Ethereum was hovering around $2,977 as traders tracked large movements in Binance’s staking wallets, repeated support retests, and rising liquidation pressure above the spot. These charts constitute a market watching to see if ETH can sustain a key level and challenge nearby resistance.

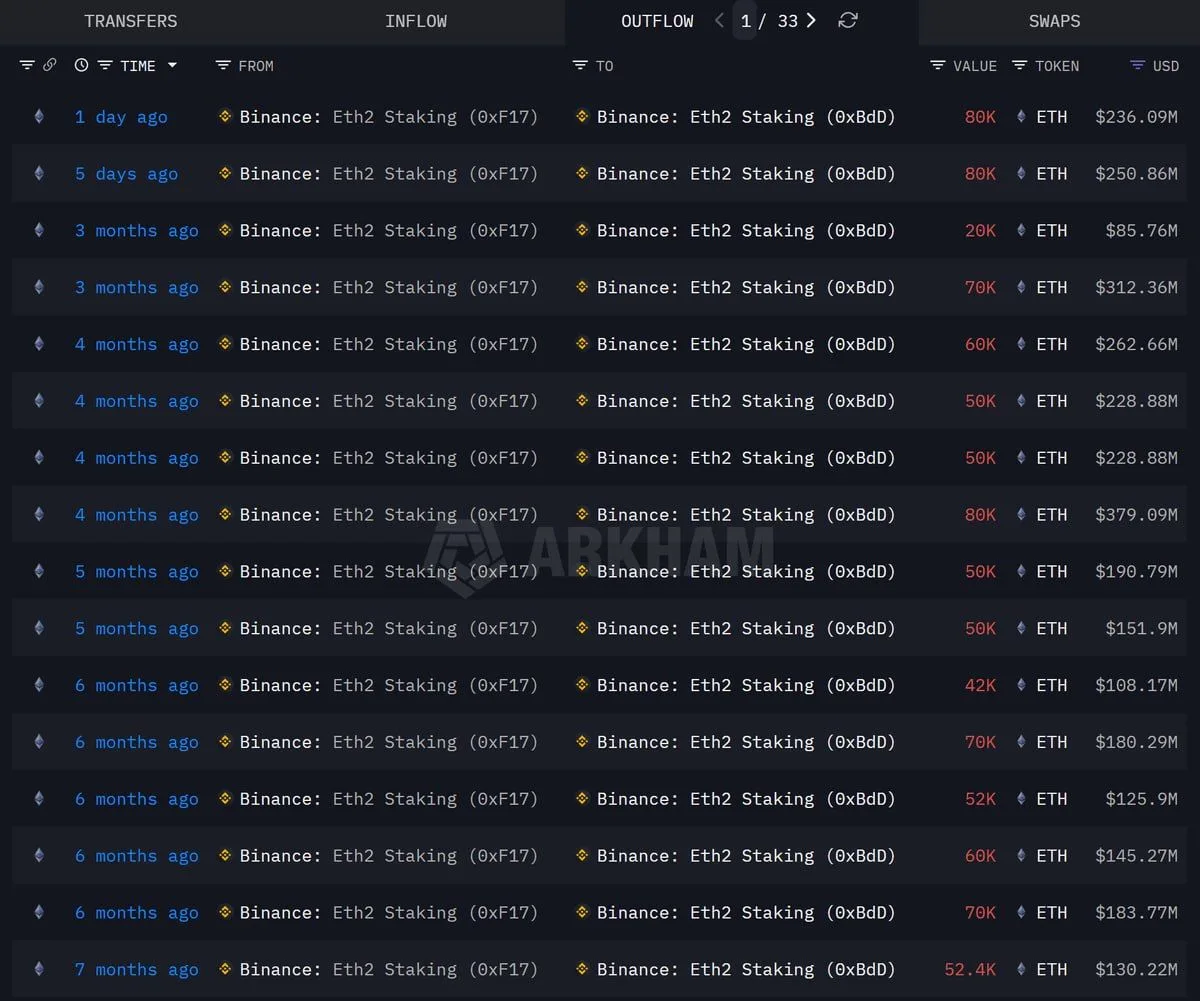

Arkham data shows massive ETH movement between Binance staking wallets

Arkham's remittance page shows multiple large Ethereum leaks between two wallets labeled Binance: “Binance: Eth2 Staking (0xF17)” and “Binance: Eth2 Staking (0xBdD).” The log includes a recent transfer of 80,000 ETH marked “1 day ago” and another 80,000 ETH transfer marked “5 days ago,” as well as older transfers such as 20,000 ETH and 70,000 ETH from about 3 months ago. Entries show estimated amounts in the hundreds of millions of US dollars for some transfers.

