Japan's interest rate hike on December 19th threatens global liquidity, and the Bitcoin price is expected to fall below $70,000.

Historically, past Bank of Japan interest rate hikes have caused Bitcoin to fall by 23% to 31%, but analysts expect it to fall by 28% this time.

Bitcoin is trading near $90,000, already down 30% from its peak as market sentiment weakens further.

Bitcoin, already struggling to regain momentum near $100,000, is facing immense pressure as the Bank of Japan (BOJ) prepares for a key interest rate decision.

In the past, BTC prices have fallen by 25% whenever the Bank of Japan has raised interest rates, but with further rate hikes expected, top crypto experts are warning that BTC could fall by nearly 28% and fall towards $70,000.

Here's what's coming:

Japan to raise interest rates by 25bps

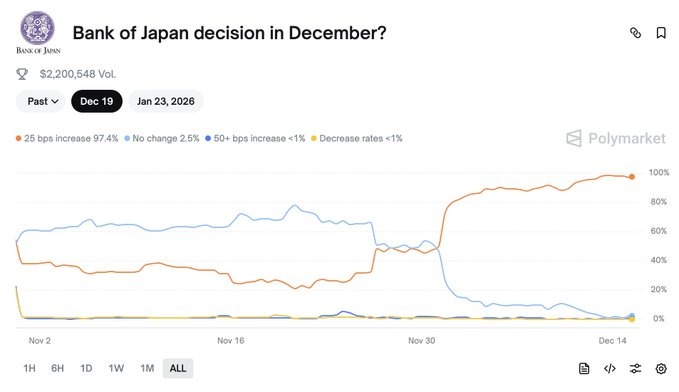

On December 19th, the Bank of Japan will hold an important policy meeting that is widely expected to raise interest rates by 25 basis points. Even prediction platform Polymarket currently puts the probability of a rate hike on December 19th at 98%.

Some experts believe policy could become even stronger, with expectations that the Bank of Japan could raise interest rates by as much as 75 basis points (bp).

Although it may seem like a local decision, Japan plays an important role in global finance. The country holds more than $1.1 trillion in U.S. debt, making it the largest foreign holder.

When Japan changes interest rates, it impacts global money flows, bond yields, and risk assets such as stocks and cryptocurrencies.

Bitcoin price drops to $70,000

History shows a clear pattern. Every time Japan raised interest rates, Bitcoin fell immediately after.

- In March 2024, when interest rates were raised, Bitcoin fell by about 23%.

- Similarly, Bitcoin fell by about 26% in July when the 2024 interest rate hike was announced.

- And in January 2025, when interest rates were raised this year, Bitcoin fell by about 31%.

If this trend repeats, top cryptocurrency analyst Marlin the Trader warns that Bitcoin could fall another 20-30%, pushing the price below $70,000 after December 19th.

The Bank of Japan may be Bitcoin's biggest enemy

Japan holds the most US government bonds.

Every time they hike, Bitcoin bleeds.March 2024: -23%

July 2024: -30%

January 2025: -31%Next hike: December 19th

Next move: Loading…If this pattern repeats, $70,000 is at stake. pic.twitter.com/R5916R702I

— Merlijn The Trader (@MerlijnTrader) December 14, 2025

Rising Japanese government bond yields add fuel to the fire

This time, the pressure on the crypto market is not only due to the possibility of interest rate hikes, but also from the rise in Japanese government bond yields, which recently reached 2.94%, the highest since 1998.

For years, traders have been borrowing cheap Japanese yen to invest in high-yield assets such as cryptocurrencies. Now, as Japanese government bond yields rise, this strategy is becoming more expensive. Traders are closing positions, which leads to selling, liquidations, and sudden market declines.

As a result, Japanese investors may start moving their funds home. Some models suggest as much as $500 billion could leave global markets over the next 18 months, potentially raising U.S. borrowing costs even without a Fed rate hike.

The virtual currency market is already struggling

Bitcoin is currently trading near $90,000, down nearly 30% from its recent high of around $126,000. The overall cryptocurrency market is also struggling, with the total market value decreasing from $4.1 trillion to about $3.05 trillion.

Major altcoins like XRP, Solana, and Cardano are all down 40% from their October highs. Some meme coins have even seen declines of 60% to 70%.