Written by Francisco Rodriguez (all times Eastern Time unless otherwise noted)

Bitcoin BTC$88,032.18 It remained above $88,000 after the Bank of Japan raised interest rates to the highest level in nearly 30 years, a move that was expected to strengthen the yen and make carry trades less attractive.

Instead, the currency weakened on concerns that rising interest rates would jeopardize the spending plans of Prime Minister Sanae Takaichi, who took office in October. The yield on 10-year Japanese government bonds has exceeded 2% for the first time since 2006.

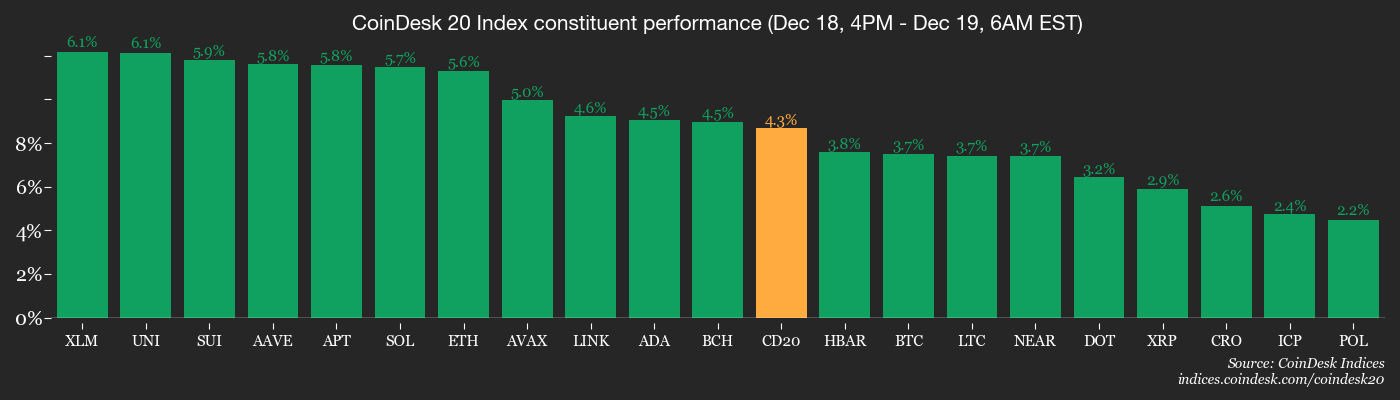

Other cryptocurrencies have also made progress. ether Ethereum$2,958.35 It gained 3.4% in the past 24 hours, while major altcoins including BNB and SOL rose less than 1%. The broader CoinDesk 20 (CD20) index rose 1.3%.

The reason for this is that the US inflation data released yesterday was lower than expected. The report raises the possibility that the U.S. Federal Reserve will cut interest rates in the future, which could be a boon for risky assets, but prediction markets still overwhelmingly believe there won't be a rate cut next month.

Additionally, risk assets still face potential unwinding of AI trading.

“While capital continues to flow aggressively into AI infrastructure, monetization issues can no longer be ignored,” QCP Capital analysts wrote. “While major companies such as Oracle and Iren have increased capital spending, AI-related revenues have remained relatively flat.”

Analysts said valuations of risk assets could plummet if returns are not realized. Some crypto companies, particularly Bitcoin miners, are starting to pivot to AI infrastructure for multi-billion dollar transactions.

Regulatory developments are also supporting market development.

“The US is poised to solidify the regulatory structure of the GENIUS Act in 2026,” Ira Auerbach, head of Tandem at Offchain Labs and former head of digital assets at Nasdaq, told CoinDesk. “Stablecoin issuers that previously relied on offshore regimes will gain significant advantages by bringing their reserves and operations back to U.S. soil.”

Auerbach also said some retirement plan providers are preparing to test balanced funds with target dates and crypto exposures of 0.5% to 1%, which could create stable demand that is less tied to market cycles.

“Treat digital assets not as a variable, but as another risk element in a long-term portfolio construction, and that's when structural demand starts to build,” Auerbach added. Be alert!

More information: For an analysis of today's activity in altcoins and derivatives, see Crypto Markets Today.

what to see

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- cryptography

- December 19: ADR sponsored by Metaplanet Inc. begins trading over-the-counter in the US under the ticker MPJPY. These replace existing unsponsored OTC trading based on the MTPLF ticker.

- macro

- December 19th 10am: December (final) University of Michigan survey. Consumer sentiment index estimate 53.4; inflation expectations forecast 4.1%.

- revenue (estimated based on FactSet data)

token event

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- Lido DAO is voting on an innovative package that will transform it from a pure staking protocol to a diverse suite of DeFi products over the next three years. Voting ends on December 19th.

