Cryptocurrency traders' concerns about the strategy center on how aggressively the company borrows money to buy Bitcoin each week. Over the years, the strategy has issued large amounts of convertible bonds and other loans to accumulate more BTC.

This strategy worked well during the bull market. But when prices fall, people become anxious. Cryptocurrency investors are concerned that the company could face pressure from debt burdens, rising interest rates and refinancing risks.

Since Bitcoin's all-time high in July, Strategy (MSTR) stock has plunged about 65%, from $456 to $158 per share, according to the data.

Saylor's BTC promotion puts strategy in trouble

Over time, Strategy's identity became increasingly tied to Bitcoin itself. Under Michael Saylor, the company has evolved into a more Bitcoin-centric entity rather than a traditional software business. Traders are concerned about whether core software revenues will be strong enough to support the company if Bitcoin enters an extended bear market.

If Bitcoin's price moves further, investors on X and Reddit often speculate about the worst-case scenario, such as having to sell Bitcoin or suffering losses for shareholders, but these things don't always happen.

The company also seems to be getting cold feet. As reported by Cryptopolitan, this week Strategy achieved its weekly funding round, but this time it put the money into US dollar reserves rather than Bitcoin. Strategy added $748 million to its reserves, bringing the total to $2.19 billion.

The decision to halt BTC purchases and raise USD reserves was intended to alleviate short-term refinancing and dividend stress. It also directly addresses concerns about forced sales of Bitcoin.

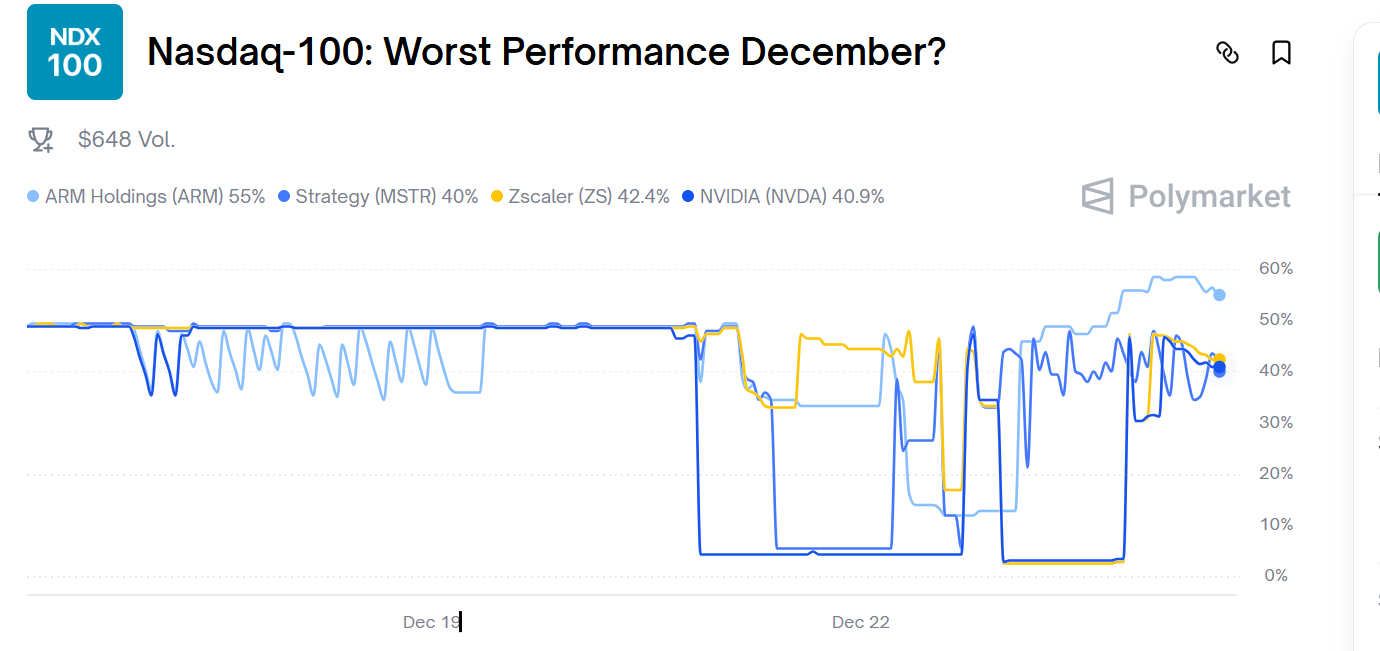

Odds of Strategy becomes the worst performing company on the Nasdaq 100. Source: Polymarket

The impending MSCI index decision has added to the anxiety. Recently, Polymarket showed that 61% of traders believe the strategy will be delisted from the MSCI index by March 31st. The company also ranks as the second worst performer on the Nasdaq 100.

Thaler argues that Bitcoin is a living network that can adapt as needed. If quantum computing becomes powerful enough to threaten current security methods, Bitcoin developers and users will respond by upgrading the network.

There is also growing mistrust in crypto and financial powerhouses, especially during the economic downturn of the past two and a half months. Thaler's influence is also declining. Some worry that Mr. Saylor's influence is leading others to take risks they don't fully understand.

Bitcoin investors increase long positions

Bitcoin remains stable, only down nearly 1% after a period of turbulent trading. The drop came after financial institutions withdrew $952 million from cryptocurrency funds. This includes $460 million in Bitcoin alone, due to concerns over regulatory delays and the possibility of more whale sales.

At the beginning of the week, $142 million was lost from Bitcoin ETFs. On the other hand, the market capitalization of Bitcoin ETF remains high at $114.99 billion. And the $111 million jump in Solana and XRP inflows shows that institutional investors are moving to other assets as Bitcoin prices fall.

On the other hand, long positions in perpetual futures are increasing. Open interest increased by 2% to 310,000 BTC (approximately $27 billion). The funding interest rate was 0.09%, the highest level in two weeks.