Bitcoin BTC$87,996.38 Bulls are struggling to break a pattern of consistent selling pressure during US hours on Friday.

BTC, which fell below $85,000 late Thursday afternoon, rose again after US markets closed and rose above the $89,000 level it started on Friday morning. However, this level has largely suppressed any breakout attempts throughout the week, with sellers pushing prices back to square one, sometimes within minutes, sometimes over hours.

The largest cryptocurrency is currently fairly stable ahead of the holiday weekend, trading at $88,400, up 0.3% in the past 24 hours.

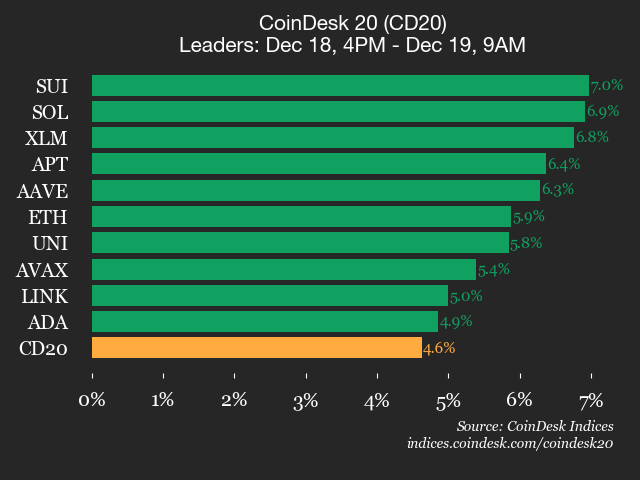

ether Ethereum$2,966.64 Solana’s SOL has risen 1% over the past day, rebounding to just below $3,000. sol$125.34 and Sui$1.4315 Leading the overnight rally in altcoins.

CoinDesk 20 performance from Thursday's US stock market close. (coin desk)

The US stock market is trading solidly again, led by a 1% rise in the Nasdaq, with AI leaders Nvidia, Oracle, and AMD up 3% to 6%.

Read more: AI mining stocks rise on Oracle TikTok deal

Digital asset stocks also followed the rally. Ethereum treasury firm Bitmine (BMNR) rose about 8%, while Galaxy Digital (GLXY) and stablecoin issuer Circle (CRCL) rose about 3% each.

Strategy (MSTR), the largest corporate BTC holder, also rallied more than 3%, pushing its net asset value (mNAV) to 1.09.

Meanwhile, Bit Digital (BTBT) rose 10% on news related to White Fiber (WYFI), which signed a 10-year, 40MW colocation agreement with Nscale worth approximately $865 million. BitDigial owns approximately 70% of WhiteFibre (BitDigial itself owns more than 11%), amplifying its positive impact on BTBT stock.