important notes

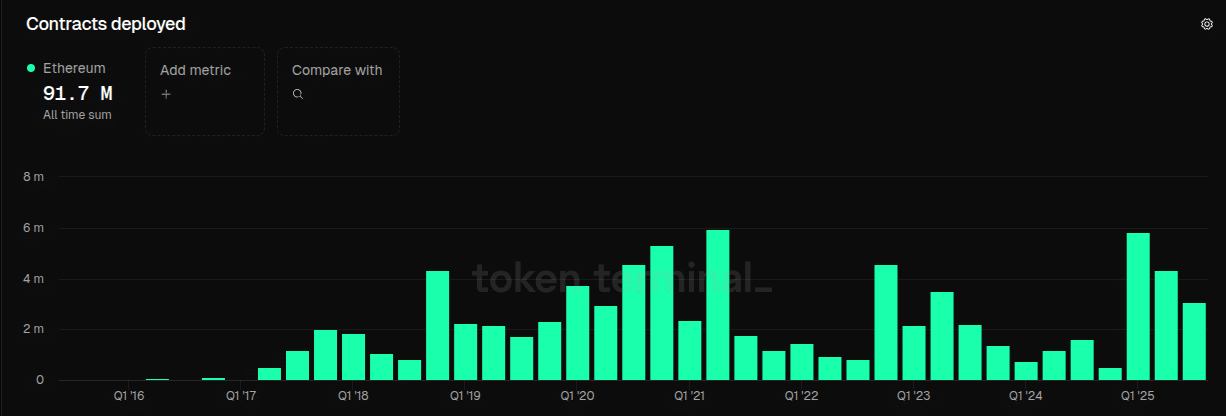

- The current record high of 8.7 million comes a year after Ethereum's worst quarter for new deployments, with just 528,100 in Q4 2024. Analyst Joseph Young pointed to ecosystem expansion, RWA issuance, stablecoins, wallets, and intents, describing it as “intrinsic growth” in a metric that “is hard to scale.” ETH is trading at $2,980, within key multi-year support and resistance. (S/R) level from $2,800 to $3,000.

ethereum network Ethereum $2,998 24 hour volatility: 2.1% Market capitalization: $35.982 billion Vol. 24 hours: 2.021 billion dollars achieved a historic record for smart contracts deployed quarterly in Q4 2025, achieving over 8.7 million contracts.

This milestone highlights the growth in developer and startup activity centered around the Ethereum ecosystem.

Joseph Young, a well-known Ethereum analyst and content creator, shared this data on December 30th based on Token Terminal charts.

He emphasized the “organic” nature of such indicators, which, in his words, is “difficult to inflate.” Deployed contracts describe unique smart contracts published on-chain and, as described by Token Terminal, “stand in for the amount of new infrastructure or applications launched on the blockchain.”

Related Article: Ethereum Posts Weakest Q4 in 6 Years as Big Whale Deposits $332 Million

Young explained that this growth is being driven by rollups and layer 2 extensions, real world asset (RWA) issuance, stablecoins, wallets, and intents. However, this metric only includes smart contracts deployed on Ethereum's base layer (L1), while contracts on the Layer 2 network are tracked separately.

Ethereum hit an all-time high of 8.7 million contracts deployed in a single quarter.

It is difficult to inflate the continued growth in contract deployment over multiple quarters. This is organic growth.

It is driven by:

> Rollup/L2 expansion

> Issuance of RWA

> Stablecoins

> Wallets and intentsEthereum. pic.twitter.com/XJPbVCiovs

— Joseph Young (@iamjosefyoung) December 30, 2025

Contracts Deployed on Ethereum: Historical Data

Quarterly contracts are on the decline in 2025, starting with around 6 million contracts in the first quarter and dropping to 4.3 million and 3.1 million contracts in the second and third quarters, respectively.

2024 was a terrible year for this metric, with barely less than 1.5 million contracts deployed in every quarter except for 1.6 million in the third quarter.

Prior to the currently ended quarter, Q2 2021 had a previous record of 6 million smart contracts deployed.

Meanwhile, Q4 2024 saw the lowest amount of contracts introduced since Q2 2017, with just 528,100 new smart contracts.

In total, 91.7 million contracts have been deployed on Ethereum, according to Token Terminal data.

Full term of contracts deployed quarterly on Ethereum as of December 30, 2025 | Source: Token Terminal

ETH price analysis and future development

Ethereum’s native token, Ether (ETH), is currently trading at $2,980, within the major multi-year support and resistance (S/R) level of $2,800 to $3,000.

A break above this resistance could push the price to ETH’s all-time high of $4,957, while a break below could see Ethereum test the lower support around $2,500.

Ethereum (Ether, ETH) 1D price chart as of December 30, 2025 | Source: TradingView

Interestingly, ETH reached a significant local bottom of $1,385 in April 2025, two quarters after the record low for deployed contracts in Q4 2025, suggesting that price may lag contract activity.

Regardless of whether there is a real correlation, a lower number of contracts deployed indicates less interest in the network as a whole, which could lead to fewer users and less market demand for the token, and vice versa.

As infrastructure, applications, tools, and on-chain interactions increase on the network, developer activity will increase through new contracts being deployed.

This increases the demand for ETH to attract more users, pay gas fees, and secure the network through staking.

Although the current price trend is negative, other indicators are consistent with the growth in contract deployment mentioned above.

Stablecoins are constantly updating new market caps, and analysts believe that under the right conditions ETH could reach $8,500.

The Ethereum ecosystem is maturing through governance discussions such as Uniswap’s UNIFation being approved and AAVE’s token adjustment proposal being rejected with record participation from holders.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.