Most crypto traders still believe that Bitcoin is following a traditional four-year pattern.

Halving → bull market → blowout at the top → multi-year bear market.

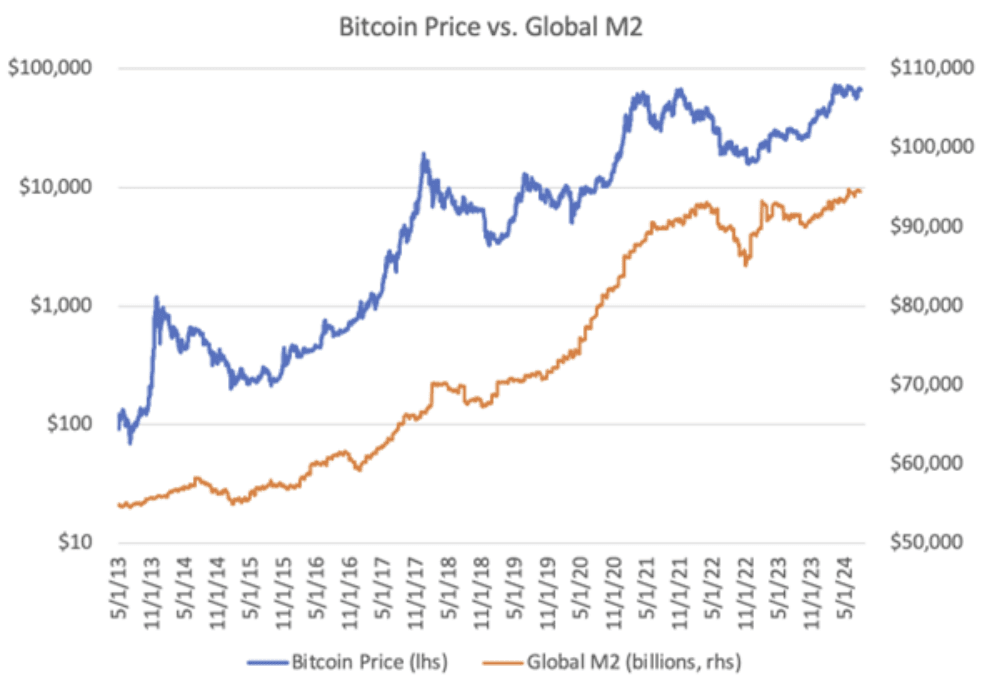

But the evidence from the past decade clearly shows that: Bitcoin's biggest move was not caused by a halving.

Those causes are: Expanding liquidity And that expansion is now forming again.

A chart comparing Bitcoin and the Global Liquidity Index makes this case unmistakable.

The date does not halve every time a major peak occurs in conjunction with a spike in liquidity.

And the same mechanism is starting to be built for 2025-2027.

According to the X-account bull theory, this is exactly the case.

1. Stablecoin liquidity shows the truth

Despite recent price declines, The total supply of stablecoins continues to increase.

This is important because stablecoins are the closest thing cryptocurrencies have to the money supply. A rise in power indicates:

- Educational institutions did not retreat.

- Capital is not leaving the cryptocurrency ecosystem.

- big players are sitting huge dry powderwaiting for a macrocatalyst.

An increase in stablecoin liquidity during a correction is one of the strongest signals that a bullish cycle is underway. pauseddo not have Finished.

2. The US Treasury is quietly bringing liquidity back to the market.

One of the biggest catalysts is happening below the surface.

The TGA (Treasury General Account) is close to $940 billion, about $90 billion above the normal range.

When the Treasury draws down this balance, that cash returns to the financial system, facilitating:

- market liquidity

- credit demand

- Risk asset performance

This is the same mechanism that drove previous expansions, and it's happening again.

Buying back government bonds was just the first hint.

The real liquidity improvement will occur when TGA starts to normalize. And historically, Bitcoin reaction is fast.

3. The global economy is entering a new phase of liquidity expansion

This cycle differs from all previous cycles in that Simultaneous global relaxation:

- China It has been injecting liquidity for several months.

- Japan Launched a roughly $135 billion stimulus package and relaxed virtual currency tax rules.

- Canada They are moving towards lower interest rates and easier terms.

