important notes

- THETA has fallen to its 2020 price range despite multiple crypto rallies passing through.

- On the long-term chart, THETA has fallen more than 97% from ATH and has repeatedly made new highs.

- The whistleblower lawsuit alleges price inflation and misleading partnerships by insiders.

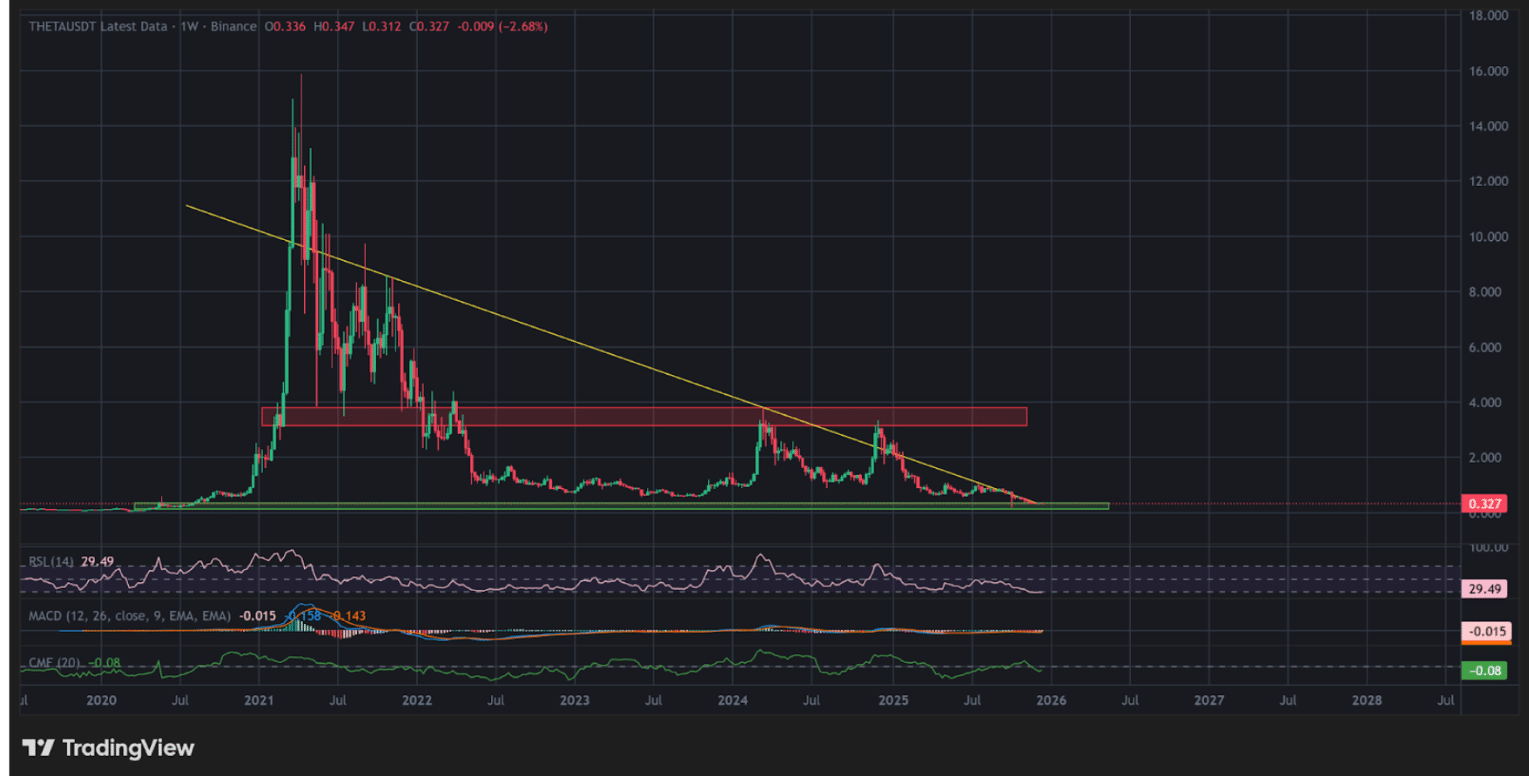

THETA has returned to price levels last seen in 2020 after erasing gains from multiple bull market rallies along the way. The long-term weekly chart shows a clear distribution structure, with each recovery attempt limited by a downtrend line extending from the 2021 peak.

Despite a brief rally from late 2020 to early 2022, THETA continues to trade at $0.3278, down 97.95% from its all-time high of over $15, according to CoinMarketCap. The altcoin has fallen by a massive 21% in the past 30 days.

The weekly chart of THETA below resembles a typical post-bubble easing period. The 2021 peak is the high of the cycle, and the rebound has become increasingly weak in subsequent years. Each pullback was capped earlier than the previous one, and support was gradually eroded until the price returned to its original cumulative range.

THETA has a long-term downward trend | Source: TradingView

Related article: Do Kwon case: Prosecutors set conditions for Korean trial

The failure to make further lows during the market's strong recovery indicates that the previous rally was primarily sentiment-driven. The charts do not support large capital allocations unless long-term resistance is decisively broken and volumes expand significantly.

Whistleblower lawsuit casts shadow over Theta Institute

THETA's price could fall further due to two whistleblower lawsuits filed in California by former Theta Labs senior executives Jerry Kowal and Andrea Berry. The complaint alleges that the company and its management engaged in deceptive conduct over the years related to the THETA token and related NFT activity.

Bloomberg reported that the filing cited internal concerns about token sales, disclosure practices and governance that allegedly resulted in retaliation rather than reform.

The lawsuit describes a pattern in which insiders allegedly reduced their exposure during periods of high trading volume, while token-related announcements and promotional activities were used to support price increases.

Former Theta Lab executives file whistleblower lawsuit

Two former senior Theta Labs executives have filed a whistleblower lawsuit in California accusing the company and CEO Mitch Liu of years of deception, market manipulation, and retaliation, according to @DecryptMedia.

— ME (@MetaEraHK) December 17, 2025

Former employees claim they witnessed repeated efforts to increase demand for THETA. Although this suspicion has not yet been proven, the token's price performance lends further legitimacy to Kowal and Berry's statements.

Celebrity Marketing and Disputed Partnerships

The lawsuit focuses on the use of high-profile marketing to attract liquidity. Promotional activities associated with celebrities such as Katy Perry are said to have served to foster speculative interest rather than natural recruitment.

The complaint also alleges that certain NFT-related activities have created an artificial appearance of demand through internal or coordinated actions. The relationship between Theta and Google is also being discussed.

The lawsuit alleges that a standard cloud services agreement was publicly framed as a strategic partnership, giving the impression of approval and validation where none existed.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.