Binance ETH staking transfer. sauce: Arkham/X

A social media post that went viral with the screenshot claimed that Binance “sted $500 million worth of ETH this week,” calling the activity “bullish for Ethereum.” However, the screenshot itself does not prove new staking demand from external users or net new ETH inflow into Binance Staking, as it shows wallet-to-wallet movement between labeled addresses on Binance Staking.

The same post also included a blurb asking readers to remember to “delete your Sol wallet address.” On the other hand, the on-chain view shown in the image focuses on Ethereum transfers and does not mention the Solana wallet or how the rewards work.

Ethereum trades near $2,977 as analysts track support hold

meanwhile, Ethereum According to a TradingView screenshot shared by DonnieBTC on X, ETH USDT traded around $2,977 on the 2-hour Binance chart after breaking above the highlighted support zone.

The chart shows that ETH has recovered from its sharp mid-week decline and has since revisited the same price range several times. Also, several shaded bands above current levels indicate nearby resistance areas on the chart, although price action remains limited by a downtrend line connecting previous highs.

Retesting the Ethereum support zone. sauce: TradingView/X

DonnieBTC writes that Ethereum has returned above the highlight zone “the last few times.” He added that he is keeping an eye on whether ETH can reclaim and hold this area, and the outlook will improve if the price can sustain above that band.

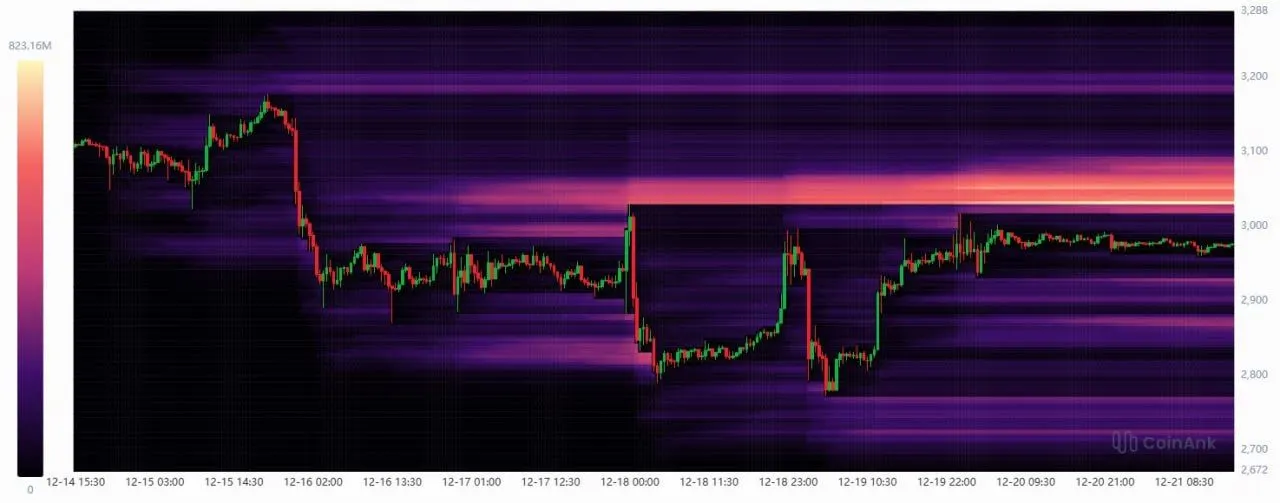

Liquidation heatmap highlights dense levels above ETH price

A CoinAnk liquidation heatmap shared by X user CW shows a large concentration of potential liquidation levels beyond Ethereum's recent trading range, as ETH has moved from the low $3,100s to the $2,700s over the past week before stabilizing around $2,900 to $3,000.

Ethereum liquidation heatmap. sauce: coin ankh

On the chart, the brightest horizontal band is currently above the price, centered around the low $3,000s. This type of heatmap typically marks larger pools of leveraged positions in brighter colors, as liquidations tend to occur near common leverage entry points or stop levels, and can be forced to close if price trades into that zone.

CW describes it as a “highly leveraged short position.” Ethereum It will be cleared soon. ” Liquidations will only occur if the price moves to those levels, so the heatmap shows where pressure may occur and does not guarantee that ETH will reach those levels.