Ethereum price has struggled to regain momentum, hovering around the $3,000 level in recent trading. This prolonged consolidation has weighed on prices and weakened short-term confidence among ETH holders.

Still, changes in on-chain signals and historical price behavior suggest that conditions may be forming for a potential rebound.

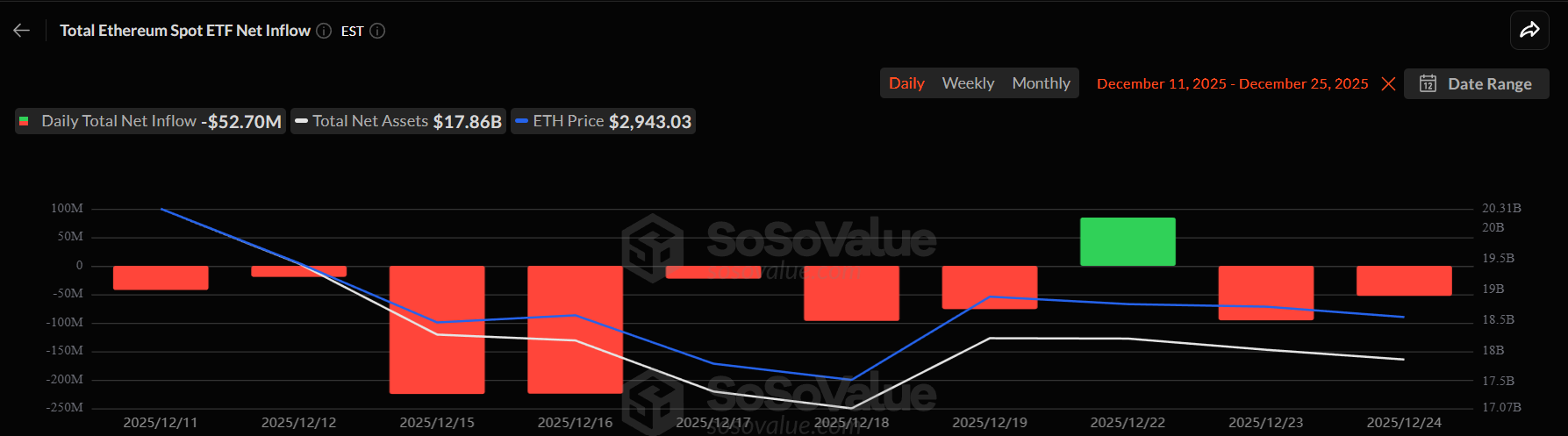

Ethereum ETF continues to lose money

Ethereum ETFs have been facing sustained pressure over the past two weeks. During this period, only one trading day recorded net inflows, primarily due to grayscale activity. Outside of that session, investors consistently withdrew funds from ETH ETFs, showing caution across traditional financial channels.

