Ethereum sent mixed signals after US spot ETFs recorded net outflows of $96.6 million led by BlackRock selling. At the same time, open interest increased, with Binance data showing heavy bids pending between $2,700 and $2,800.

Ethereum ETF records $96.6 million in daily outflows as BlackRock leads selling

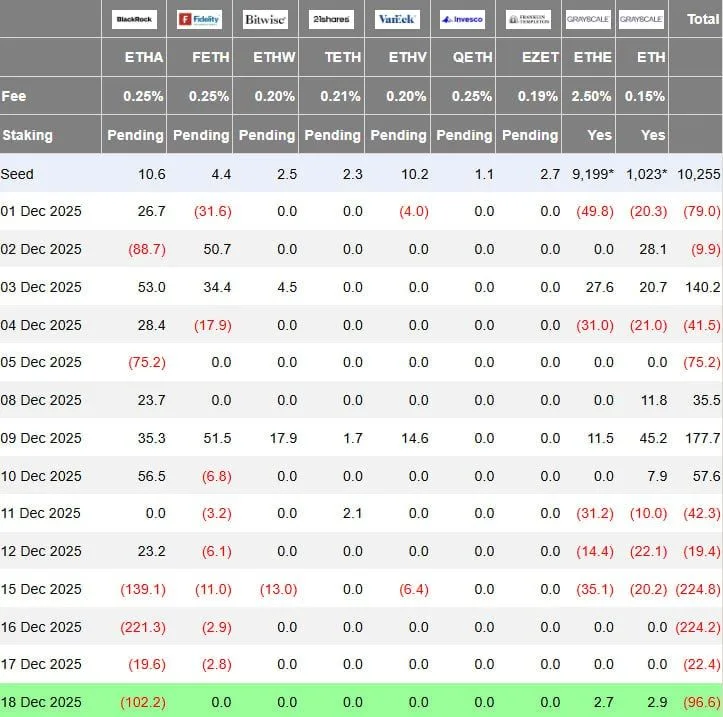

The US Spot Ethereum exchange-traded fund recorded a net outflow of $96.6 million in the latest trade, according to daily flow data shared by market analysts. The numbers point to broader weakness across the ETF complex, with redemptions outpacing new allocations for the day.

Ethereum ETF daily outflow table. sauce: Ted Pillows of X

BlackRock was the largest single move. Asset managers sold approximately $102.2 million worth of Ethereum from their ETF products, which was the main driver of overall net outflows. Other issuers had limited activity and were unable to offset the size of BlackRock's sale.

This data reflects that investor demand for Ethereum ETFs remained uneven in December. Although inflows were modest in some sessions at the beginning of the month, they have recently turned negative, indicating the cautious attitude of institutional investors as capital flows remain sensitive to broader market conditions and short-term price movements.

ETH price is lagging, but open interest is rising

meanwhile, Ethereum Derivatives data shows a clear disconnect between positioning and price. According to data from TradingView and Hyblock Capital, total open interest on major perpetual futures exchanges continued to rise, but ETH price failed to regain its all-time high near $3,000.

Discrepancy between Ethereum price and open interest. sauce: Highblock Capital, Martin on X

According to the chart, Ethereum is trading at around $2,950, while open interest has expanded to around $11.79 billion. This represents a notable increase compared to recent trading and indicates new leverage is entering the market, even though spot price momentum remains below resistance. Historically, increases in open interest without price follow-through often reflect crowded positioning rather than confirmation of trend continuation.

This setting suggests that the market is under increasing pressure. If open interest rises but prices remain range-bound or prices remain depressed, increased volatility may correct the imbalance. Traders typically closely monitor such situations, as once the price decisively breaks above resistance or pulls back toward a lower support zone, a continued move or forced unwinding may follow.

Ethereum order book shows heavy bid support around $2,700-$2,800

According to a graph shared by market analyst Ted Pillows, Binance order book data shows more than $150 million worth of buy orders piled up in Ethereum’s $2,700 to $2,800 range. The bid price is below the current trading zone around $2,950, creating a dense pocket of liquidity that could act as short-term downside support.

Ethereum Binance Order Book Bidwall is $2,700 to $2,800. sauce: ted pillows

The heatmap highlights sustained interest at these levels rather than individual orders. Multiple bidding layers appear to be spread across the zone, suggesting coordinated demand rather than short-term scalping activity. Such clustering often reflects institutional positioning and large players issuing limit orders well in advance of potential exits.

Price movements in recent session shows Ethereum The bidding wall remains in place, but it has rebounded after falling toward the high $2,800s. If the price falls back again, the stacked orders could delay or absorb the selling pressure. At the same time, concentrated bidding tends to define key decision areas in the market, and failure to maintain that zone is likely to force rapid liquidity shifts.