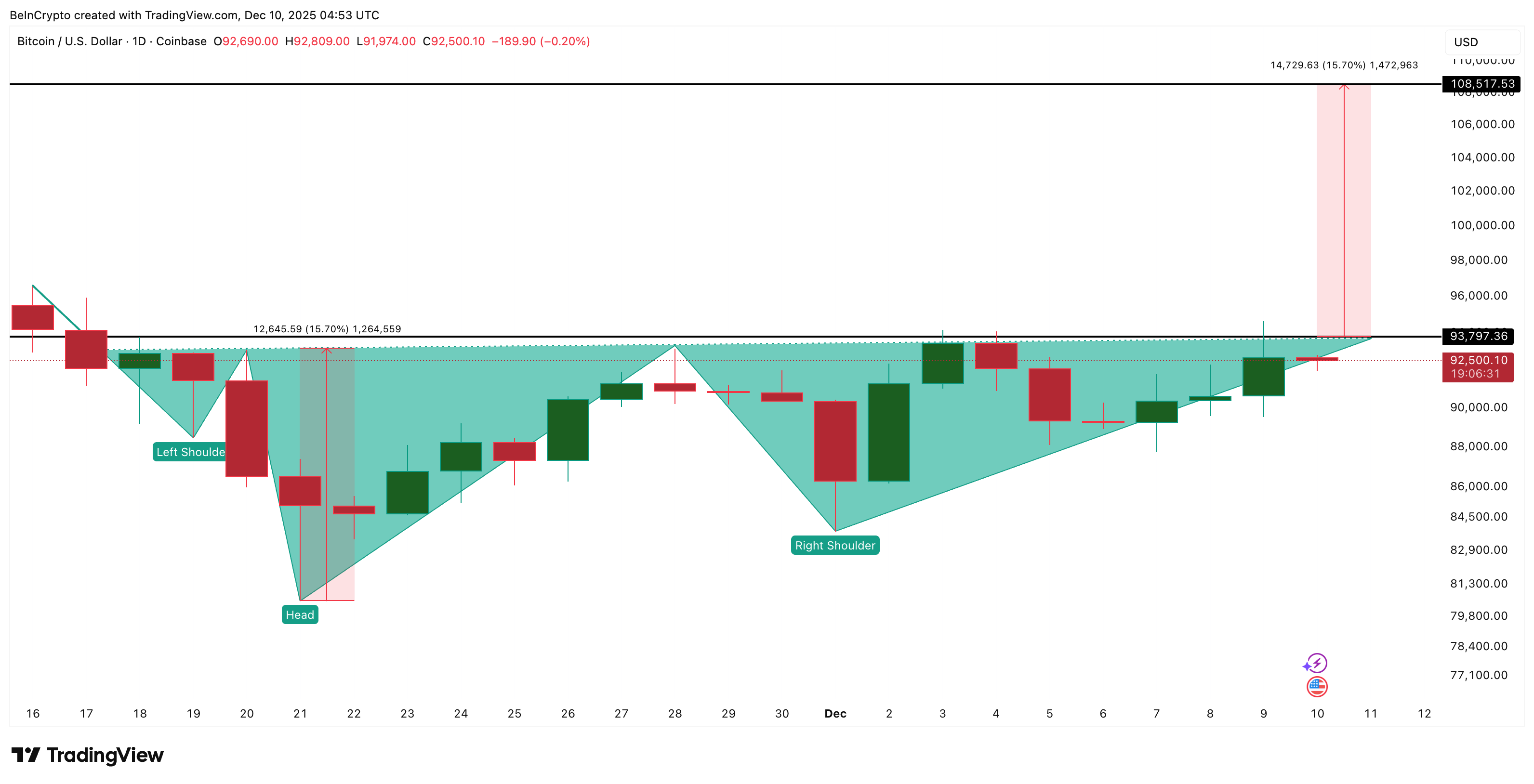

Bitcoin price has increased about 2.8% in the past 24 hours and is trading around $92,500. The daily chart still shows a nice inverted head-and-shoulders structure towards $108,500, but all attempts to break above have stalled.

Two clear reasons explain why breakouts keep failing. And the good news is that both can still swing in favor of Bitcoin.

Stubborn levels and weak whale support continue to hinder movement

Bitcoin continues to honor the inverted head-and-shoulders pattern that formed on November 16th. This structure remains valid, but the $93,700 neckline has rejected all clean breakout attempts so far. The pattern cannot be activated until Bitcoin price closes above this line.

