Large crypto holders appear to be preparing to sell their tokens on Binance, one of the world's largest crypto exchanges, but analysts have warned that buyers are not yet ready to trade.

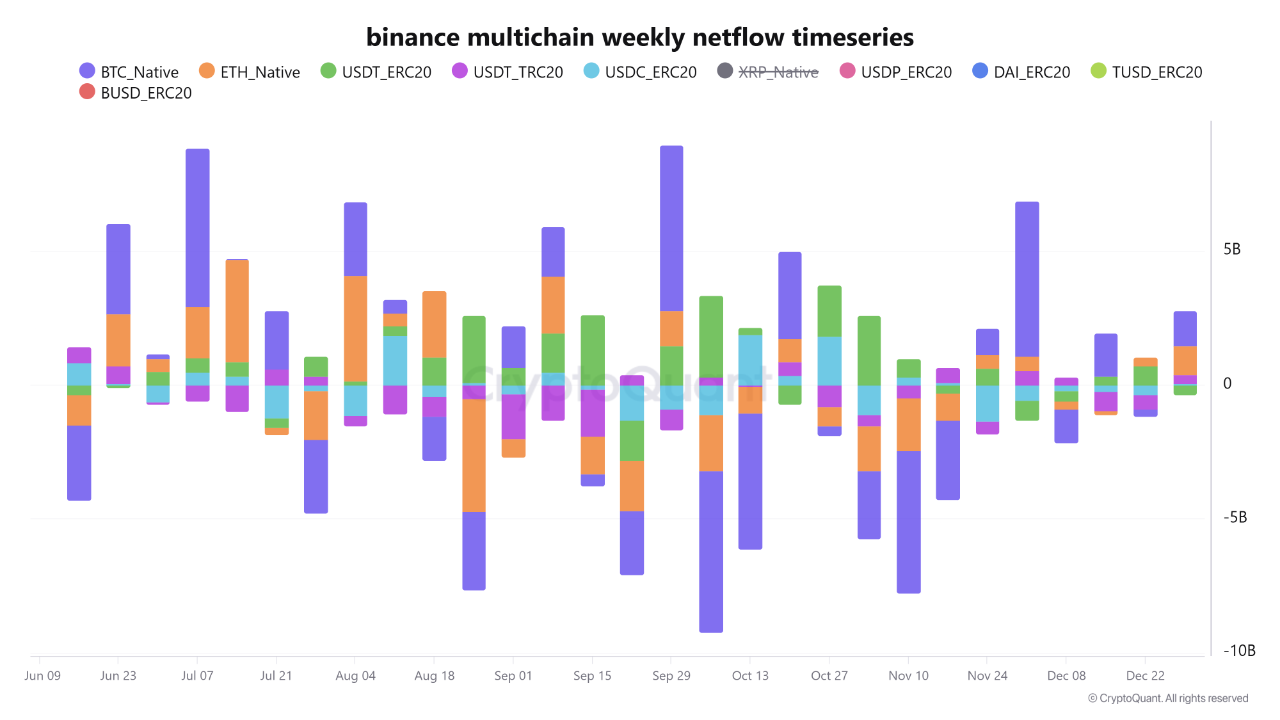

So-called crypto whales deposited $2.4 billion on Binance last week, split almost evenly between Bitcoin (BTC) and Ether (ETH), the exchange's largest net inflow in a month, but “lack purchasing power,” CryptoOnChain said in a note to CryptoQuant on Sunday.

“Importantly, this surge in risk asset deposits was not accompanied by new purchasing power,” it added, noting that stablecoin net inflows were “nearly flat” this week with $42 million in inflows, most of which were tokens moving between the Ethereum and Tron blockchains.

Binance had net inflows of $1.33 billion in Bitcoin and $1.07 billion in Ether last week. sauce: cryptoquant

CryptoOnchain said that large transfers of cryptocurrencies from wallets to exchanges typically indicate either “preparation for sale or use of these assets as collateral in the derivatives market.”

