Main highlights

- Crypto.com has formally challenged a rule that excludes companies with more than 50% of digital assets from the world's major stock indexes

- This opposition led to increased support from industry leaders and advocates

- Bitcoin’s biggest corporate holders warn that the rules are “discriminatory, arbitrary and unenforceable”

Crypto.com, a major cryptocurrency exchange, has formally objected to Morgan Stanley Capital International (MSCI)'s proposal. MSCI's proposal aims to exclude certain companies from major stock indexes based on their cryptocurrency holdings.

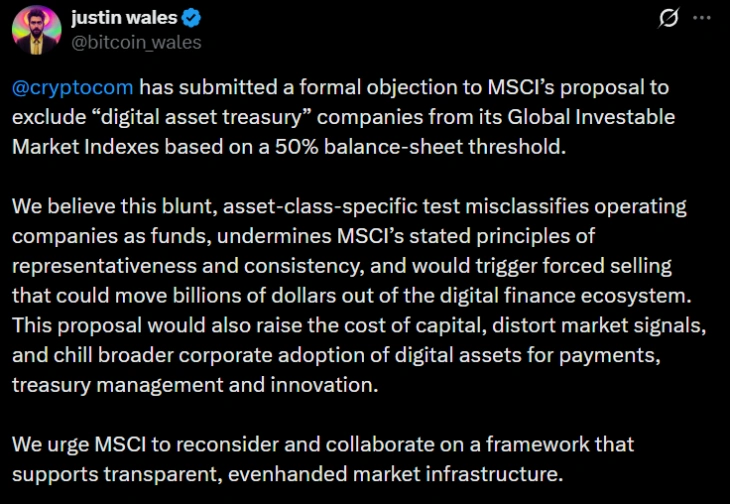

Justin Wales Crypto.com's head of Americas legal affairs argues that the new rules unfairly identify digital assets as treasury holdings, unlike other asset types.

Index methodologies must be neutral, consistent, and based on economic reality. Proposals that focus on a single asset class or set vague balance sheet thresholds risk misclassifying companies and weakening the accuracy and comparability of the index. The Global Index is… https://t.co/KTUtRmrMGE

— Blockchain Association (@BlockchainAssn) December 23, 2025

The proposal also received support from the crypto industry.

MSCI's new rules on digital asset finance spark controversy

The controversy began in October 2025, when MSCI introduced new guidelines. According to the new rules, the firm will consider removing a company from its flagship Global Investable Market Index if digital assets account for more than 50% of its total assets and its primary activity is deemed to be the management of its “digital asset vault.”

MSCI says these companies are becoming more like non-indexed investment funds than traditional commercial operations.

The review was based on questions from MSCI's clients, including large investment funds that track these indexes and asked for clear guidelines.

However, digital asset companies dispute this. They acknowledged that the proposal creates bias because it focuses on the types of assets rather than what companies actually do. According to MSCI's initial list, 39 companies could be affected, with a total market value of more than $113 billion.

Crypto.com and Corporate Bitcoin Government Bonds Strike Back at MSCI Proposal

The company most directly targeted is Strategy, the world's largest Bitcoin holder. As of this writing, the company has: 671,268BTC. This easily puts the company above the proposed 50% threshold and makes it a major company for exclusion. If removed from MSCI's indexes, index-tracking funds could be forced to sell billions of dollars worth of strategy shares.

Michael Saylor, the company's executive chairman, strongly objected to the proposal. In a detailed letter co-signed with CEO Von Leh in December 2025, Strategy called the 50% rule “discriminatory, arbitrary and unenforceable.”

“The proposed 50% rule would arbitrarily single out and uniquely disadvantage digital asset businesses, while leaving businesses in other industries with similarly concentrated holdings in a single asset type (oil, timber, gold, media, entertainment, real estate, etc.) alone. And there is no way to consistently and equitably enforce the proposed 50% rule,” the letter states.

Response to MSCI index problem

Strategy is not a fund, trust or holding company. We are a publicly traded company with a $500 million software business and a unique financial strategy that uses Bitcoin as production capital.

It was completed only this year…

— Michael Saylor (@saylor) November 21, 2025

“Funds and trusts passively hold assets. Holding companies continue to invest. We create, build, issue, and operate. Our team is building a new breed of company: a Bitcoin-backed structured finance company with the ability to innovate in both capital markets and software,” Michael Saylor said in a post on X.

(Source: Justin Wales of X)

Justin Wales said the new rules could “misclassify operating companies as funds, undermine MSCI's stated principles of representativeness and consistency, and potentially trigger forced divestitures that could drain billions of dollars from the digital financial ecosystem.”

He added: “This proposal would raise the cost of capital, distort market signals, and chill widespread enterprise adoption of digital assets for payments, financial management, and innovation.”

Experts warn of impact of MSCI index exclusion

Many financial analysts are warning about the potential impact of MSCI's new rules. Advocacy group BitcoinForCorporations has revealed that the eviction could result in selling pressure of $10 billion to $15 billion for all affected companies.

According to an analysis by banking giant JPMorgan, the strategy alone could generate $2.8 billion in revenue from passive funds.

Also read: US Q3 GDP soars 4.3%, Bitcoin falls amid profit-taking