Bitcoin bullish structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

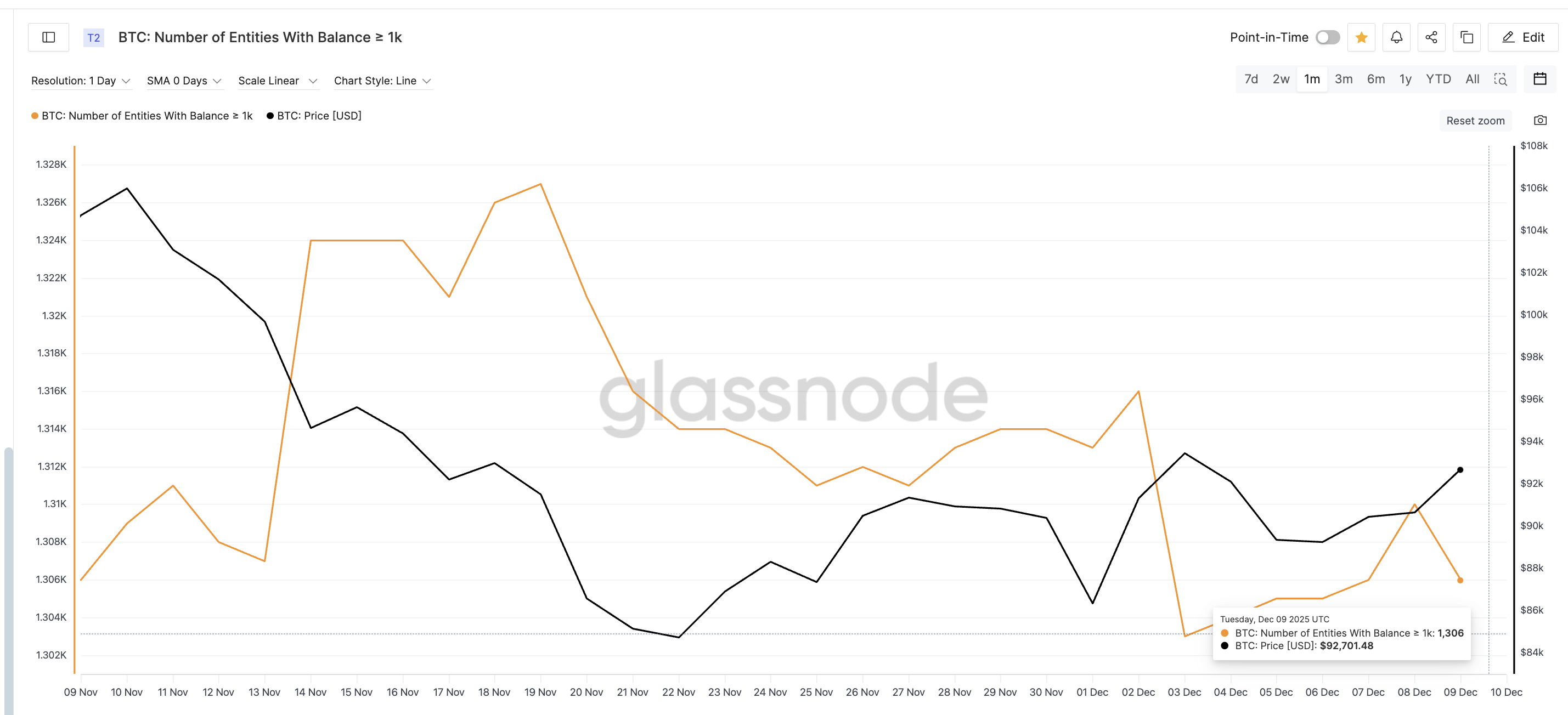

The location of the whale is the second issue.

Entities holding at least 1,000 BTC have been decreasing their count since November 19th. The index dropped to a monthly low of 1,303 bits on December 3rd and remains close to that level. This weakens any attempts to push through the resistance, as groups that see a major breakout are usually still cautious.

A similar setup occurred between December 2nd and December 3rd.

The price of Bitcoin reached $93,400, but the number of whales decreased from 1,316 to 1,303. Shortly after, the price corrected to $89,300, down about 4.4%.

Large holders are still far away: Glassnode

When prices rise and whales reduce their exposure, momentum often wanes as large buyers do not support the move.

These two issues, the $93,700 wall and the hesitant whale, explain why BTC price breakouts keep failing. However, neither problem is structural, so both can be fixed if circumstances change.

