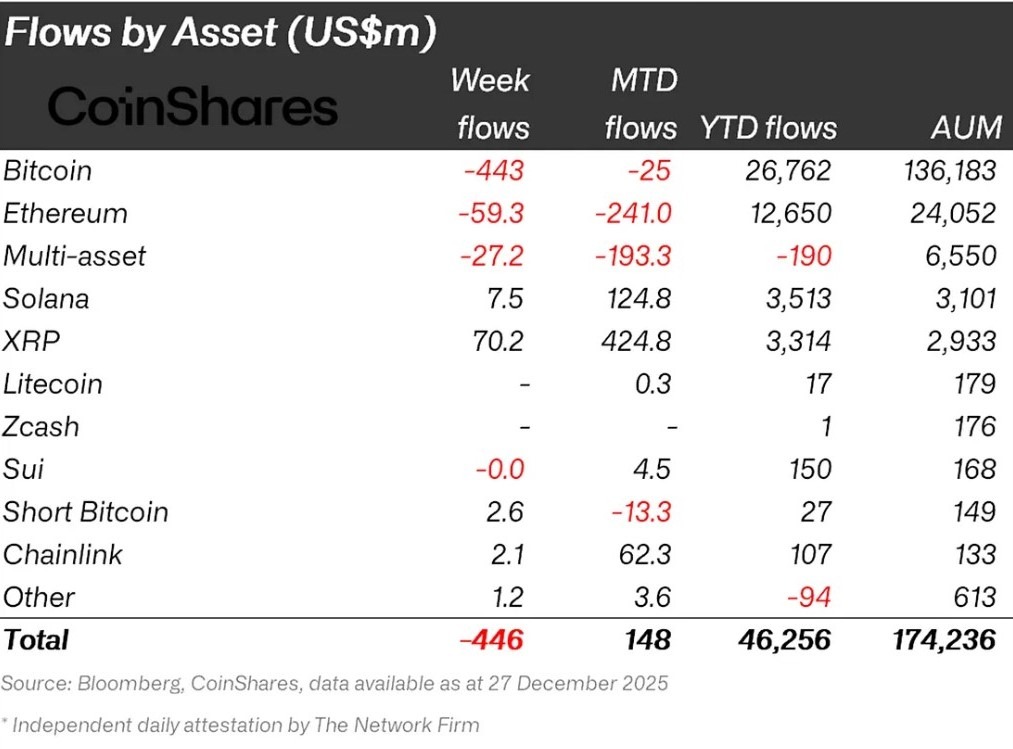

Last week, crypto exchange-traded products recorded net outflows of $446 million, continuing a cautious trend that has continued since the market's sharp correction in October.

According to asset management firm CoinShares, the withdrawals bring the total outflows since October 10 to $3.2 billion, indicating that investor confidence has not yet recovered at the end of the year. Weekly outflows contrast with robust inflows of $463 billion year-to-date (year-to-date), which is roughly in line with 2024 levels.

CoinShares head of research James Butterfill said total assets under management (AuM) have increased by just 10% year-to-date. He said this shows that “given flows, the average investor is not seeing a positive outcome this year.”

Froese also revealed a clear divide in investor behavior. While Bitcoin (BTC) and Ether (ETH) products continued to experience outflows, the newer XRP (XRP) and Solana (SOL) ETPs attracted new capital, highlighting a rotation rather than a mass exit.

Weekly ETP flows per crypto asset are in the millions. Source: CoinShares

XRP and Solana ETFs defy widespread market caution

According to the data, XRP and Solana ETP recorded the strongest inflows, collecting $70.2 million and $7.5 million, respectively.

According to data from SoSoValue, the XRP ETF has not recorded a single day of outflows since its launch, while the Solana ETF has recorded outflows in just three days.

Since the ETF debuted in the US in mid-October, XRP products have attracted more than $1 billion in net inflows each, defying the widespread risk-off sentiment weighing on older crypto ETPs. Meanwhile, cumulative net inflows into the SOL ETF were approximately $750 million.

Meanwhile, Bitcoin products recorded weekly outflows of $443 million, while Ether products posted $59.5 million. Overall, since the launch of the new ETF, $2.8 billion and $1.6 billion in Bitcoin and Ether products have flown out of the fund.

The latest data suggests that crypto capital remains involved but is becoming more selective as 2025 draws to a close. Rather than capitulation, this flow reflects a market that is growing more disciplined and favoring targeted positions over broad exposure.

Related: Cryptocurrency ETP will enter the “cheesecake factory” era in 2026: Bitwise

While Germany continues to buy, US capital outflows dominate

Outflows were widely distributed across the region, but were particularly concentrated in the United States, underscoring the cautious attitude of U.S. investors heading into the end of the year.

Weekly outflows from the US of $460 million accounted for the bulk of global redemptions, according to CoinShares data, adding to the defensive stance following October's price shock.

In contrast, Germany recorded weekly inflows of $35.7 million, bringing the month-to-date total inflows to around $248 million, the strongest of all regions. The continued buying suggests that German investors are viewing the recent price weakness as an opportunity to add exposure.

magazine: South Koreans 'pump' alternatives after Upbit hack, China BTC mining surges: Asia Express