Bitcoin is likely to face tough times in 2026, and many analysts expect the cryptocurrency's downturn to extend into the second half of 2025. However, despite the softening price, early adopters say next year could be a turning point for Bitcoin's real-world utility as payments infrastructure continues to mature and using BTC as a medium of exchange becomes easier and more accessible.

According to early Bitcoin investor Michael Turpin, the price of Bitcoin (BTC) could bottom out at around $60,000 in the fourth quarter of 2026, creating a buying opportunity. Terpine forecast:

“The end of 2026 will be a great time to buy as fear-based market lows will gradually give way to bulk purchases in 2028 and 2029, when the next halving leads to a potential supply shock.”

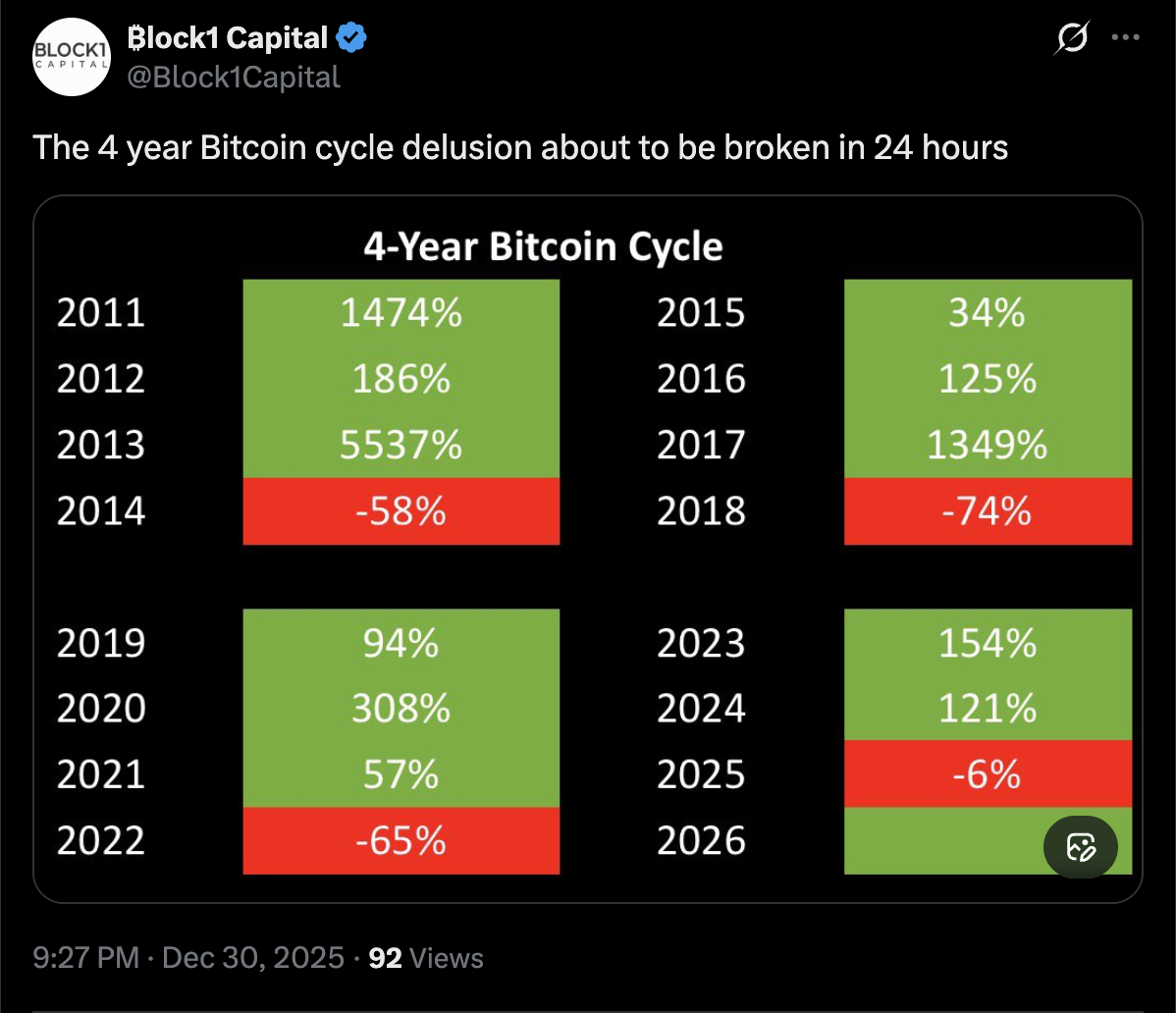

Bitcoin is on track to end 2025 cheaper than it started the year, breaking the four-year cycle theory that has dominated BTC market analysis for the past decade. sauce: block 1 capital

Turpin said Bitcoin still has about a 20% chance of forming a new high before a cycle low, but that probability is decreasing with each passing month.

Terpin said the new Fed chair should ease macroeconomic conditions by lowering interest rates, but the pro-crypto regulatory environment will be “paralyzed” if Republicans fail to win both houses of Congress in the 2026 U.S. midterm elections.

2025 is widely expected to be a big shake-up in the price of Bitcoin, with several analysts predicting BTC to be between $180,000 and $250,000 by the end of 2025, while BTC is expected to end the year at a lower price than the high of over $100,000 it hit in January.

Bitcoin price trends last year. sauce: coin market cap

Related: What the Fed's Divided 2026 Outlook Means for Bitcoin and Cryptocurrencies

Despite the downturn, Bitcoin payments infrastructure and use cases are set to grow in 2026

“In 2025, it will be easier to hold Bitcoin and it will be easier to earn yield,” said Rich Lines, an early Bitcoin adopter and blockchain software developer. “It should actually be easier to use by 2026.”

Lines said Bitcoin neobanks, digital infrastructure companies that provide online banking services, and stablecoins backed by Bitcoin will facilitate the use of Bitcoin as a medium of exchange.

Payments company Square has integrated Bitcoin payments into its POS system, allowing merchants to accept BTC as payment and automatically convert 1% of gross sales to BTC if desired.

Bitcoin Lightning Network Whitepaper. sauce: bitcoin lightning network

The Bitcoin Lightning Network is a layer 2 scaling solution that allows BTC to be used for payments, reducing friction by opening payment channels between parties, and only the net balance of the payment channel is posted to the BTC ledger in one final transaction.

Graham Krizek, founder of Lightning Network payments company Voltage, told Cointelegraph that the Lightning Network could capture 5% of stablecoin flow by 2028.

magazine: The big question: Did a time-traveling AI invent Bitcoin?