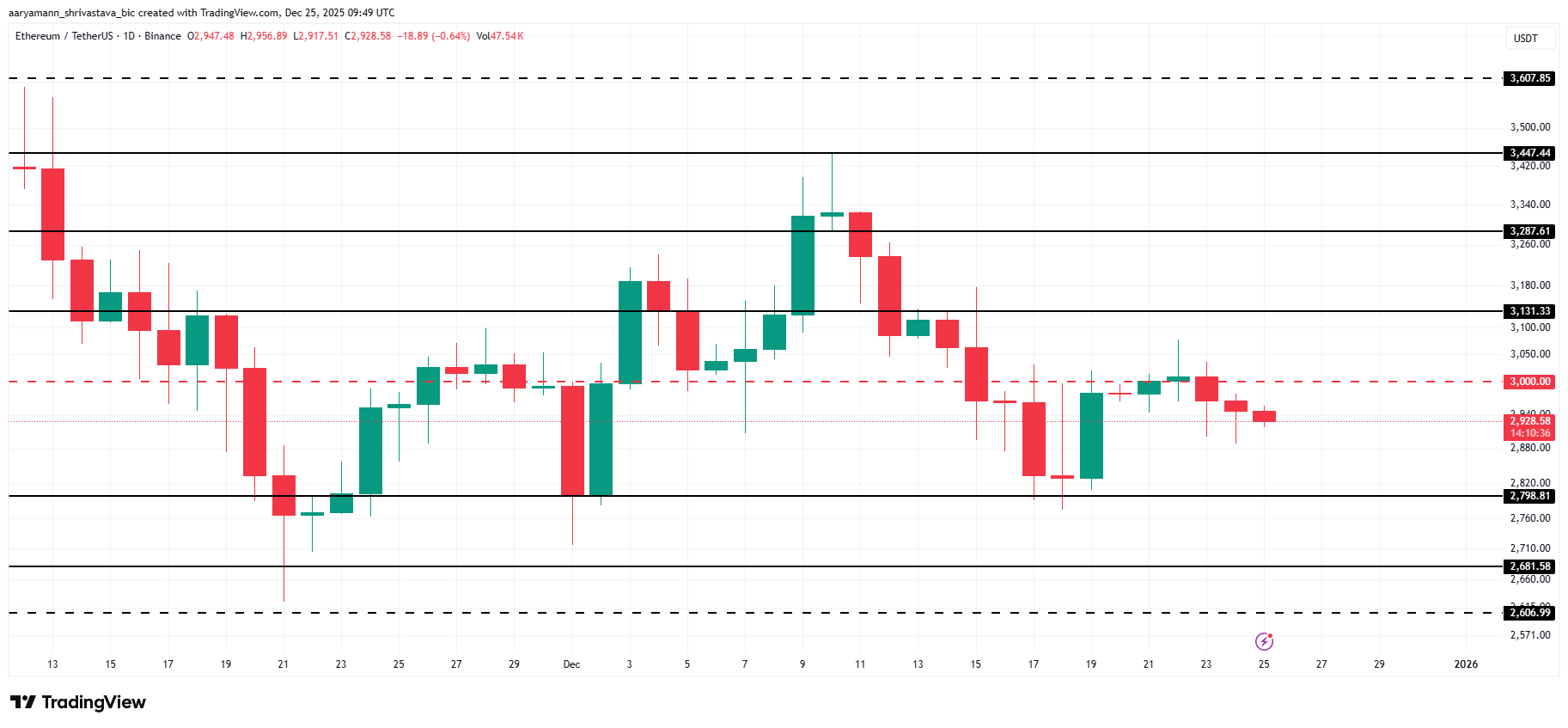

This rebound appears to be cyclical rather than structural. Buyers could re-enter if Ethereum retests the $2,798 support level. Successful restoration and reclamation of that zone could reset market expectations and restore the upward trajectory of prices.