- Fed has already ended QTwhich is historically a step before liquidity expansion.

When multiple major countries inject liquidity at the same time, risk assets typically react. in front Stocks and Commodities.

This is why Bitcoin's “delay” cycle is more severe. macro adjustment phase than the finished top.

4. The Hidden Catalyst: The Possibility of Salvation for SLR Cameras

In 2020, Exemption for SLR cameras U.S. banks were able to expand their balance sheets and increase lending, resulting in a significant acceleration of liquidity in all markets.

If any SLR remedy is returned:

- Bank loans increase

- credit expands

- System-wide liquidity increases

- Bitcoin and cryptocurrencies react instantly

This policy alone has the potential to reshape the entire financial landscape from 2025 to 2027.

5. The political class will make 2026 a major turning point.

President Trump's repeatedly stated policy direction reinforces the shift toward expansion.

- potential Tax restructuringincluding consideration of eliminating income tax.

- proposed $2,000 Tariff Dividend

- Market-friendly regulatory stance

- probably new fed chair More supportive of liquidity and constructive towards cryptocurrencies

This political cycle is important because Policy shapes liquidityand liquidity forms the Bitcoin cycle.

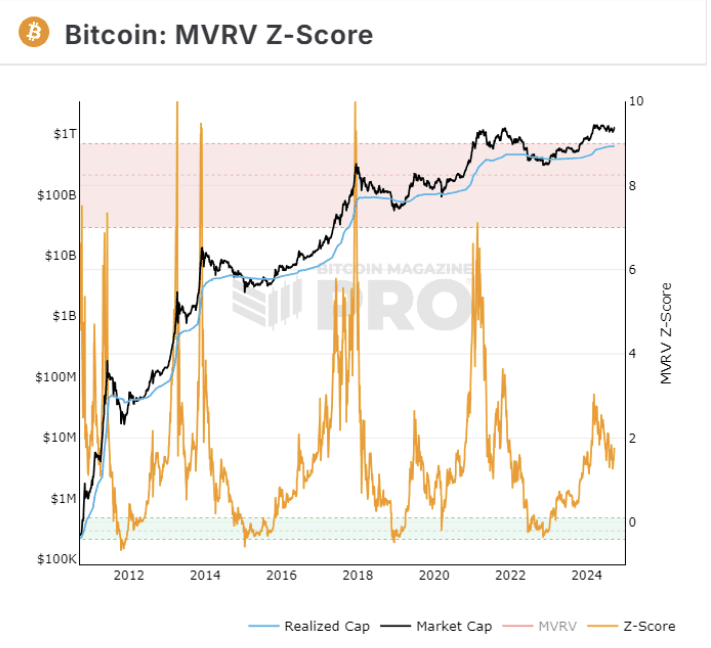

6. Overall signals point to a new longer Bitcoin cycle

When you add all the elements together, the big picture becomes clear.

- Increasing stablecoin liquidity

- Ministry of Finance preparing to inject cashback into the market

- Resurrection of global quantitative easing (China, Japan, Canada, etc.)

- QT ending in the US

- Possibility of expanding bank financing

- Market-friendly policies will shift in 2026

- New entrant institutions

- progress of clear method

- More crypto-friendly Fed leadership is on the horizon

This combination includes never It's happened before in Bitcoin's history.

This will completely break the traditional four-year pattern.

7. What the new Bitcoin cycle will look like (2025–2027)

Instead of the classic cycle:

❌Sharp run-up

❌ Blow-off top

❌ Multi-year bear market

Typing:

**Liquidity-driven expansion phase

It could last until 2026-2027. **

A cycle is defined as:

- Increased structural liquidity

- global mitigation

- political incentives

- Influx of institutional investors

- regulatory clarity

This is not a Bitcoin cycle of the past, but a completely new macro cycle.

Bitcoin is no longer responsive to block rewards or halvings.

is reacting to global liquidityAs well as other major risk assets.

The data shows:

- Liquidity has bottomed out.

- Liquidity is rising.

- The economies of major countries are all easing.

- US policy has become expansionary.

- Stablecoins are expanding.

- The engine is loading dry powder.

The next major Bitcoin phase will not follow the old scenario.

It will be longer, broader and more powerful, driven by macro liquidity rather than mining schedules.