A potential initial public offering (IPO) by cryptocurrency exchange Kraken next year could attract fresh capital from traditional finance (TradFi) investors.

Bitcoin hit an all-time high of over $126,000 on October 6th, but has yet to recover from the $19 billion liquidation event that hit the industry a few days later. At the time of writing, the world's largest cryptocurrency was trading at $87,015 per coin, down 6% in two weeks, according to CoinGecko.

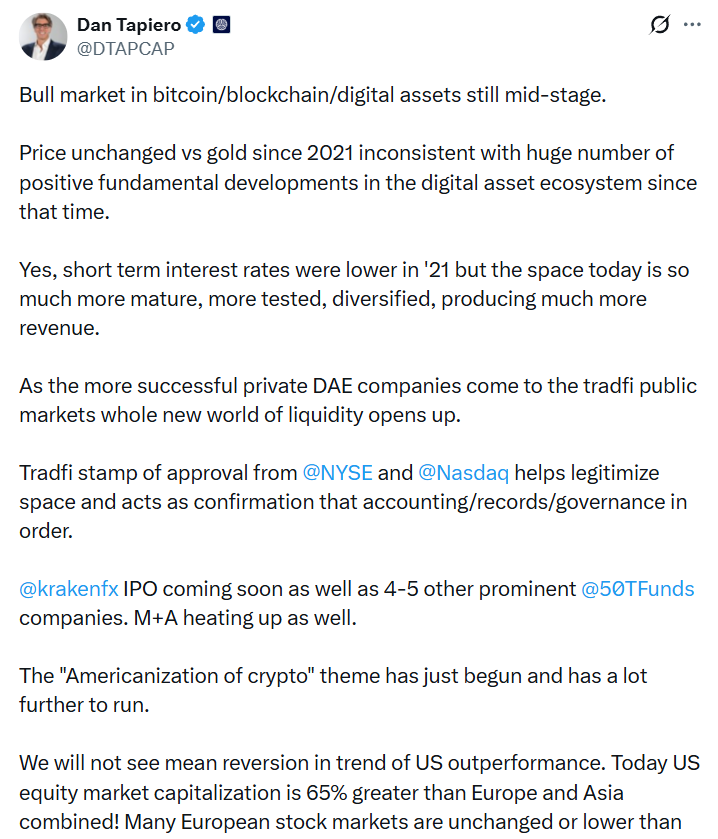

Still, Dan Tapiello, founder and CEO of 50T Funds, insisted that the Bitcoin (BTC) bull market is “still in the middle.” He added that Kraken's IPO and (M&A) growth could be the tailwind it needs to bring in fresh capital from TradFi.

Kraken has raised $800 million in funding to reach a $20 billion valuation, the exchange announced on Nov. 18. The company reportedly filed for an IPO in the US in early November.

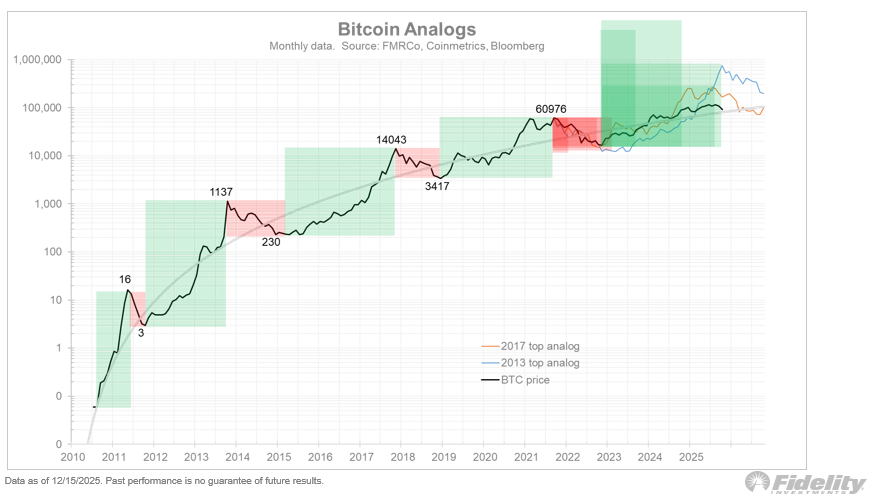

Not all analysts are convinced the bullish cycle will continue. Julian Timmer, director of global macroeconomic research at Fidelity, predicts a downturn for Bitcoin in 2026.

Source: Dan Tapiello

Related: Transparency Act Delays Led to $952 Million Cryptocurrency Fund Outflow: CoinShares

Crypto industry watchers are divided on whether the bull cycle will continue in 2026

Tapiello's prediction contrasts with that of Timmer, who predicts this year's decline could send Bitcoin to a bottom near $65,000.

“Bitcoin’s winter has lasted about a year, so my sense is that 2026 could be an ‘off year’ (or ‘off year’) for Bitcoin, with support at $65,000-$75,000,” Timmer wrote in a Thursday post.

Source: Julian wood

Jimmy Xue, co-founder and chief operating officer of Axis, an on-chain quantitative yield platform that manages $100 million in live capital, said Bitcoin's four-year cycle provided an “initial rhythm” but market movements are now being driven by more fundamental factors, such as global liquidity and continued sovereign adoption.

Xue told Cointelegraph that Fidelity’s exit request is “a fair warning that volatility is still on the table,” so “it’s not surprising to see institutional caution as we exit 2025.” He added:

“However, viewing 2026 as a purely downside year may be missing the forest for the trees.”

“If global liquidity continues to loosen, the $75,000 support could actually become a higher low within a longer-term supercycle structure,” he explained, adding that the four-year cycle is “evolving into a broader long-term trend” determined by macroeconomic forces.

Smart money traders hold top perpetual futures positions in Hyperliquid. Source: Nansen

The industry's most profitable traders, tracked as “smart money” traders on Nansen's blockchain intelligence platform, are also betting on a short-term market decline.

According to Nansen, smart money had a net shortfall in all top cryptocurrencies except Avalanche (AVAX) token and meme coin launchpad Pump.fun (PUMP) coin.

magazine: If the crypto bull market is ending… it's time to buy a Ferrari — Crypto Kid