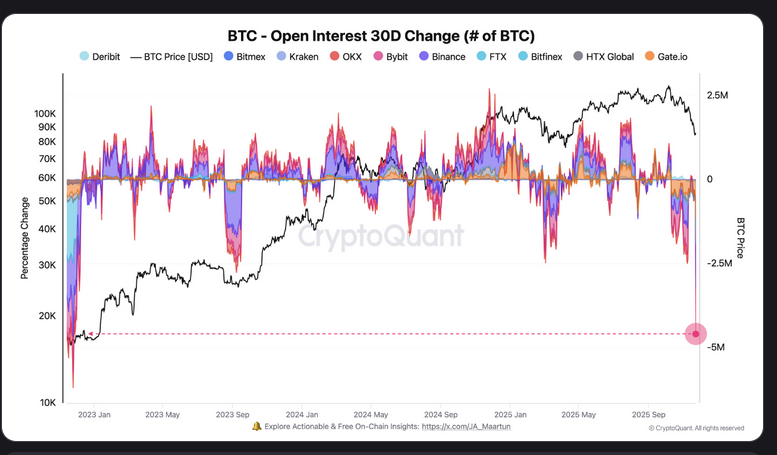

Bitcoin (BTC)'s open interest was around 1.3 million BTC, marking “the steepest 30-day decline in this cycle,” and it is now worth $114 billion, with Bitcoin trading at $87,500, analyst Darkforst posted on CryptoQuant on Sunday.

The cascading rise in Bitcoin prices over the past few weeks “continues to cause liquidations,” forcing traders to double down or recalibrate their strategies. But now investors appear to be halting futures trading to “reduce risk exposure.”

“Historically, these cleansing steps have often been essential to form a solid bottom and set the stage for a new bullish trend. Deleveraging, liquidating overly optimistic positions, and gradually reducing speculative exposures help rebalance the market.”

Dirkforst said the last time Bitcoin's open interest fell this quickly over a 30-day period was “during the 2022 bear market. This highlights how important the current cleanup is.”

30-day change in open interest. sauce: cryptoquant

Bitcoin has fallen 20% in the past month, and has fallen more than 30% since hitting a high of more than $126,000 in early October, about two months ago.

Bull market could return with gains above $90,000

Cryptocurrency analyst and MN Fund founder Michael van de Poppe claimed that next week will be “definitive” for BTC prices, hinting at the possibility of a new all-time high in the near future.

Related: Bitcoin volatility spike could signal a return to options-driven prices: analyst

In an X post on Sunday, Van de Poppe said that if BTC were able to rise sharply and stay within the $90,000 to $96,000 range, “the chances of a comeback towards a new ATH have increased significantly.”

“Fear and panic have been at their max over the last few days. That's the best opportunity for the market,” he said.

magazine: Will Bitcoin reach $200,000 soon or in 2029? Scott Bessent appears at Bitcoin Bar: Hodler's Digest, November 16-22