- The CoW DAO is voting to dissolve the Sprinter Solver Bonding Pool and return the 500,000 USDC and 1.5 million COW deposited to the original funders. Voting ends on December 19th.

- Arbitrum DAO has voted to enable the ArbOS 51 upgrade, which introduces a 32 million transaction gas limit, dynamic gas goals, and a 2x minimum base price to enhance network scalability. Voting ends on December 19th.

- December 19: Avantis hosts League of Leverage discussion.

- unlock

- December 20th: ZRO$1.3127 Releases 6.79% of circulating supply worth $37.28 million.

- Activate token

- December 19: ZkPass (ZKP) is scheduled to be listed on Binance, MEXC, Bybit, BingX, etc.

conference

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

market movements

- BTC is up 2.91% since Wednesday at 4pm ET to $88,092.82 (24h: +0.73%).

- ETH rose 6.82% to $2,969 (24 hours: -3.87%)

- CoinDesk 20 rose 3.33% to 2,707.79 (24 hours: +1.22%)

- Ether CESR overall staking interest rate decreased by 1bp to 2.86%

- BTC funding rate is 0.01% on Binance (10.95% p.a.)

- DXY rose 0.23% to 98.65.

- Gold futures unchanged at $4,360.50

- Silver futures rose 1.73% to $66.35.

- The Nikkei 225 rose 1.03% to close at 49,507.21.

- The Hang Seng rose 0.75% to close at 25,690.53.

- FTSE fell 0.10% to 9,828.28.

- Euro Stoxx 50 was unchanged at 5,745.04.

- DJIA closed 0.14% higher at 47,951.85.

- The S&P 500 index rose 0.79% to close at 6,774.76.

- The Nasdaq Composite Index rose 1.38% to end at 23,006.36.

- The S&P/TSX Composite rose 0.61% to end at 31,440.85.

- The S&P 40 Latin America Index rose 1.15% to end at 3,093.49.

- The US 10-year Treasury rate rose 2.9bps to 4.145%.

- E-mini S&P 500 futures rose 0.27% to 6,849.00

- E-mini Nasdaq 100 futures rose 0.4% to 25,363.25.

- E-mini Dow Jones Industrial Average futures unchanged at 48,356.00

bitcoin statistics

- BTC Dominance: 59.94% (+0.13%)

- Ether/Bitcoin ratio: 0.03347 (1.19%)

