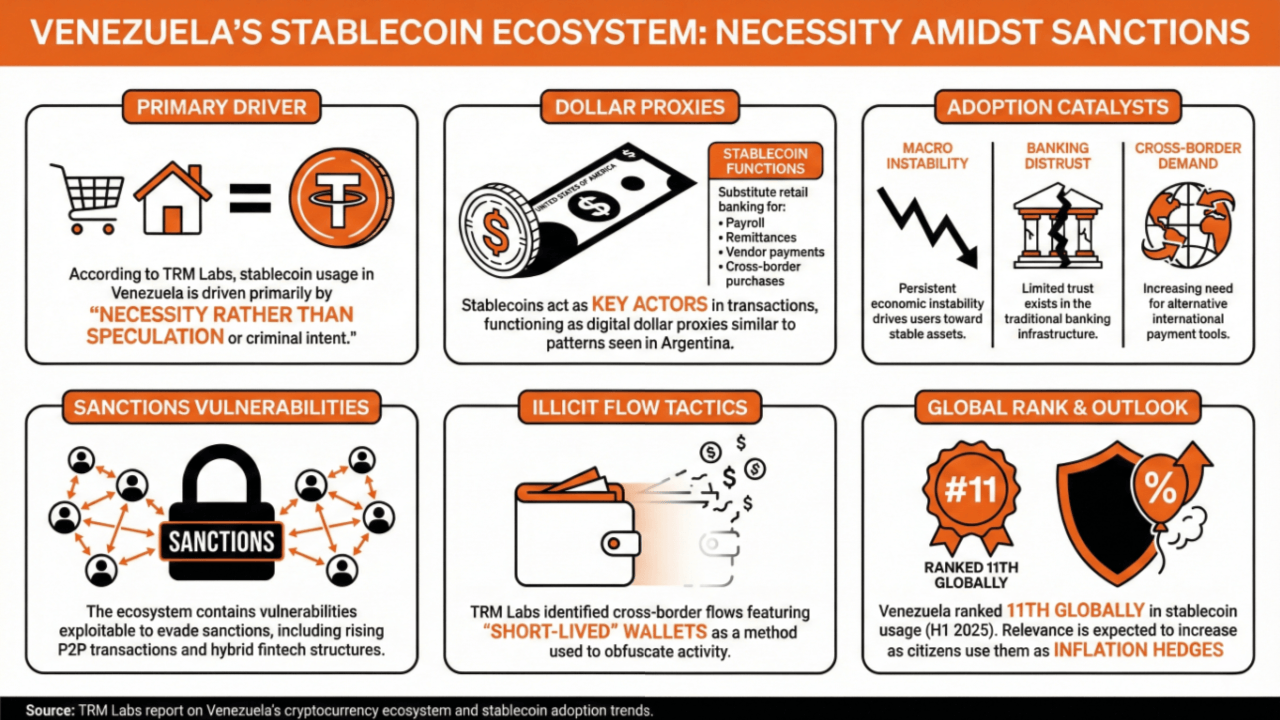

In a recent report, TRM Labs argued that organic adoption is dominating trading volumes, as stablecoins have become a key driver for Venezuelans to overcome economic instability and exclusion from traditional global payment and settlement platforms, even in an ecosystem with structural risks.

TRM Institute: Venezuela’s organic cryptocurrency adoption outweighs illegal activities

TRM Labs, a global blockchain forensics and analysis company, discussed the current state of Venezuela's cryptocurrency ecosystem in the context of tightening sanctions.

In a recent article, the company acknowledged that despite renewed global compliance concerns, the use of stablecoins remains primarily driven by “necessity rather than speculation or criminal intent.”

The TRM Institute found that the adoption of stablecoins in Venezuela follows a similar pattern to that observed in countries such as Argentina, where they play an important role in both household and commercial transactions as agents for the dollar.

For the company, three factors are driving stablecoin adoption in the current Venezuelan economic climate: continued macroeconomic instability, limited trust in traditional banking infrastructure, and growing demand for alternative cross-border payment tools.

TRM Institute says:

Stablecoins currently serve as an alternative to retail banking, facilitating payroll, family remittances, vendor payments, and cross-border purchases even in the absence of consistent domestic financial services.

Nevertheless, TRM Labs also identified several vulnerabilities within the Venezuelan ecosystem that could be exploited to circumvent unilateral sanctions. These include the growing popularity of P2P (peer-to-peer) transactions, the use of hybrid fintech structures that combine banking services with blockchain wallets, and the existence of cross-border flows featuring “short-lived” wallets.

The TRM Institute's report comes in the wake of the US government's recent seizure of a tanker carrying Venezuelan oil, an act deemed “piracy” by Venezuelan authorities.

Previous reports have linked the sale of Venezuelan oil to third parties to stablecoin transactions, but no official statement has been made and the company has neither confirmed nor denied these allegations.

Finally, TRM Labs concludes that if nothing changes, the relevance of stablecoins in Venezuela is expected to continue to grow as the general public continues to rely on these tools as a hedge against inflation and currency devaluation.

The company's proprietary Stablecoin Cryptocurrency Adoption Report ranked Venezuela as the 11th country with the highest stablecoin usage in the first half of 2025.

read more: The Economist: Utilizing USDT to settle Venezuelan oil sales

FAQ

What insights has TRM Labs recently provided regarding the use of cryptocurrencies in Venezuela?

TRM Labs emphasized that the use of stablecoins in Venezuela is mainly driven by the need due to tightening sanctions and economic instability.What patterns have you observed in stablecoin adoption?

The adoption of stablecoins in Venezuela mirrors trends in Argentina, where they serve as a proxy for the dollar in both household and commercial transactions.What factors are driving the use of stablecoins in Venezuela?

There are three main factors: macroeconomic instabilitylack of trust in traditional banking, and growing demand for alternative cross-border payment methods.What trends do you foresee for Venezuelan stablecoins in the future?

TRM Labs expects stablecoins to become increasingly important as Venezuelans continue to rely on these digital assets to protect against inflation and currency devaluation.