Ethereum ETF Netflow. Source: SoSoValue

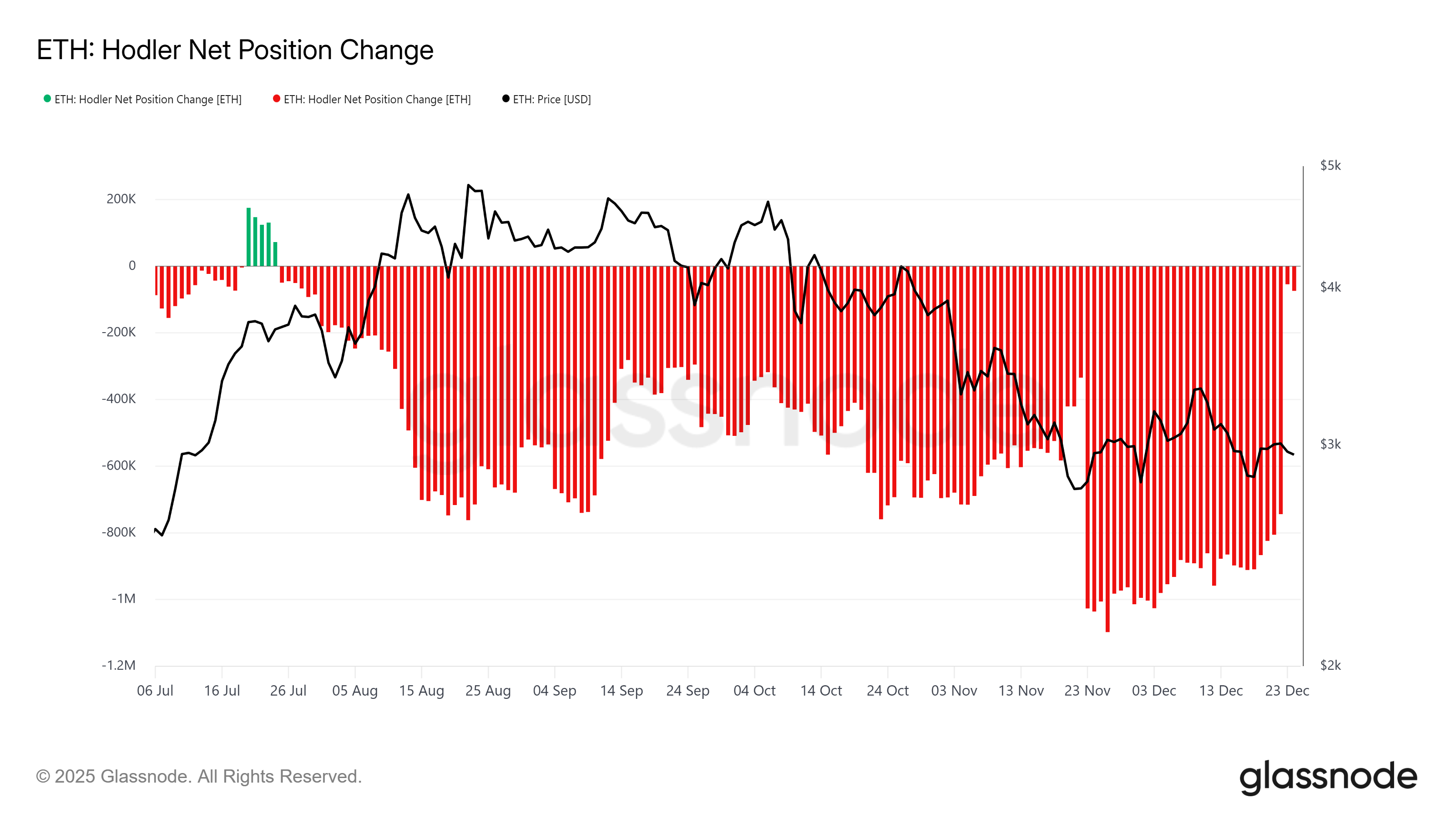

Crucial holders are showing strength

On-chain data shows that behind-the-scenes macro momentum is improving. Ethereum’s HODler Net Position Change, which tracks the behavior of long-term holders, has soared. The index is currently near the highest level of outflows in the past five months.

This change suggests that older holders are easing selling pressure and regaining confidence in Ethereum's recovery potential. If this indicator rises above the zero line, we will confirm net inflows from long-term holders. Such actions historically support price stability and trend reversals.

ETH price may rebound

At the time of writing, Ethereum is trading around $2,978, still below the psychological barrier of $3,000. This consolidation raised concerns about whether ETH could finish 2025 at that level. Persistent hesitance has increased volatility and sentiment remains fragile.

However, the dynamics of ETFs and the behavior of long-term holders suggest that change is possible. A controlled decline towards $2,798 could provide the basis for a rebound. If Ethereum regains $3,000 as support, the price movement could widen to above $3,131.

ETH price analysis. Source: TradingView

Downside risks remain if bullish momentum does not develop. A break below $2,798 will weaken the technical structure. In that case, Ethereum price could fall towards $2,681, invalidating the bullish outlook and increasing near-term bearish pressure.