Correctable Path: Short Squeeze Setting Could Help Bitcoin Price Breakout

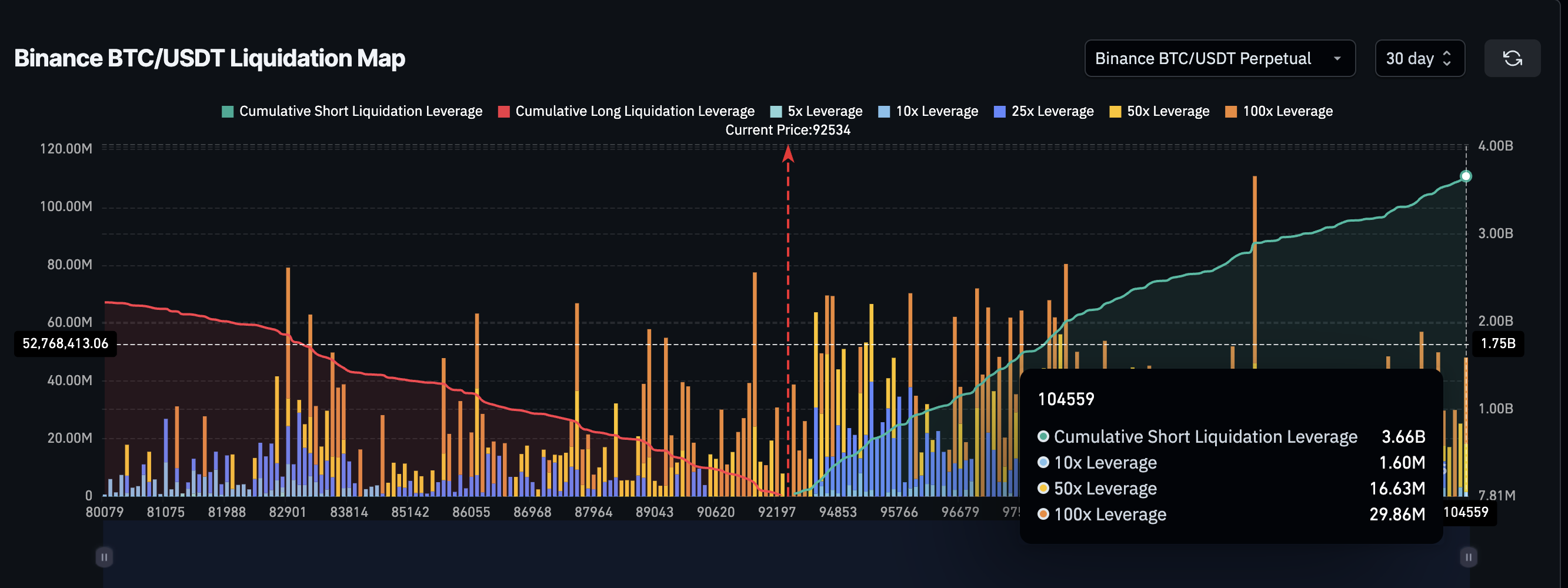

The second half of the story is more optimistic. Even without whale support, Bitcoin still has a strong short squeeze setup that can force a breakout.

On Binance, short-term liquidation leverage has remained close to $3.66 billion over the past 30 days, while long-term liquidation leverage is $2.22 billion. Shorts are up almost 50%, creating pressure that could quickly unwind if Bitcoin price rises above $93,700 again.

Short squeeze setup ready: Coinglass

This mechanism has already appeared several times this month.

The small price movement of 1-2% turned into a strong rebound as short positions were unwound.

BREAKING: Bitcoin just broke above $94,400 and is currently up $4,400 in the past two hours.

ETH also regained $3,350.

The crypto market added $156 billion in the past four hours, while $254 million worth of short sales were liquidated at the same time.

This is a massive short squeeze. pic.twitter.com/jvPvcc98ZA

— Bull Theory (@Bull Theoryio) December 9, 2025

If Bitcoin can cleanly close the day above $93,700, this squeeze could build enough strength to break through the next major barrier at $94,600. At that point, the whales may no longer need to trigger migration. Momentum alone can drive prices higher. And once that momentum arrives, whales may become more convinced to participate.

Above $93,700 and $94,600, a breakout path opens towards $105,200. Clearing this area would allow Bitcoin to rise approximately 15.7% from the neckline and reach the full measurement target of $108,500.

Bitcoin Price Analysis: TradingView

The inverted head and shoulders pattern remains valid above $83,800. A decline below $80,500 invalidates the structure and increases the risk of a deeper pullback if the whales continue to reduce their balances.

As of now, the overall picture is as follows. Two reasons are holding back a breakout: resistance lines and whale caution, but both are still capable of correction if buyers break above $93,700 or a short squeeze takes over.

The post Bitcoin’s Breakout to $108,500 Keeps Failing for Two Reasons—Both Can Be Fixed? appeared first on BeInCrypto.