Bitcoin accumulation stagnates

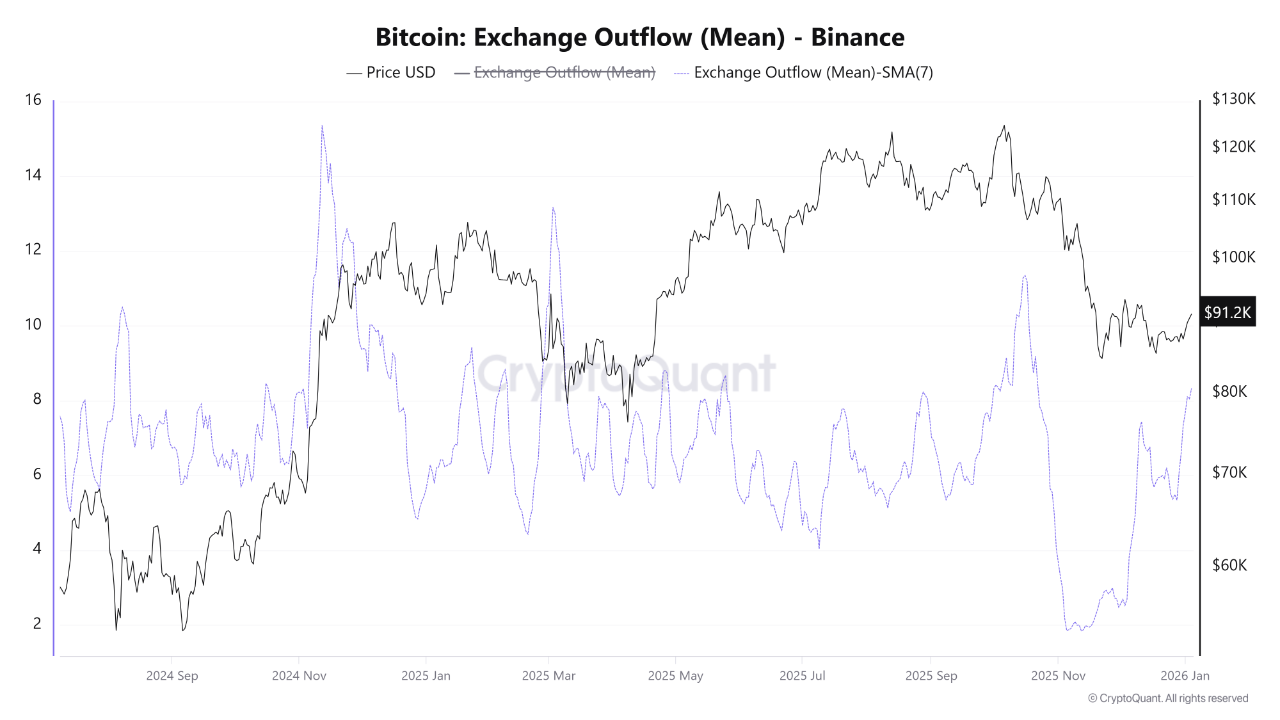

CryptoOnchain announced earlier on Sunday that while the average deposit amount on Binance has increased, the level of Bitcoin accumulation has stagnated since October, a “potentially bearish” signal.

It added that the average transaction value flowing into Binance has jumped from around 8-10 Bitcoins to as much as 22-26 Bitcoins as whales have transferred “significant amounts” to the platform.

Meanwhile, exchange outflows have seen a “sharp decline in the average size of withdrawal transactions,” with average exchange outflows fluctuating between a “subdued range” of 5.5 to 8.3 Bitcoins.

Outflows on the Binance exchange fell sharply in October and have since struggled to recover. sauce: cryptoquant

Related: No, whales are not accumulating large amounts of Bitcoin: CryptoQuant

“In other words, large-scale accumulation and movement of Bitcoin into cold storage by major holders has decreased significantly,” CryptoOnchain said.

It added that the indicator was a “clear warning signal” as it points to increased selling pressure and “a diminished appetite for long-term holdings among major companies, which could be a major headwind to price appreciation in the short to medium term.”

Bitcoin has risen 1.3% over the past day, hitting a 24-hour high of $93,170 before settling at $92,600 as the market's holiday lull ends.

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?