- Hashrate (7-day moving average): 1,031 EH/s

- Hash Price (Spot): $37.57

- Total fees: 2.74 BTC / $237,800

- CME futures open interest: 120,865 BTC

- BTC Gold Price: 20.3oz

- BTC vs. Gold Market Cap: 5.9%

technical analysis

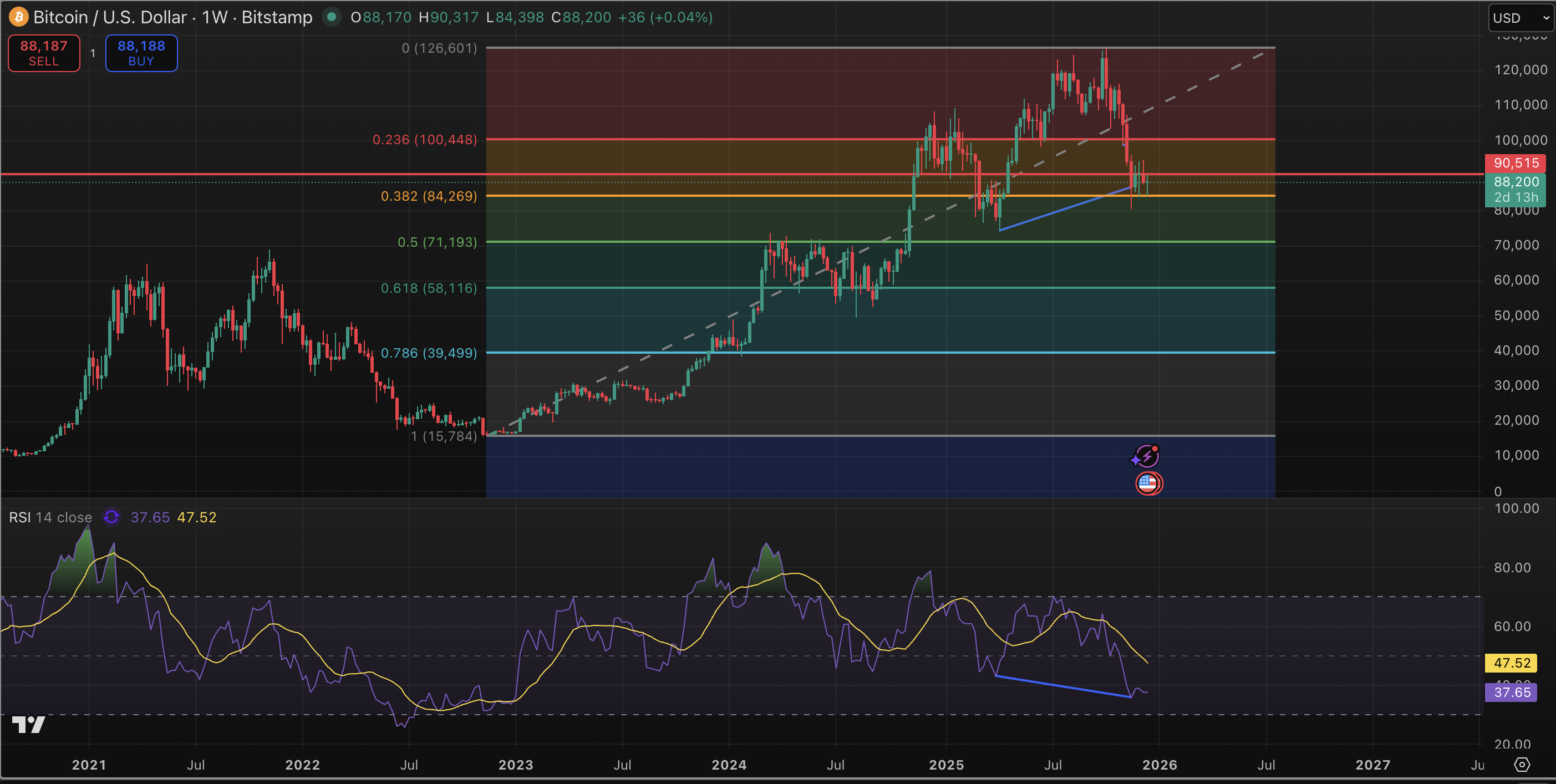

- BTC/USD is currently wedged between weekly support at $84,200 and resistance at $90,500. Although the 0.382 Fibonacci level is on the lower side at $84,200, the current price movement is above it, supported by a clear bullish RSI divergence that is gaining momentum despite price consolidation.

- A decisive weekly close above $90,500 is likely to confirm this divergence and trigger a trend continuation towards the 0.236 Fibonacci target of $100,400.

crypto assets

- Coinbase Global (COIN): Thursday close $239.20 (-2.04%), pre-market $246.94, +3.24%

- Circle (CRCL): $80.99 (+2.26%), +3.04% to end at $83.45

- Galaxy Digital (GLXY): $22.51 (-1.32%), +3.07% to end at $23.20.

- Bullish (BLSH): Closed at $42.88 (+1.73%), +1.28% $43.43

- MARA Holdings (MARA): $9.69 (-2.42%), +2.68% to close at $9.95

- Riot Platform (RIOT): $13.38 (+3.24%), +3.21% to close at $13.81.

- Core Scientific (CORZ): $14.56 (+7.3%), +3.71% to end at $15.10

- CleanSpark (CLSK): $11.20 (-2.44%), +3.66% to end at $11.61

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Ended at $37.49 (+2.68%)

- Exodus Movement (EXOD): Closed at $15.21 (+4.61%)

crypto asset company

- Strategy (MSTR): $158.24 (-1.33%), +3.71% to end at $164.11

- Semler Scientific (SMLR): Ended at $17.11 (+1.06%)

- SharpLink Gaming (SBET): $9.02 (-2.7%), +5.1% to end at $9.48

- Upexi (UPXI): Closed at $1.88 (+0.53%)

- Light Strategy (LITS): Closed at $1.35 (-1.46%)

ETF flow

Spot BTC ETF

- Daily net flow: -$161.3 million

- Cumulative net flow: $57.55 billion

- Total BTC holdings ~1.31 million

Spot ETH ETF

- Net flow per day: -$96.6 million

- Cumulative net flow: $12.54 billion

- Total ETH holdings approximately 6.15 million

Source: Farside Investors

while you were sleeping

- Coinbase files lawsuit in three states over attempts to regulate prediction markets (CoinDesk): The cryptocurrency exchange is pursuing legal action against Connecticut, Michigan, and Illinois, Chief Legal Officer Paul Grewal told X.

- Japan raises interest rates to 30-year high (New York Times): The 25 basis point hike reflects concerns about inflation and a weak yen, while raising questions about how rising borrowing costs will affect Prime Minister Sanae Takaichi's massive government spending plans.

- Jump Accused of Contributing to the Collapse of Do Kwon's Cryptocurrency Empire, Terraform (Wall Street Journal): A bankruptcy court appointee is seeking $4 billion from a trading company and two executives, alleging they enriched insiders while accumulating losses related to failed projects.