Ethereum has repeatedly failed to close above the $3,000 level and continues to struggle with a price recovery. ETH briefly attempted to rise, but then retreated due to selling pressure.

While price action remains frustrating for holders, the underlying network data points to strengthening fundamentals that could support a future recovery.

Ethereum holders stay

Ethereum leads all major cryptocurrencies in number of non-empty wallets. The network hosts over 167.9 million active addresses with balances. In comparison, there are approximately 57.62 million Bitcoins. Other top cap assets lag far behind both networks.

This advantage highlights Ethereum's wide user base and diverse use cases. Decentralized finance, NFTs, and smart contract activity will continue to drive engagement. Active participation reflects trust and plays an important role in maintaining demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum holder data. Source: Santiment

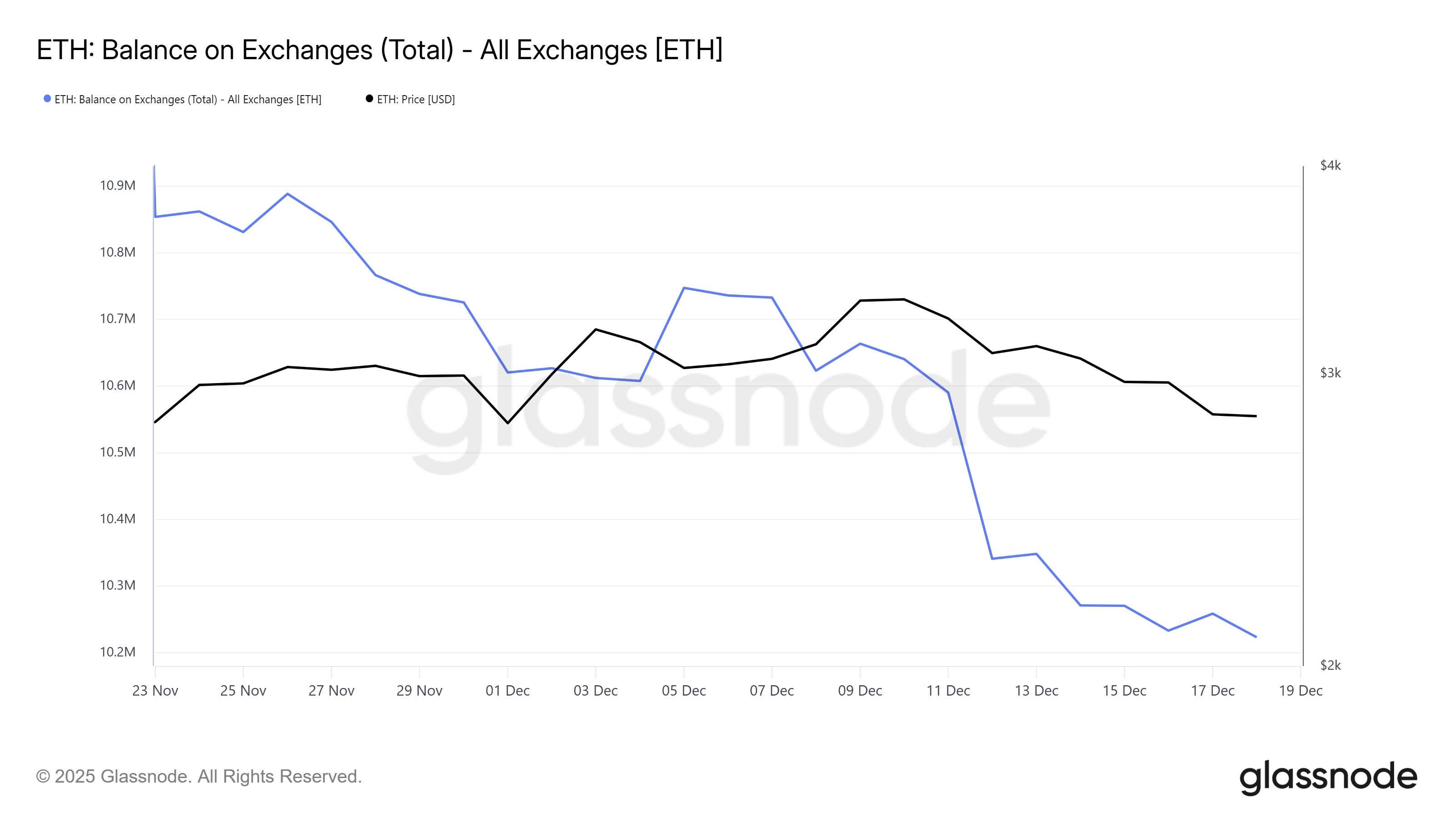

Macro indicators further support the constructive outlook. Ethereum balances on centralized exchanges have been steadily decreasing. Approximately 397,495 ETH has been withdrawn from exchanges since the beginning of the month, reducing sell-side supply for the time being.

These outflows suggest accumulation at current price levels. The value of ETH withdrawn was over $1.17 billion, demonstrating the confidence of long-term investors. Declining exchange balances often precede a decline in selling pressure, and stronger demand can support price recovery.

Ethereum balance on the exchange. Source: Glassnode

ETH price could break through an important barrier

Ethereum is trading around $2,946 at the time of writing, still below the psychological level of $3,000. The asset has consistently rebounded from the $2,762 support zone in recent weeks. This move shows that buyers are holding to lower standards despite widespread uncertainty.

If the supportive trend continues, ETH could attempt another breakout above $3,000. If this move is successful, it could pave the way to $3,131. If momentum continues, the rally could widen towards $3,287, suggesting improved confidence among both retail and institutional participants.

ETH price analysis. Source: TradingView

Risk remains if selling pressure increases. If the price falls below $2,762, the recovery momentum will weaken. Losing this support could send Ethereum heading toward the $2,681 level, marking a four-week low and invalidating the bullish thesis outlined by improving on-chain indicators.

The article Ethereum Outperforms Bitcoin Despite Price Stagnating Below $3,000 appeared first on BeInCrypto.